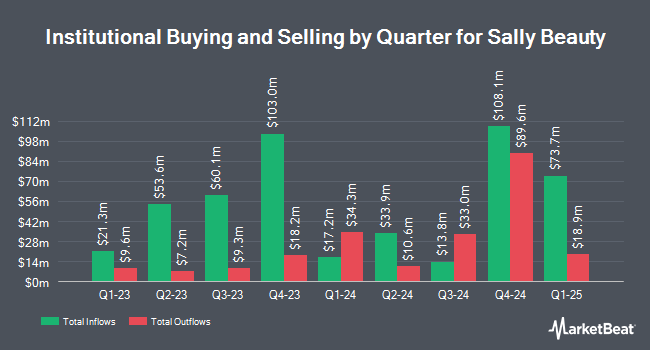

Invenomic Capital Management LP grew its position in Sally Beauty Holdings, Inc. (NYSE:SBH - Free Report) by 160.3% in the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 1,889,310 shares of the specialty retailer's stock after acquiring an additional 1,163,619 shares during the period. Invenomic Capital Management LP owned about 1.85% of Sally Beauty worth $17,060,000 at the end of the most recent quarter.

Other large investors have also modified their holdings of the company. Golden State Wealth Management LLC raised its position in shares of Sally Beauty by 100.0% in the first quarter. Golden State Wealth Management LLC now owns 3,470 shares of the specialty retailer's stock worth $31,000 after acquiring an additional 1,735 shares during the period. Parallel Advisors LLC raised its position in shares of Sally Beauty by 536.4% during the 1st quarter. Parallel Advisors LLC now owns 3,920 shares of the specialty retailer's stock worth $35,000 after purchasing an additional 3,304 shares during the last quarter. GAMMA Investing LLC raised its position in shares of Sally Beauty by 820.3% during the 1st quarter. GAMMA Investing LLC now owns 4,712 shares of the specialty retailer's stock worth $43,000 after purchasing an additional 4,200 shares during the last quarter. CWM LLC raised its position in shares of Sally Beauty by 123.7% during the 1st quarter. CWM LLC now owns 8,949 shares of the specialty retailer's stock worth $81,000 after purchasing an additional 4,948 shares during the last quarter. Finally, EP Wealth Advisors LLC acquired a new position in shares of Sally Beauty during the 1st quarter worth about $100,000.

Sally Beauty Trading Down 0.9%

NYSE:SBH traded down $0.13 on Wednesday, hitting $14.51. The stock had a trading volume of 1,427,720 shares, compared to its average volume of 2,141,052. The company has a quick ratio of 0.49, a current ratio of 2.41 and a debt-to-equity ratio of 1.16. The stock has a market cap of $1.44 billion, a price-to-earnings ratio of 7.79 and a beta of 1.38. The company has a fifty day moving average price of $11.73 and a two-hundred day moving average price of $9.77. Sally Beauty Holdings, Inc. has a 1-year low of $7.54 and a 1-year high of $14.79.

Sally Beauty (NYSE:SBH - Get Free Report) last posted its earnings results on Tuesday, August 5th. The specialty retailer reported $0.51 earnings per share for the quarter, beating the consensus estimate of $0.42 by $0.09. The company had revenue of $933.31 million for the quarter, compared to analyst estimates of $928.78 million. Sally Beauty had a net margin of 5.26% and a return on equity of 28.11%. Sally Beauty's revenue was down 1.0% on a year-over-year basis. During the same period in the previous year, the business posted $0.45 EPS. Sally Beauty has set its FY 2025 guidance at EPS. Equities research analysts expect that Sally Beauty Holdings, Inc. will post 1.81 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several research analysts recently weighed in on SBH shares. Wall Street Zen downgraded shares of Sally Beauty from a "buy" rating to a "hold" rating in a research report on Thursday, May 22nd. Cowen restated a "buy" rating on shares of Sally Beauty in a research report on Thursday, September 4th. Zacks Research raised shares of Sally Beauty from a "hold" rating to a "strong-buy" rating in a research note on Friday, September 5th. Canaccord Genuity Group upped their price objective on shares of Sally Beauty from $14.00 to $15.00 and gave the company a "buy" rating in a research note on Wednesday, August 6th. Finally, TD Cowen upped their price objective on shares of Sally Beauty from $13.00 to $16.00 and gave the company a "buy" rating in a research note on Thursday, September 4th. One analyst has rated the stock with a Strong Buy rating, three have issued a Buy rating, two have assigned a Hold rating and one has assigned a Sell rating to the stock. Based on data from MarketBeat.com, Sally Beauty presently has an average rating of "Moderate Buy" and an average price target of $12.88.

Check Out Our Latest Report on Sally Beauty

Insider Buying and Selling at Sally Beauty

In other news, Director Max R. Rangel bought 3,500 shares of the firm's stock in a transaction on Thursday, September 4th. The shares were bought at an average cost of $14.07 per share, for a total transaction of $49,245.00. Following the acquisition, the director directly owned 3,500 shares of the company's stock, valued at $49,245. This trade represents a ∞ increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available at the SEC website. Also, Director Diana Sue Ferguson bought 2,500 shares of the firm's stock in a transaction on Thursday, August 7th. The stock was purchased at an average price of $12.02 per share, for a total transaction of $30,050.00. Following the completion of the acquisition, the director directly owned 7,912 shares in the company, valued at $95,102.24. The trade was a 46.19% increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders have bought 10,500 shares of company stock worth $132,125 in the last ninety days. 1.56% of the stock is owned by insiders.

About Sally Beauty

(

Free Report)

Sally Beauty Holdings, Inc operates as a specialty retailer and distributor of professional beauty supplies. The company operates through two segments, Sally Beauty Supply and Beauty Systems Group. The Sally Beauty Supply segment offers beauty products, including hair color and care products, skin and nail care products, styling tools, and other beauty products for retail customers, salons, and salon professionals.

Featured Stories

Before you consider Sally Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sally Beauty wasn't on the list.

While Sally Beauty currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.