Inspire Advisors LLC bought a new stake in Five Below, Inc. (NASDAQ:FIVE - Free Report) in the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The firm bought 7,676 shares of the specialty retailer's stock, valued at approximately $575,000.

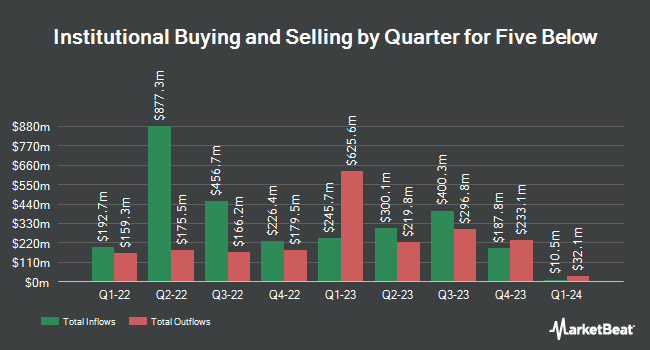

Several other hedge funds have also bought and sold shares of FIVE. Steadfast Capital Management LP acquired a new stake in Five Below during the fourth quarter worth approximately $123,601,000. Marshall Wace LLP lifted its position in Five Below by 86.0% during the fourth quarter. Marshall Wace LLP now owns 2,320,212 shares of the specialty retailer's stock worth $243,529,000 after acquiring an additional 1,072,642 shares during the last quarter. Norges Bank acquired a new stake in Five Below during the fourth quarter worth approximately $66,933,000. Alliancebernstein L.P. lifted its position in Five Below by 487.0% during the fourth quarter. Alliancebernstein L.P. now owns 566,695 shares of the specialty retailer's stock worth $59,480,000 after acquiring an additional 470,150 shares during the last quarter. Finally, Man Group plc lifted its position in Five Below by 399.5% during the fourth quarter. Man Group plc now owns 562,902 shares of the specialty retailer's stock worth $59,082,000 after acquiring an additional 450,215 shares during the last quarter.

Five Below Stock Performance

NASDAQ FIVE opened at $138.67 on Monday. The firm's fifty day moving average price is $125.96 and its two-hundred day moving average price is $97.63. The stock has a market cap of $7.63 billion, a PE ratio of 29.07 and a beta of 1.04. Five Below, Inc. has a fifty-two week low of $52.38 and a fifty-two week high of $142.13.

Five Below (NASDAQ:FIVE - Get Free Report) last posted its earnings results on Wednesday, June 4th. The specialty retailer reported $0.86 earnings per share for the quarter, topping analysts' consensus estimates of $0.83 by $0.03. The firm had revenue of $970.53 million for the quarter, compared to analysts' expectations of $966.29 million. Five Below had a net margin of 6.52% and a return on equity of 17.00%. The company's revenue was up 19.5% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.60 earnings per share. As a group, sell-side analysts predict that Five Below, Inc. will post 4.93 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, insider Amit Jhunjhunwala sold 1,700 shares of the business's stock in a transaction on Monday, June 16th. The shares were sold at an average price of $125.17, for a total value of $212,789.00. Following the sale, the insider owned 25,890 shares of the company's stock, valued at $3,240,651.30. The trade was a 6.16% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Also, insider George Hill sold 1,500 shares of the business's stock in a transaction on Thursday, July 17th. The stock was sold at an average price of $140.00, for a total transaction of $210,000.00. Following the completion of the sale, the insider directly owned 42,672 shares in the company, valued at approximately $5,974,080. This represents a 3.40% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 13,200 shares of company stock valued at $1,740,209. 1.90% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

Several equities research analysts have issued reports on FIVE shares. DA Davidson cut their price objective on shares of Five Below from $50.00 to $25.00 and set a "neutral" rating for the company in a research report on Monday, April 14th. Truist Financial raised their price objective on shares of Five Below from $81.00 to $112.00 and gave the stock a "hold" rating in a research report on Monday, June 2nd. Loop Capital raised their price objective on shares of Five Below from $90.00 to $130.00 and gave the stock a "hold" rating in a research report on Friday, June 6th. JPMorgan Chase & Co. lifted their price target on shares of Five Below from $105.00 to $154.00 and gave the company a "neutral" rating in a research report on Monday, July 21st. Finally, Evercore ISI boosted their price target on Five Below from $115.00 to $120.00 and gave the company an "in-line" rating in a research note on Tuesday, June 24th. One analyst has rated the stock with a sell rating, fourteen have issued a hold rating and six have issued a buy rating to the company's stock. According to data from MarketBeat.com, Five Below presently has a consensus rating of "Hold" and an average target price of $119.00.

Read Our Latest Research Report on FIVE

About Five Below

(

Free Report)

Five Below, Inc operates as a specialty value retailer in the United States. The company offers range of accessories, which includes novelty socks, sunglasses, jewelry, scarves, gloves, hair accessories, athletic tops and bottoms, and t-shirts, as well as nail polish, lip gloss, fragrance, and branded cosmetics; and personalized living space products, such as lamps, posters, frames, fleece blankets, plush items, pillows, candles, incense, lighting, novelty décor, accent furniture, and related items, as well as provides storage options.

Featured Articles

Want to see what other hedge funds are holding FIVE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Five Below, Inc. (NASDAQ:FIVE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Five Below, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five Below wasn't on the list.

While Five Below currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report