Ironvine Capital Partners LLC lowered its holdings in shares of Alphabet Inc. (NASDAQ:GOOG - Free Report) by 7.8% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 292,431 shares of the information services provider's stock after selling 24,762 shares during the quarter. Alphabet accounts for about 5.0% of Ironvine Capital Partners LLC's portfolio, making the stock its 7th largest position. Ironvine Capital Partners LLC's holdings in Alphabet were worth $45,686,000 as of its most recent SEC filing.

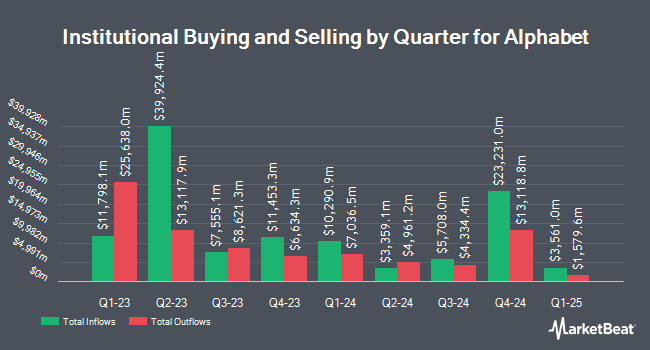

Several other institutional investors have also bought and sold shares of the business. Brighton Jones LLC raised its stake in shares of Alphabet by 5.6% in the fourth quarter. Brighton Jones LLC now owns 120,253 shares of the information services provider's stock valued at $22,901,000 after acquiring an additional 6,410 shares during the period. Bank Pictet & Cie Europe AG raised its stake in shares of Alphabet by 4.3% in the fourth quarter. Bank Pictet & Cie Europe AG now owns 506,535 shares of the information services provider's stock valued at $96,465,000 after acquiring an additional 20,855 shares during the period. Clark Capital Management Group Inc. raised its stake in shares of Alphabet by 7.5% in the fourth quarter. Clark Capital Management Group Inc. now owns 12,839 shares of the information services provider's stock valued at $2,445,000 after acquiring an additional 894 shares during the period. FWL Investment Management LLC increased its stake in Alphabet by 3.1% in the 4th quarter. FWL Investment Management LLC now owns 75,402 shares of the information services provider's stock worth $14,360,000 after buying an additional 2,258 shares during the period. Finally, Family Management Corp increased its stake in Alphabet by 1.3% in the 4th quarter. Family Management Corp now owns 7,319 shares of the information services provider's stock worth $1,394,000 after buying an additional 94 shares during the period. Institutional investors own 27.26% of the company's stock.

Analyst Ratings Changes

Several research analysts recently commented on GOOG shares. Lake Street Capital reaffirmed a "buy" rating on shares of Alphabet in a research note on Wednesday, July 9th. Wells Fargo & Company restated an "equal weight" rating on shares of Alphabet in a report on Wednesday, July 9th. Oppenheimer reiterated an "outperform" rating and issued a $270.00 target price (up from $235.00) on shares of Alphabet in a research note on Wednesday, September 3rd. JPMorgan Chase & Co. lifted their target price on shares of Alphabet from $232.00 to $260.00 and gave the stock an "overweight" rating in a research note on Wednesday, September 3rd. Finally, UBS Group raised their price target on shares of Alphabet from $186.00 to $192.00 and gave the stock a "neutral" rating in a research report on Wednesday, July 16th. Five equities research analysts have rated the stock with a Strong Buy rating, seventeen have given a Buy rating, six have given a Hold rating and three have issued a Sell rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $227.56.

View Our Latest Analysis on GOOG

Insider Activity at Alphabet

In other news, Director Kavitark Ram Shriram sold 18,566 shares of the stock in a transaction dated Friday, July 18th. The shares were sold at an average price of $185.76, for a total transaction of $3,448,820.16. Following the sale, the director owned 243,400 shares of the company's stock, valued at approximately $45,213,984. This represents a 7.09% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director John L. Hennessy sold 1,000 shares of the stock in a transaction dated Friday, August 8th. The stock was sold at an average price of $200.00, for a total transaction of $200,000.00. Following the sale, the director directly owned 6,916 shares in the company, valued at $1,383,200. This represents a 12.63% decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 254,710 shares of company stock worth $49,208,380. 12.99% of the stock is owned by corporate insiders.

Alphabet Price Performance

Shares of Alphabet stock traded down $0.80 during trading hours on Monday, reaching $234.16. 22,702,435 shares of the company's stock were exchanged, compared to its average volume of 24,040,084. The business has a fifty day moving average of $196.65 and a two-hundred day moving average of $176.75. The company has a quick ratio of 1.90, a current ratio of 1.90 and a debt-to-equity ratio of 0.07. The company has a market capitalization of $2.83 trillion, a P/E ratio of 24.94, a price-to-earnings-growth ratio of 1.58 and a beta of 1.01. Alphabet Inc. has a 1 year low of $142.66 and a 1 year high of $238.40.

Alphabet (NASDAQ:GOOG - Get Free Report) last announced its quarterly earnings results on Wednesday, July 23rd. The information services provider reported $2.31 earnings per share for the quarter, beating the consensus estimate of $2.12 by $0.19. Alphabet had a net margin of 31.12% and a return on equity of 34.31%. The firm had revenue of $96.43 billion for the quarter, compared to analysts' expectations of $93.67 billion. During the same quarter in the previous year, the company posted $1.89 EPS. The company's revenue was up 13.8% compared to the same quarter last year. As a group, research analysts predict that Alphabet Inc. will post 8.89 earnings per share for the current fiscal year.

Alphabet Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, September 15th. Shareholders of record on Monday, September 8th will be given a $0.21 dividend. The ex-dividend date of this dividend is Monday, September 8th. This represents a $0.84 dividend on an annualized basis and a yield of 0.4%. Alphabet's dividend payout ratio is presently 8.95%.

Alphabet Profile

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Further Reading

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report