Inspire Trust Co. N.A. boosted its position in shares of DexCom, Inc. (NASDAQ:DXCM - Free Report) by 33.6% during the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 35,000 shares of the medical device company's stock after acquiring an additional 8,800 shares during the period. Inspire Trust Co. N.A.'s holdings in DexCom were worth $2,390,000 at the end of the most recent quarter.

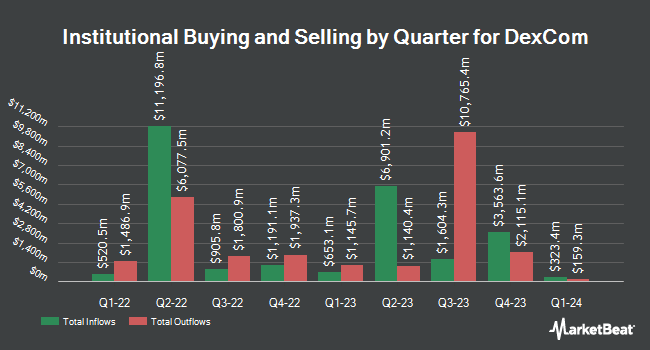

Other institutional investors and hedge funds have also modified their holdings of the company. Vanguard Group Inc. lifted its holdings in DexCom by 2.0% during the first quarter. Vanguard Group Inc. now owns 47,455,899 shares of the medical device company's stock worth $3,240,763,000 after acquiring an additional 925,882 shares in the last quarter. Jennison Associates LLC increased its holdings in DexCom by 37.7% in the 1st quarter. Jennison Associates LLC now owns 10,523,246 shares of the medical device company's stock valued at $718,632,000 after buying an additional 2,879,489 shares during the period. Nuveen LLC bought a new stake in shares of DexCom during the 1st quarter valued at approximately $554,893,000. Northern Trust Corp boosted its position in DexCom by 22.2% in the fourth quarter. Northern Trust Corp now owns 4,146,249 shares of the medical device company's stock valued at $322,454,000 after buying an additional 753,857 shares in the last quarter. Finally, Massachusetts Financial Services Co. MA grew its holdings in DexCom by 171.0% during the 1st quarter. Massachusetts Financial Services Co. MA now owns 3,194,829 shares of the medical device company's stock worth $218,175,000 after acquiring an additional 2,015,971 shares during the last quarter. 97.75% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling at DexCom

In other DexCom news, EVP Sadie Stern sold 6,184 shares of DexCom stock in a transaction that occurred on Tuesday, May 27th. The stock was sold at an average price of $85.11, for a total transaction of $526,320.24. Following the transaction, the executive vice president owned 109,621 shares of the company's stock, valued at $9,329,843.31. The trade was a 5.34% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, Director Nicholas Augustinos sold 3,672 shares of the business's stock in a transaction that occurred on Monday, June 16th. The shares were sold at an average price of $82.80, for a total value of $304,041.60. Following the completion of the transaction, the director directly owned 33,411 shares in the company, valued at approximately $2,766,430.80. The trade was a 9.90% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 31,906 shares of company stock worth $2,675,251. 0.32% of the stock is owned by company insiders.

Analysts Set New Price Targets

DXCM has been the topic of several research analyst reports. Raymond James Financial increased their target price on shares of DexCom from $99.00 to $102.00 and gave the stock a "strong-buy" rating in a research note on Thursday, July 31st. Wall Street Zen downgraded shares of DexCom from a "strong-buy" rating to a "buy" rating in a research note on Sunday, August 10th. UBS Group upped their target price on shares of DexCom from $105.00 to $106.00 and gave the stock a "buy" rating in a report on Thursday, July 31st. Citigroup reissued a "buy" rating and issued a $102.00 price target (up previously from $82.00) on shares of DexCom in a research note on Thursday, May 22nd. Finally, Morgan Stanley upped their price objective on shares of DexCom from $82.00 to $89.00 and gave the company an "equal weight" rating in a research note on Tuesday, July 15th. Three analysts have rated the stock with a Strong Buy rating, fifteen have given a Buy rating and four have issued a Hold rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $99.89.

Read Our Latest Analysis on DXCM

DexCom Trading Down 0.4%

Shares of DXCM traded down $0.3310 during trading hours on Tuesday, reaching $80.4890. 707,860 shares of the company traded hands, compared to its average volume of 3,873,105. DexCom, Inc. has a 12-month low of $57.52 and a 12-month high of $93.25. The stock's fifty day moving average price is $82.96 and its 200 day moving average price is $79.95. The firm has a market cap of $31.56 billion, a price-to-earnings ratio of 55.83, a PEG ratio of 1.70 and a beta of 1.43. The company has a current ratio of 1.52, a quick ratio of 1.35 and a debt-to-equity ratio of 0.48.

DexCom (NASDAQ:DXCM - Get Free Report) last issued its earnings results on Wednesday, July 30th. The medical device company reported $0.48 EPS for the quarter, beating analysts' consensus estimates of $0.45 by $0.03. DexCom had a return on equity of 30.41% and a net margin of 13.29%.The firm had revenue of $1.16 billion for the quarter, compared to analyst estimates of $1.13 billion. During the same quarter in the prior year, the firm earned $0.43 earnings per share. DexCom's revenue for the quarter was up 15.2% on a year-over-year basis. DexCom has set its FY 2025 guidance at EPS. Sell-side analysts forecast that DexCom, Inc. will post 2.03 earnings per share for the current year.

About DexCom

(

Free Report)

DexCom, Inc, a medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally. The company provides its systems for use by people with diabetes, as well as for use by healthcare providers. Its products include Dexcom G6 and Dexcom G7, integrated CGM systems for diabetes management; Dexcom Share, a remote monitoring system; Dexcom Real-Time API, which enables authorized third-party software developers to integrate real-time CGM data into their digital health apps and devices; and Dexcom ONE, that is designed to replace finger stick blood glucose testing for diabetes treatment decisions.

Featured Articles

Before you consider DexCom, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DexCom wasn't on the list.

While DexCom currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report