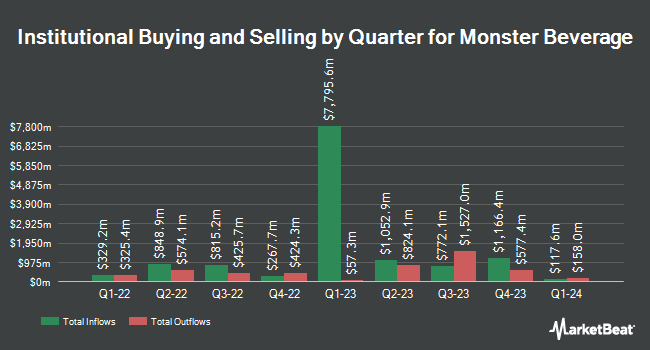

Inspire Investing LLC grew its position in Monster Beverage Corporation (NASDAQ:MNST - Free Report) by 572.6% during the 2nd quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 53,489 shares of the company's stock after purchasing an additional 45,536 shares during the period. Inspire Investing LLC's holdings in Monster Beverage were worth $3,351,000 as of its most recent filing with the SEC.

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Aberdeen Group plc boosted its stake in shares of Monster Beverage by 4.8% in the 2nd quarter. Aberdeen Group plc now owns 534,225 shares of the company's stock valued at $33,464,000 after purchasing an additional 24,368 shares in the last quarter. PDS Planning Inc boosted its stake in shares of Monster Beverage by 14.6% in the 2nd quarter. PDS Planning Inc now owns 5,554 shares of the company's stock valued at $348,000 after purchasing an additional 706 shares in the last quarter. Blue Trust Inc. boosted its stake in shares of Monster Beverage by 6.7% in the 2nd quarter. Blue Trust Inc. now owns 3,293 shares of the company's stock valued at $206,000 after purchasing an additional 207 shares in the last quarter. Cyndeo Wealth Partners LLC acquired a new stake in shares of Monster Beverage in the 2nd quarter valued at $362,000. Finally, Vivid Wealth Management LLC acquired a new stake in shares of Monster Beverage in the 2nd quarter valued at $2,340,000. Institutional investors and hedge funds own 72.36% of the company's stock.

Monster Beverage Trading Up 0.9%

Monster Beverage stock opened at $69.62 on Friday. Monster Beverage Corporation has a 1 year low of $45.70 and a 1 year high of $70.06. The company has a market cap of $67.98 billion, a PE ratio of 43.24, a PEG ratio of 2.40 and a beta of 0.54. The company's 50-day moving average is $64.31 and its two-hundred day moving average is $61.96.

Monster Beverage (NASDAQ:MNST - Get Free Report) last released its earnings results on Thursday, August 7th. The company reported $0.52 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.48 by $0.04. Monster Beverage had a net margin of 20.54% and a return on equity of 27.46%. The company had revenue of $2.11 billion for the quarter, compared to the consensus estimate of $2.08 billion. During the same period in the prior year, the company posted $0.41 EPS. The company's revenue was up 11.1% compared to the same quarter last year. Research analysts forecast that Monster Beverage Corporation will post 1.62 EPS for the current year.

Analyst Ratings Changes

Several equities research analysts have recently commented on the stock. Bank of America boosted their target price on shares of Monster Beverage from $72.00 to $75.00 and gave the company a "buy" rating in a research note on Wednesday. Citigroup reiterated a "buy" rating and set a $79.00 price target (up previously from $76.00) on shares of Monster Beverage in a research report on Thursday. Morgan Stanley upped their price target on shares of Monster Beverage from $70.00 to $74.00 and gave the stock an "overweight" rating in a research report on Friday, August 8th. UBS Group upped their price target on shares of Monster Beverage from $67.00 to $72.00 and gave the stock a "neutral" rating in a research report on Wednesday. Finally, Wells Fargo & Company set a $73.00 price target on shares of Monster Beverage and gave the stock an "overweight" rating in a research report on Friday, August 8th. Thirteen investment analysts have rated the stock with a Buy rating, eight have given a Hold rating and two have given a Sell rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $66.05.

Get Our Latest Analysis on Monster Beverage

Insider Activity at Monster Beverage

In other news, Director Mark Vidergauz sold 10,000 shares of the company's stock in a transaction dated Wednesday, August 13th. The stock was sold at an average price of $63.73, for a total value of $637,300.00. Following the completion of the sale, the director directly owned 51,191 shares of the company's stock, valued at $3,262,402.43. This represents a 16.34% decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. 8.30% of the stock is currently owned by company insiders.

Monster Beverage Company Profile

(

Free Report)

Monster Beverage Corporation, through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally. The company operates through three segments: Monster Energy Drinks, Strategic Brands, Alcohol Brands, and Other.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Monster Beverage, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Monster Beverage wasn't on the list.

While Monster Beverage currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.