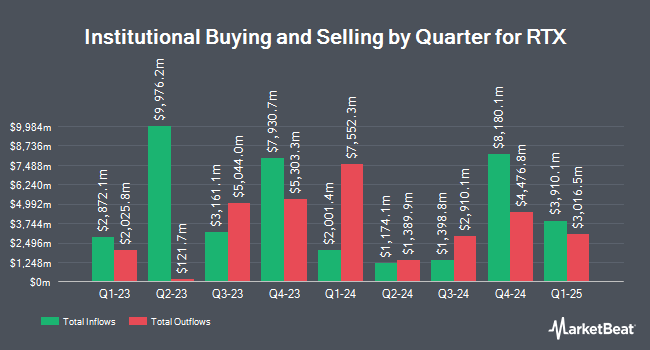

Integrated Investment Consultants LLC decreased its stake in shares of RTX Corporation (NYSE:RTX - Free Report) by 66.3% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 5,784 shares of the company's stock after selling 11,380 shares during the quarter. Integrated Investment Consultants LLC's holdings in RTX were worth $766,000 at the end of the most recent quarter.

Several other institutional investors and hedge funds also recently made changes to their positions in RTX. Geode Capital Management LLC boosted its position in shares of RTX by 3.7% in the fourth quarter. Geode Capital Management LLC now owns 28,264,502 shares of the company's stock worth $3,263,610,000 after purchasing an additional 1,000,722 shares during the period. Franklin Resources Inc. grew its position in shares of RTX by 3.8% during the 4th quarter. Franklin Resources Inc. now owns 16,611,341 shares of the company's stock worth $1,922,264,000 after buying an additional 603,159 shares in the last quarter. Northern Trust Corp lifted its holdings in RTX by 8.4% during the fourth quarter. Northern Trust Corp now owns 12,912,698 shares of the company's stock worth $1,494,257,000 after buying an additional 997,806 shares during the period. T. Rowe Price Investment Management Inc. raised its stake in shares of RTX by 43.1% during the 4th quarter. T. Rowe Price Investment Management Inc. now owns 10,508,662 shares of the company's stock worth $1,216,063,000 after acquiring an additional 3,164,844 shares in the last quarter. Finally, Invesco Ltd. boosted its stake in RTX by 17.6% in the 4th quarter. Invesco Ltd. now owns 10,157,769 shares of the company's stock worth $1,175,457,000 after purchasing an additional 1,522,251 shares in the last quarter. Institutional investors own 86.50% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have recently commented on RTX shares. Citigroup raised their price objective on shares of RTX from $148.00 to $182.00 and gave the stock a "buy" rating in a research note on Monday, July 14th. Royal Bank Of Canada reaffirmed an "outperform" rating and issued a $170.00 target price (up from $165.00) on shares of RTX in a research report on Wednesday, July 23rd. Bank of America boosted their target price on RTX from $150.00 to $175.00 and gave the stock a "buy" rating in a research note on Wednesday, July 23rd. Susquehanna increased their target price on shares of RTX from $160.00 to $175.00 and gave the stock a "positive" rating in a research note on Wednesday, July 23rd. Finally, Benchmark raised shares of RTX from a "hold" rating to a "buy" rating and set a $140.00 price target on the stock in a research note on Wednesday, May 14th. Six investment analysts have rated the stock with a hold rating, fourteen have given a buy rating and three have given a strong buy rating to the company. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $155.69.

View Our Latest Report on RTX

RTX Trading Down 0.5%

NYSE RTX traded down $0.82 on Monday, hitting $156.06. The company's stock had a trading volume of 4,022,106 shares, compared to its average volume of 4,686,952. The company's 50-day simple moving average is $143.86 and its 200 day simple moving average is $133.33. RTX Corporation has a 52-week low of $112.27 and a 52-week high of $157.33. The firm has a market cap of $208.89 billion, a P/E ratio of 34.30, a PEG ratio of 2.89 and a beta of 0.64. The company has a current ratio of 1.01, a quick ratio of 0.75 and a debt-to-equity ratio of 0.60.

RTX (NYSE:RTX - Get Free Report) last announced its quarterly earnings data on Tuesday, July 22nd. The company reported $1.56 EPS for the quarter, beating the consensus estimate of $1.45 by $0.11. RTX had a net margin of 7.35% and a return on equity of 12.89%. The company had revenue of $21.58 billion for the quarter, compared to the consensus estimate of $20.68 billion. During the same period in the prior year, the firm posted $1.41 EPS. RTX's revenue for the quarter was up 9.4% on a year-over-year basis. Research analysts predict that RTX Corporation will post 6.11 EPS for the current fiscal year.

RTX Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, September 4th. Shareholders of record on Friday, August 15th will be issued a dividend of $0.68 per share. This represents a $2.72 annualized dividend and a dividend yield of 1.74%. RTX's dividend payout ratio (DPR) is presently 59.78%.

Insider Transactions at RTX

In other news, EVP Dantaya M. Williams sold 16,922 shares of the stock in a transaction on Tuesday, June 3rd. The shares were sold at an average price of $137.62, for a total value of $2,328,805.64. Following the sale, the executive vice president owned 16,538 shares of the company's stock, valued at approximately $2,275,959.56. This represents a 50.57% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, VP Amy L. Johnson sold 4,146 shares of the stock in a transaction on Tuesday, May 6th. The stock was sold at an average price of $127.54, for a total value of $528,780.84. Following the completion of the sale, the vice president owned 9,546 shares in the company, valued at approximately $1,217,496.84. The trade was a 30.28% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 31,234 shares of company stock valued at $4,439,755 in the last ninety days. Corporate insiders own 0.15% of the company's stock.

RTX Profile

(

Free Report)

RTX Corporation, an aerospace and defense company, provides systems and services for the commercial, military, and government customers in the United States and internationally. It operates through three segments: Collins Aerospace, Pratt & Whitney, and Raytheon. The Collins Aerospace Systems segment offers aerospace and defense products, and aftermarket service solutions for civil and military aircraft manufacturers and commercial airlines, as well as regional, business, and general aviation, defense, and commercial space operations.

Read More

Before you consider RTX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RTX wasn't on the list.

While RTX currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report