Navellier & Associates Inc. trimmed its holdings in International General Insurance Holdings Ltd. (NASDAQ:IGIC - Free Report) by 43.5% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 35,112 shares of the company's stock after selling 27,045 shares during the quarter. Navellier & Associates Inc. owned 0.08% of International General Insurance worth $917,000 as of its most recent filing with the Securities and Exchange Commission.

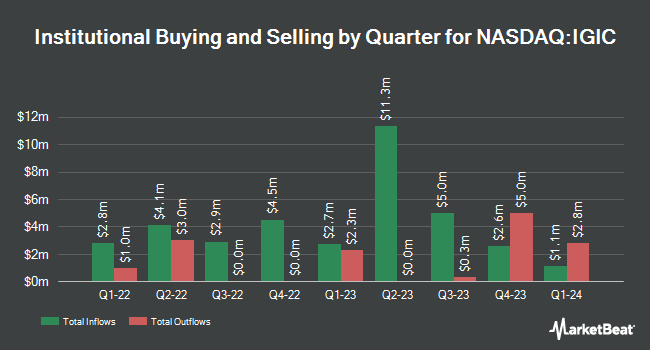

A number of other institutional investors and hedge funds also recently bought and sold shares of the business. Royce & Associates LP lifted its holdings in International General Insurance by 10.1% in the 1st quarter. Royce & Associates LP now owns 2,636,063 shares of the company's stock valued at $69,355,000 after acquiring an additional 242,104 shares during the last quarter. Diamond Hill Capital Management Inc. lifted its holdings in International General Insurance by 16.1% in the 1st quarter. Diamond Hill Capital Management Inc. now owns 221,271 shares of the company's stock valued at $5,822,000 after acquiring an additional 30,708 shares during the last quarter. Catalyst Capital Advisors LLC acquired a new stake in International General Insurance in the 1st quarter valued at about $147,000. Deroy & Devereaux Private Investment Counsel Inc. lifted its holdings in International General Insurance by 3.2% in the 1st quarter. Deroy & Devereaux Private Investment Counsel Inc. now owns 195,890 shares of the company's stock valued at $5,154,000 after acquiring an additional 6,065 shares during the last quarter. Finally, CWA Asset Management Group LLC acquired a new stake in International General Insurance in the 1st quarter valued at about $1,112,000. 54.24% of the stock is owned by institutional investors and hedge funds.

International General Insurance Trading Up 0.1%

IGIC stock traded up $0.03 during mid-day trading on Tuesday, reaching $23.35. 82,723 shares of the stock traded hands, compared to its average volume of 118,658. International General Insurance Holdings Ltd. has a 52-week low of $15.00 and a 52-week high of $27.76. The company has a market cap of $1.04 billion, a P/E ratio of 8.58 and a beta of 0.24. The stock's fifty day moving average is $23.41 and its 200-day moving average is $24.43.

International General Insurance (NASDAQ:IGIC - Get Free Report) last posted its quarterly earnings data on Tuesday, May 6th. The company reported $0.42 EPS for the quarter, missing analysts' consensus estimates of $0.47 by ($0.05). International General Insurance had a net margin of 23.16% and a return on equity of 19.54%. The firm had revenue of $129.00 million for the quarter, compared to analysts' expectations of $135.50 million. Equities research analysts expect that International General Insurance Holdings Ltd. will post 3.18 earnings per share for the current year.

International General Insurance Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, June 18th. Stockholders of record on Monday, June 2nd were given a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a dividend yield of 0.86%. The ex-dividend date of this dividend was Monday, June 2nd. International General Insurance's dividend payout ratio (DPR) is 7.35%.

International General Insurance Profile

(

Free Report)

International General Insurance Holdings Ltd. engages in the provision of specialty insurance and reinsurance solutions worldwide. The company operates through three segments: Specialty Long-tail, Specialty Short-tail, and Reinsurance. It is involved in underwriting a portfolio of specialty risks, including energy, property, construction and engineering, ports and terminals, general aviation, political violence, professional lines, financial institutions, motor, marine liability, contingency, marine, treaty, and casualty insurance and reinsurance.

See Also

Before you consider International General Insurance, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International General Insurance wasn't on the list.

While International General Insurance currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.