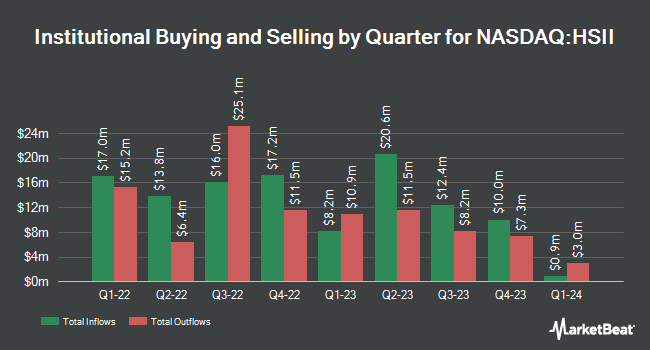

Invenomic Capital Management LP decreased its holdings in shares of Heidrick & Struggles International, Inc. (NASDAQ:HSII - Free Report) by 10.3% during the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 234,987 shares of the business services provider's stock after selling 26,946 shares during the quarter. Invenomic Capital Management LP owned 1.14% of Heidrick & Struggles International worth $10,064,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds have also modified their holdings of HSII. Northern Trust Corp grew its holdings in shares of Heidrick & Struggles International by 9.5% during the fourth quarter. Northern Trust Corp now owns 251,778 shares of the business services provider's stock valued at $11,156,000 after buying an additional 21,843 shares in the last quarter. Jane Street Group LLC grew its holdings in shares of Heidrick & Struggles International by 259.2% during the fourth quarter. Jane Street Group LLC now owns 31,595 shares of the business services provider's stock valued at $1,400,000 after buying an additional 22,798 shares in the last quarter. Algert Global LLC grew its holdings in shares of Heidrick & Struggles International by 4.5% during the fourth quarter. Algert Global LLC now owns 38,759 shares of the business services provider's stock valued at $1,717,000 after buying an additional 1,669 shares in the last quarter. BNP Paribas Financial Markets grew its holdings in shares of Heidrick & Struggles International by 1.2% during the fourth quarter. BNP Paribas Financial Markets now owns 34,570 shares of the business services provider's stock valued at $1,532,000 after buying an additional 400 shares in the last quarter. Finally, Deutsche Bank AG grew its holdings in shares of Heidrick & Struggles International by 51.8% during the fourth quarter. Deutsche Bank AG now owns 18,419 shares of the business services provider's stock valued at $816,000 after buying an additional 6,285 shares in the last quarter. Hedge funds and other institutional investors own 90.13% of the company's stock.

Analyst Ratings Changes

A number of brokerages have recently weighed in on HSII. Wall Street Zen upgraded Heidrick & Struggles International from a "buy" rating to a "strong-buy" rating in a report on Saturday, August 9th. Barrington Research boosted their target price on Heidrick & Struggles International from $52.00 to $56.00 and gave the company an "outperform" rating in a research note on Friday, August 22nd. Finally, Truist Financial boosted their target price on Heidrick & Struggles International from $44.00 to $46.00 and gave the company a "hold" rating in a research note on Friday, June 20th. One investment analyst has rated the stock with a Buy rating and one has assigned a Hold rating to the company's stock. According to MarketBeat.com, Heidrick & Struggles International currently has a consensus rating of "Moderate Buy" and a consensus price target of $51.00.

Get Our Latest Report on Heidrick & Struggles International

Heidrick & Struggles International Trading Down 2.3%

NASDAQ HSII traded down $1.15 on Wednesday, reaching $49.23. The stock had a trading volume of 26,892 shares, compared to its average volume of 129,070. Heidrick & Struggles International, Inc. has a 1 year low of $35.54 and a 1 year high of $52.17. The business has a 50 day moving average price of $47.78 and a 200 day moving average price of $44.18. The company has a market capitalization of $1.02 billion, a price-to-earnings ratio of 30.94, a P/E/G ratio of 0.99 and a beta of 1.07.

Heidrick & Struggles International (NASDAQ:HSII - Get Free Report) last announced its quarterly earnings results on Monday, August 4th. The business services provider reported $0.85 earnings per share for the quarter, topping analysts' consensus estimates of $0.74 by $0.11. Heidrick & Struggles International had a return on equity of 14.85% and a net margin of 2.92%.The company had revenue of $317.25 million during the quarter, compared to analysts' expectations of $292.94 million. Heidrick & Struggles International has set its Q3 2025 guidance at EPS. On average, analysts anticipate that Heidrick & Struggles International, Inc. will post 2.68 earnings per share for the current fiscal year.

Heidrick & Struggles International Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, August 28th. Shareholders of record on Thursday, August 14th were given a $0.15 dividend. The ex-dividend date of this dividend was Thursday, August 14th. This represents a $0.60 dividend on an annualized basis and a dividend yield of 1.2%. Heidrick & Struggles International's payout ratio is currently 37.74%.

About Heidrick & Struggles International

(

Free Report)

Heidrick & Struggles International, Inc engages in provision of leadership consulting, culture shaping and senior-level executive search services. It offers its clients build leadership teams through facilitating the recruitment, management and deployment of senior executives. It operates under the following segments: Americas, Europe, Asia Pacific, Heidrick Consulting, and On Demand Talent Business.

See Also

Before you consider Heidrick & Struggles International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Heidrick & Struggles International wasn't on the list.

While Heidrick & Struggles International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.