ING Groep NV raised its stake in shares of Light & Wonder, Inc. (NASDAQ:LNW - Free Report) by 1.9% during the 1st quarter, according to the company in its most recent filing with the SEC. The firm owned 582,926 shares of the company's stock after purchasing an additional 10,926 shares during the quarter. ING Groep NV owned 0.69% of Light & Wonder worth $50,487,000 as of its most recent filing with the SEC.

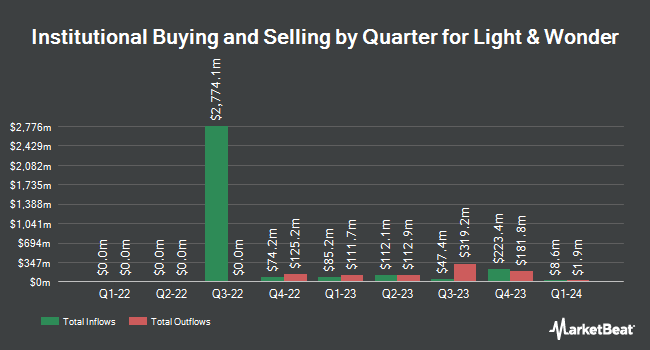

Other large investors have also made changes to their positions in the company. Centaurus Financial Inc. lifted its position in shares of Light & Wonder by 3.3% during the 4th quarter. Centaurus Financial Inc. now owns 3,350 shares of the company's stock worth $289,000 after buying an additional 108 shares during the period. Zurcher Kantonalbank Zurich Cantonalbank grew its position in Light & Wonder by 0.6% in the first quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 22,018 shares of the company's stock valued at $1,907,000 after acquiring an additional 133 shares during the period. Simon Quick Advisors LLC raised its stake in Light & Wonder by 2.9% during the first quarter. Simon Quick Advisors LLC now owns 4,752 shares of the company's stock worth $412,000 after acquiring an additional 136 shares in the last quarter. KBC Group NV lifted its holdings in shares of Light & Wonder by 3.8% during the first quarter. KBC Group NV now owns 3,746 shares of the company's stock valued at $324,000 after acquiring an additional 137 shares during the period. Finally, US Bancorp DE boosted its stake in shares of Light & Wonder by 18.7% in the 1st quarter. US Bancorp DE now owns 1,164 shares of the company's stock valued at $101,000 after purchasing an additional 183 shares in the last quarter. Institutional investors and hedge funds own 88.08% of the company's stock.

Light & Wonder Stock Up 3.4%

Shares of NASDAQ LNW traded up $2.68 during midday trading on Friday, reaching $80.55. The company's stock had a trading volume of 2,215,793 shares, compared to its average volume of 920,496. The stock has a 50 day simple moving average of $92.84 and a 200-day simple moving average of $92.08. The company has a current ratio of 1.57, a quick ratio of 1.35 and a debt-to-equity ratio of 6.26. Light & Wonder, Inc. has a fifty-two week low of $69.56 and a fifty-two week high of $115.00. The stock has a market capitalization of $6.80 billion, a price-to-earnings ratio of 20.34, a PEG ratio of 0.54 and a beta of 1.21.

Light & Wonder (NASDAQ:LNW - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The company reported $1.11 EPS for the quarter, missing analysts' consensus estimates of $1.44 by ($0.33). The firm had revenue of $809.00 million during the quarter, compared to analyst estimates of $851.29 million. Light & Wonder had a net margin of 10.89% and a return on equity of 71.10%. The business's revenue was down 1.1% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.90 EPS. Equities research analysts predict that Light & Wonder, Inc. will post 4.3 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of research firms have commented on LNW. Stifel Nicolaus boosted their price objective on Light & Wonder from $84.00 to $95.00 and gave the stock a "hold" rating in a research note on Thursday, May 8th. Jefferies Financial Group set a $116.00 price objective on shares of Light & Wonder in a research report on Wednesday, June 25th. Benchmark lowered their price target on shares of Light & Wonder from $100.00 to $90.00 and set a "buy" rating for the company in a report on Friday. Mizuho increased their price objective on Light & Wonder from $80.00 to $84.00 and gave the company an "underperform" rating in a research report on Thursday, May 8th. Finally, Truist Financial boosted their target price on Light & Wonder from $110.00 to $130.00 and gave the stock a "buy" rating in a research report on Wednesday, July 16th. One equities research analyst has rated the stock with a sell rating, five have issued a hold rating, seven have given a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat, Light & Wonder has an average rating of "Moderate Buy" and an average target price of $105.64.

Read Our Latest Research Report on LNW

Light & Wonder Company Profile

(

Free Report)

Light & Wonder, Inc is a cross-platform global games company, which engages in the development of content and digital markets. It operates through the following segments: Gaming, SciPlay, and iGaming. The Gaming segment includes the design, manufacture, marketing, and distribution of portfolio of gaming products and services.

Read More

Before you consider Light & Wonder, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Light & Wonder wasn't on the list.

While Light & Wonder currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.