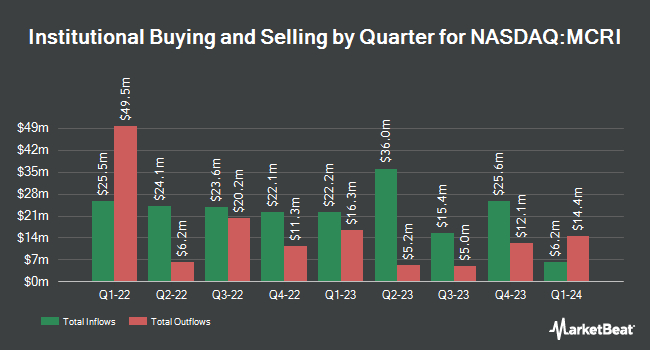

Informed Momentum Co LLC acquired a new stake in Monarch Casino & Resort, Inc. (NASDAQ:MCRI - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 41,128 shares of the company's stock, valued at approximately $3,198,000. Informed Momentum Co LLC owned 0.22% of Monarch Casino & Resort at the end of the most recent reporting period.

Other large investors also recently added to or reduced their stakes in the company. TD Private Client Wealth LLC lifted its position in shares of Monarch Casino & Resort by 72.6% in the 1st quarter. TD Private Client Wealth LLC now owns 378 shares of the company's stock worth $29,000 after purchasing an additional 159 shares during the period. Vestcor Inc purchased a new stake in shares of Monarch Casino & Resort in the 1st quarter worth approximately $58,000. Meeder Asset Management Inc. lifted its position in shares of Monarch Casino & Resort by 45.3% in the 1st quarter. Meeder Asset Management Inc. now owns 1,139 shares of the company's stock worth $89,000 after purchasing an additional 355 shares during the period. Golden State Wealth Management LLC lifted its position in shares of Monarch Casino & Resort by 100.0% in the 1st quarter. Golden State Wealth Management LLC now owns 1,332 shares of the company's stock worth $104,000 after purchasing an additional 666 shares during the period. Finally, CWM LLC lifted its position in shares of Monarch Casino & Resort by 264.7% in the 1st quarter. CWM LLC now owns 1,827 shares of the company's stock worth $142,000 after purchasing an additional 1,326 shares during the period. 62.37% of the stock is owned by hedge funds and other institutional investors.

Monarch Casino & Resort Price Performance

MCRI stock traded down $1.31 during midday trading on Friday, hitting $100.41. 132,222 shares of the stock traded hands, compared to its average volume of 135,395. The firm has a market cap of $1.83 billion, a P/E ratio of 18.87 and a beta of 1.56. The stock's fifty day simple moving average is $93.43 and its 200-day simple moving average is $86.30. Monarch Casino & Resort, Inc. has a 1-year low of $69.99 and a 1-year high of $113.88.

Monarch Casino & Resort (NASDAQ:MCRI - Get Free Report) last released its quarterly earnings results on Wednesday, July 16th. The company reported $1.44 EPS for the quarter, beating the consensus estimate of $1.22 by $0.22. The company had revenue of $136.91 million for the quarter, compared to analyst estimates of $129.76 million. Monarch Casino & Resort had a net margin of 18.70% and a return on equity of 18.99%. On average, research analysts predict that Monarch Casino & Resort, Inc. will post 5.13 earnings per share for the current year.

Insider Buying and Selling at Monarch Casino & Resort

In other Monarch Casino & Resort news, Director Craig F. Sullivan sold 12,200 shares of the stock in a transaction on Tuesday, July 22nd. The shares were sold at an average price of $105.55, for a total transaction of $1,287,710.00. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, CEO John Farahi sold 2,000 shares of the firm's stock in a transaction dated Tuesday, July 22nd. The stock was sold at an average price of $105.78, for a total transaction of $211,560.00. Following the completion of the transaction, the chief executive officer directly owned 560,110 shares in the company, valued at approximately $59,248,435.80. This represents a 0.36% decrease in their ownership of the stock. The disclosure for this sale can be found here. Company insiders own 25.52% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts recently commented on the stock. Macquarie reissued a "neutral" rating and set a $92.00 target price on shares of Monarch Casino & Resort in a research report on Wednesday, April 23rd. Wells Fargo & Company raised shares of Monarch Casino & Resort from an "underweight" rating to an "equal weight" rating and increased their target price for the company from $83.00 to $89.00 in a research report on Thursday, July 17th. Wall Street Zen upgraded shares of Monarch Casino & Resort from a "hold" rating to a "buy" rating in a research note on Sunday, July 13th. Stifel Nicolaus upped their price target on shares of Monarch Casino & Resort from $81.00 to $92.00 and gave the company a "hold" rating in a research note on Thursday, July 17th. Finally, Truist Financial upped their price target on shares of Monarch Casino & Resort from $100.00 to $105.00 and gave the company a "buy" rating in a research note on Wednesday, July 16th. Four analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Monarch Casino & Resort presently has a consensus rating of "Hold" and an average price target of $93.20.

Read Our Latest Research Report on Monarch Casino & Resort

Monarch Casino & Resort Company Profile

(

Free Report)

Monarch Casino & Resort, Inc engages in the ownership and operation of the Atlantis Casino Resort Spa, a hotel and casino facility in Reno, Nevada, and the Monarch Black Hawk Casino in Black Hawk, Colorado. The company was founded in 1993 and is headquartered in Reno, NV.

Featured Stories

Before you consider Monarch Casino & Resort, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monarch Casino & Resort wasn't on the list.

While Monarch Casino & Resort currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.