American Trust increased its stake in Intuit Inc. (NASDAQ:INTU - Free Report) by 60.5% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,911 shares of the software maker's stock after purchasing an additional 1,097 shares during the quarter. American Trust's holdings in Intuit were worth $1,830,000 as of its most recent filing with the Securities and Exchange Commission.

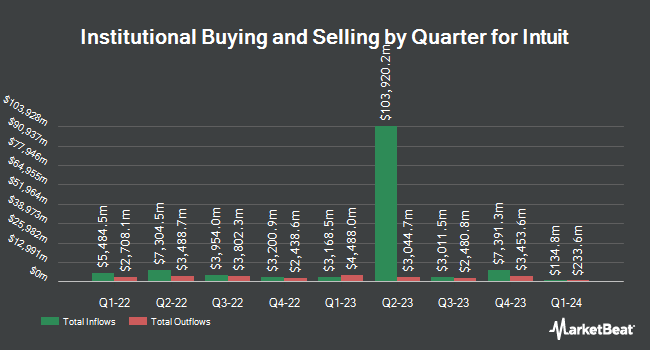

A number of other institutional investors have also recently bought and sold shares of INTU. R Squared Ltd acquired a new position in shares of Intuit in the 4th quarter valued at about $25,000. NewSquare Capital LLC increased its holdings in shares of Intuit by 72.0% in the 4th quarter. NewSquare Capital LLC now owns 43 shares of the software maker's stock valued at $27,000 after purchasing an additional 18 shares during the period. Heck Capital Advisors LLC acquired a new position in shares of Intuit in the 4th quarter valued at about $28,000. Migdal Insurance & Financial Holdings Ltd. acquired a new position in shares of Intuit in the 4th quarter valued at about $28,000. Finally, Summit Securities Group LLC acquired a new position in shares of Intuit in the 4th quarter valued at about $28,000. Hedge funds and other institutional investors own 83.66% of the company's stock.

Insider Transactions at Intuit

In related news, insider Scott D. Cook sold 6,446 shares of the company's stock in a transaction on Friday, February 28th. The stock was sold at an average price of $604.26, for a total value of $3,895,059.96. Following the completion of the transaction, the insider now directly owns 6,219,900 shares in the company, valued at approximately $3,758,436,774. This represents a 0.10% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, EVP Laura A. Fennell sold 8,163 shares of the company's stock in a transaction on Monday, March 24th. The shares were sold at an average price of $612.46, for a total value of $4,999,510.98. Following the completion of the transaction, the executive vice president now owns 21,882 shares of the company's stock, valued at $13,401,849.72. The trade was a 27.17% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 23,696 shares of company stock worth $14,347,731 over the last three months. 2.68% of the stock is currently owned by insiders.

Analysts Set New Price Targets

A number of equities analysts have recently weighed in on the company. Citigroup reiterated a "buy" rating and issued a $789.00 target price (up previously from $726.00) on shares of Intuit in a report on Friday, May 23rd. Piper Sandler reissued an "overweight" rating and issued a $825.00 price target (up previously from $785.00) on shares of Intuit in a research note on Friday, May 23rd. Morgan Stanley reissued an "overweight" rating and issued a $785.00 price target (up previously from $720.00) on shares of Intuit in a research note on Friday, May 23rd. Stifel Nicolaus boosted their price target on Intuit from $725.00 to $850.00 and gave the company a "buy" rating in a research note on Friday, May 23rd. Finally, UBS Group set a $750.00 price target on Intuit and gave the company a "neutral" rating in a research note on Friday, May 23rd. One investment analyst has rated the stock with a sell rating, three have issued a hold rating, twenty have issued a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $785.33.

View Our Latest Report on Intuit

Intuit Stock Performance

INTU traded up $2.49 on Wednesday, hitting $754.45. The company had a trading volume of 2,501,896 shares, compared to its average volume of 1,628,758. The company's fifty day moving average price is $622.13 and its 200 day moving average price is $621.81. Intuit Inc. has a 1-year low of $532.65 and a 1-year high of $774.78. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.24 and a quick ratio of 1.24. The stock has a market cap of $210.92 billion, a price-to-earnings ratio of 73.25, a price-to-earnings-growth ratio of 2.85 and a beta of 1.24.

Intuit (NASDAQ:INTU - Get Free Report) last issued its quarterly earnings results on Thursday, May 22nd. The software maker reported $11.65 EPS for the quarter, topping analysts' consensus estimates of $10.89 by $0.76. Intuit had a return on equity of 18.25% and a net margin of 17.59%. The company had revenue of $7.75 billion during the quarter, compared to analyst estimates of $7.56 billion. During the same period in the previous year, the company earned $9.88 earnings per share. The company's quarterly revenue was up 15.1% compared to the same quarter last year. Equities analysts predict that Intuit Inc. will post 14.09 earnings per share for the current fiscal year.

Intuit Company Profile

(

Free Report)

Intuit Inc provides financial management and compliance products and services for consumers, small businesses, self-employed, and accounting professionals in the United States, Canada, and internationally. The company operates in four segments: Small Business & Self-Employed, Consumer, Credit Karma, and ProTax.

Recommended Stories

Before you consider Intuit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intuit wasn't on the list.

While Intuit currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.