Itau Unibanco Holding S.A. grew its stake in shares of Datadog, Inc. (NASDAQ:DDOG - Free Report) by 1,714.6% in the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 5,825 shares of the company's stock after purchasing an additional 5,504 shares during the quarter. Itau Unibanco Holding S.A.'s holdings in Datadog were worth $578,000 at the end of the most recent quarter.

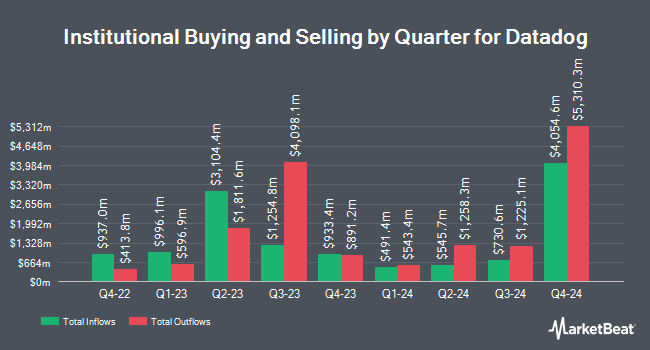

Other large investors have also recently made changes to their positions in the company. Emerald Advisers LLC increased its holdings in Datadog by 1.1% in the 1st quarter. Emerald Advisers LLC now owns 9,300 shares of the company's stock worth $923,000 after buying an additional 97 shares during the period. YANKCOM Partnership increased its holdings in Datadog by 12.0% in the 1st quarter. YANKCOM Partnership now owns 927 shares of the company's stock worth $92,000 after buying an additional 99 shares during the period. Covestor Ltd increased its holdings in Datadog by 8.9% in the 1st quarter. Covestor Ltd now owns 1,388 shares of the company's stock worth $138,000 after buying an additional 113 shares during the period. State of Wyoming increased its holdings in Datadog by 3.7% in the 4th quarter. State of Wyoming now owns 3,277 shares of the company's stock worth $468,000 after buying an additional 117 shares during the period. Finally, Forum Financial Management LP increased its holdings in Datadog by 6.1% in the 1st quarter. Forum Financial Management LP now owns 2,040 shares of the company's stock worth $202,000 after buying an additional 118 shares during the period. 78.29% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at Datadog

In other Datadog news, CTO Alexis Le-Quoc sold 127,105 shares of the firm's stock in a transaction on Wednesday, June 4th. The stock was sold at an average price of $119.96, for a total value of $15,247,515.80. Following the completion of the sale, the chief technology officer directly owned 452,769 shares of the company's stock, valued at $54,314,169.24. This trade represents a 21.92% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Olivier Pomel sold 107,365 shares of the firm's stock in a transaction on Monday, June 9th. The stock was sold at an average price of $121.71, for a total value of $13,067,394.15. Following the completion of the sale, the chief executive officer directly owned 548,715 shares of the company's stock, valued at $66,784,102.65. This trade represents a 16.36% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 1,503,062 shares of company stock worth $193,352,588. Corporate insiders own 8.70% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts recently weighed in on DDOG shares. Jefferies Financial Group increased their price target on shares of Datadog from $135.00 to $160.00 and gave the stock a "buy" rating in a report on Monday, August 4th. Stifel Nicolaus lifted their target price on shares of Datadog from $120.00 to $135.00 and gave the company a "hold" rating in a report on Thursday, June 26th. Citigroup lifted their target price on shares of Datadog from $165.00 to $170.00 and gave the company a "buy" rating in a report on Monday, August 18th. Rosenblatt Securities cut their target price on shares of Datadog from $160.00 to $150.00 and set a "buy" rating for the company in a report on Monday, May 5th. Finally, Needham & Company LLC reaffirmed a "buy" rating and set a $175.00 target price on shares of Datadog in a report on Thursday, August 14th. Twenty-four analysts have rated the stock with a Buy rating, five have issued a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $153.10.

Get Our Latest Research Report on DDOG

Datadog Price Performance

Shares of NASDAQ:DDOG traded down $2.19 during midday trading on Tuesday, reaching $134.50. 3,524,298 shares of the company's stock traded hands, compared to its average volume of 5,859,098. The company has a fifty day simple moving average of $137.56 and a two-hundred day simple moving average of $119.16. The company has a debt-to-equity ratio of 0.31, a quick ratio of 3.43 and a current ratio of 3.43. The company has a market cap of $46.90 billion, a P/E ratio of 383.39, a PEG ratio of 56.37 and a beta of 1.11. Datadog, Inc. has a 1 year low of $81.63 and a 1 year high of $170.08.

Datadog (NASDAQ:DDOG - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The company reported $0.46 earnings per share for the quarter, beating analysts' consensus estimates of $0.41 by $0.05. The company had revenue of $826.76 million for the quarter, compared to analyst estimates of $791.72 million. Datadog had a return on equity of 5.04% and a net margin of 4.13%.The firm's revenue for the quarter was up 28.1% on a year-over-year basis. During the same quarter last year, the firm posted $0.43 EPS. Datadog has set its Q3 2025 guidance at 0.440-0.460 EPS. FY 2025 guidance at 1.800-1.830 EPS. Equities analysts predict that Datadog, Inc. will post 0.34 EPS for the current fiscal year.

About Datadog

(

Free Report)

Datadog, Inc operates an observability and security platform for cloud applications in North America and internationally. The company's products comprise infrastructure and application performance monitoring, log management, digital experience monitoring, continuous profiler, database monitoring, data streams and universal service monitoring, network monitoring, incident management, workflow automation, observability pipelines, cloud cost and cloud security management, application security management, cloud SIEM, sensitive data scanner, and CI visibility.

Featured Articles

Before you consider Datadog, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Datadog wasn't on the list.

While Datadog currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.