IFP Advisors Inc trimmed its position in Evergy Inc. (NASDAQ:EVRG - Free Report) by 61.5% during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 3,811 shares of the company's stock after selling 6,100 shares during the quarter. IFP Advisors Inc's holdings in Evergy were worth $263,000 at the end of the most recent quarter.

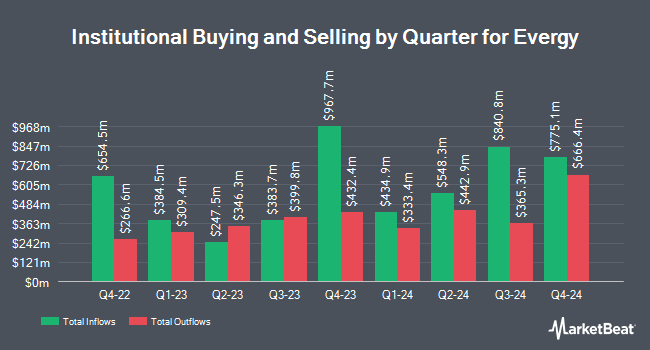

A number of other large investors have also modified their holdings of the stock. Franklin Resources Inc. grew its position in Evergy by 2.3% in the 4th quarter. Franklin Resources Inc. now owns 5,660,930 shares of the company's stock valued at $348,430,000 after buying an additional 128,211 shares in the last quarter. Geode Capital Management LLC boosted its holdings in shares of Evergy by 2.4% in the fourth quarter. Geode Capital Management LLC now owns 5,637,257 shares of the company's stock worth $346,063,000 after buying an additional 133,641 shares during the period. Federated Hermes Inc. raised its position in Evergy by 2.2% during the fourth quarter. Federated Hermes Inc. now owns 3,434,216 shares of the company's stock valued at $211,376,000 after buying an additional 73,066 shares during the period. Northern Trust Corp raised its position in Evergy by 5.7% during the fourth quarter. Northern Trust Corp now owns 2,345,119 shares of the company's stock valued at $144,342,000 after buying an additional 125,898 shares during the period. Finally, ExodusPoint Capital Management LP raised its position in Evergy by 164.8% during the fourth quarter. ExodusPoint Capital Management LP now owns 2,312,953 shares of the company's stock valued at $142,362,000 after acquiring an additional 1,439,450 shares in the last quarter. Institutional investors and hedge funds own 87.24% of the company's stock.

Wall Street Analyst Weigh In

EVRG has been the topic of several recent analyst reports. UBS Group raised Evergy from a "neutral" rating to a "buy" rating and boosted their price target for the company from $68.00 to $78.00 in a research note on Monday, April 28th. Mizuho upped their price objective on Evergy from $70.00 to $74.00 and gave the stock an "outperform" rating in a research note on Friday, July 18th. Barclays decreased their price objective on Evergy from $73.00 to $71.00 and set an "overweight" rating on the stock in a report on Friday, May 30th. Wall Street Zen downgraded Evergy from a "hold" rating to a "sell" rating in a research report on Thursday, May 22nd. Finally, Citigroup upped their target price on Evergy from $77.00 to $79.00 and gave the stock a "buy" rating in a report on Friday, May 16th. One analyst has rated the stock with a sell rating, eight have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $74.06.

View Our Latest Research Report on EVRG

Evergy Trading Up 0.3%

Shares of NASDAQ EVRG traded up $0.18 during midday trading on Thursday, reaching $70.34. The company had a trading volume of 313,960 shares, compared to its average volume of 2,310,726. The firm's fifty day moving average price is $67.92 and its 200-day moving average price is $66.97. The stock has a market cap of $16.19 billion, a PE ratio of 18.50, a price-to-earnings-growth ratio of 3.05 and a beta of 0.50. The company has a quick ratio of 0.29, a current ratio of 0.55 and a debt-to-equity ratio of 1.24. Evergy Inc. has a one year low of $57.25 and a one year high of $70.75.

Evergy (NASDAQ:EVRG - Get Free Report) last released its quarterly earnings results on Thursday, May 8th. The company reported $0.54 earnings per share for the quarter, missing the consensus estimate of $0.66 by ($0.12). Evergy had a net margin of 14.87% and a return on equity of 8.84%. The firm had revenue of $1.37 billion for the quarter, compared to the consensus estimate of $1.21 billion. During the same period in the previous year, the company earned $0.54 earnings per share. On average, equities research analysts anticipate that Evergy Inc. will post 3.83 earnings per share for the current year.

Evergy Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, June 20th. Shareholders of record on Friday, May 23rd were issued a $0.6675 dividend. This represents a $2.67 annualized dividend and a yield of 3.80%. The ex-dividend date of this dividend was Friday, May 23rd. Evergy's payout ratio is 70.26%.

Evergy Company Profile

(

Free Report)

Evergy, Inc, together with its subsidiaries, engages in the generation, transmission, distribution, and sale of electricity in the United States. The company generates electricity through coal, landfill gas, uranium, and natural gas and oil sources, as well as solar, wind, other renewable sources. It serves residences, commercial firms, industrials, municipalities, and other electric utilities.

Featured Stories

Before you consider Evergy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Evergy wasn't on the list.

While Evergy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.