Informed Momentum Co LLC trimmed its stake in Qfin Holdings Inc. - Sponsored ADR (NASDAQ:QFIN - Free Report) by 23.7% during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 34,342 shares of the company's stock after selling 10,679 shares during the period. Informed Momentum Co LLC's holdings in Qfin were worth $1,542,000 as of its most recent SEC filing.

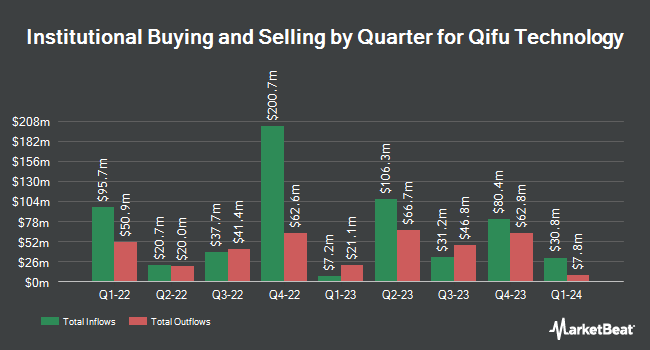

Several other institutional investors also recently modified their holdings of the stock. Krane Funds Advisors LLC increased its position in shares of Qfin by 24.4% in the first quarter. Krane Funds Advisors LLC now owns 7,032,927 shares of the company's stock worth $315,849,000 after purchasing an additional 1,381,624 shares during the last quarter. Aspex Management HK Ltd boosted its stake in shares of Qfin by 11.3% during the 4th quarter. Aspex Management HK Ltd now owns 6,371,808 shares of the company's stock valued at $244,550,000 after purchasing an additional 648,088 shares in the last quarter. Vanguard Group Inc. lifted its position in Qfin by 0.7% during the first quarter. Vanguard Group Inc. now owns 4,572,985 shares of the company's stock valued at $205,373,000 after buying an additional 31,155 shares during the period. AQR Capital Management LLC lifted its position in Qfin by 11.9% during the fourth quarter. AQR Capital Management LLC now owns 2,432,131 shares of the company's stock valued at $93,345,000 after buying an additional 258,586 shares during the period. Finally, Mirae Asset Global Investments Co. Ltd. lifted its position in Qfin by 10,812.1% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,042,306 shares of the company's stock valued at $91,720,000 after buying an additional 2,023,590 shares during the period. 74.81% of the stock is currently owned by institutional investors.

Qfin Stock Down 4.1%

Shares of NASDAQ QFIN traded down $1.35 during midday trading on Friday, hitting $31.95. The stock had a trading volume of 2,485,035 shares, compared to its average volume of 2,300,131. Qfin Holdings Inc. - Sponsored ADR has a 52 week low of $23.81 and a 52 week high of $48.94. The business's 50 day moving average is $39.82 and its 200-day moving average is $41.10. The company has a quick ratio of 3.08, a current ratio of 3.08 and a debt-to-equity ratio of 0.21. The company has a market cap of $5.04 billion, a P/E ratio of 4.51, a PEG ratio of 0.40 and a beta of 0.39.

Qfin (NASDAQ:QFIN - Get Free Report) last issued its earnings results on Thursday, August 14th. The company reported $1.78 earnings per share for the quarter, missing analysts' consensus estimates of $1.79 by ($0.01). Qfin had a return on equity of 31.00% and a net margin of 38.66%. The business had revenue of $728.00 million during the quarter, compared to analysts' expectations of $4.68 billion. As a group, analysts predict that Qfin Holdings Inc. - Sponsored ADR will post 5.71 EPS for the current year.

Analyst Upgrades and Downgrades

Several equities analysts have commented on QFIN shares. Wall Street Zen lowered Qfin from a "strong-buy" rating to a "buy" rating in a research report on Friday, July 18th. JPMorgan Chase & Co. began coverage on shares of Qfin in a research note on Wednesday, July 2nd. They issued an "overweight" rating and a $65.00 target price on the stock.

Get Our Latest Research Report on QFIN

Qfin Profile

(

Free Report)

Qifu Technology, Inc, through its subsidiaries, operates credit-tech platform under the 360 Jietiao brand in the People's Republic of China. It provides credit-driven services that matches borrowers with financial institutions to conduct customer acquisition, initial and credit screening, advanced risk assessment, credit assessment, fund matching, and other post-facilitation services; and platform services, including loan facilitation and post-facilitation services to financial institution partners under intelligence credit engine, referral services, and risk management software-as-a-service.

Recommended Stories

Before you consider Qfin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qfin wasn't on the list.

While Qfin currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.