IvyRock Asset Management HK Ltd purchased a new stake in shares of AST SpaceMobile, Inc. (NASDAQ:ASTS - Free Report) in the first quarter, according to its most recent Form 13F filing with the SEC. The firm purchased 9,300 shares of the company's stock, valued at approximately $211,000. AST SpaceMobile accounts for approximately 0.1% of IvyRock Asset Management HK Ltd's portfolio, making the stock its 15th largest position.

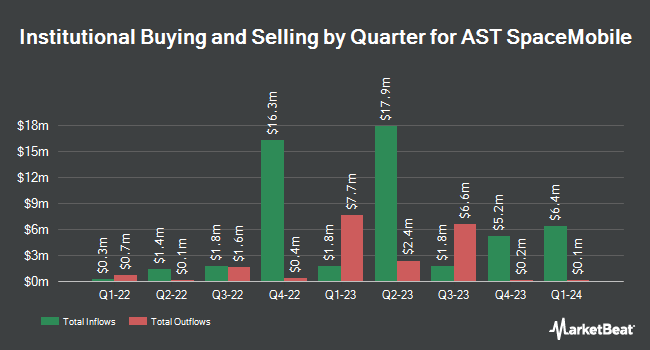

A number of other large investors also recently bought and sold shares of ASTS. Alphabet Inc. purchased a new position in shares of AST SpaceMobile in the first quarter worth $203,375,000. Vanguard Group Inc. lifted its holdings in shares of AST SpaceMobile by 49.4% in the fourth quarter. Vanguard Group Inc. now owns 14,987,351 shares of the company's stock worth $316,233,000 after buying an additional 4,955,941 shares in the last quarter. T. Rowe Price Investment Management Inc. purchased a new position in shares of AST SpaceMobile in the fourth quarter worth $59,523,000. Key Colony Management LLC lifted its holdings in shares of AST SpaceMobile by 204.1% in the first quarter. Key Colony Management LLC now owns 596,000 shares of the company's stock worth $13,553,000 after buying an additional 400,000 shares in the last quarter. Finally, Massachusetts Financial Services Co. MA purchased a new position in shares of AST SpaceMobile in the first quarter worth $7,294,000. 60.95% of the stock is owned by hedge funds and other institutional investors.

AST SpaceMobile Trading Up 0.0%

NASDAQ ASTS traded up $0.01 during trading hours on Monday, reaching $54.35. The company had a trading volume of 5,155,058 shares, compared to its average volume of 12,246,919. The stock has a market capitalization of $17.20 billion, a P/E ratio of -27.25 and a beta of 2.27. AST SpaceMobile, Inc. has a 1-year low of $16.98 and a 1-year high of $60.95. The company has a current ratio of 10.62, a quick ratio of 10.62 and a debt-to-equity ratio of 0.60. The stock has a 50-day moving average of $40.83 and a 200 day moving average of $30.51.

AST SpaceMobile (NASDAQ:ASTS - Get Free Report) last issued its quarterly earnings results on Monday, May 12th. The company reported ($0.20) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.17) by ($0.03). The business had revenue of $0.72 million for the quarter, compared to analyst estimates of $3.85 million. AST SpaceMobile had a negative return on equity of 23.56% and a negative net margin of 7,033.22%. As a group, research analysts anticipate that AST SpaceMobile, Inc. will post -0.4 earnings per share for the current fiscal year.

Insider Buying and Selling

In other AST SpaceMobile news, CTO Huiwen Yao sold 4,250 shares of the firm's stock in a transaction on Tuesday, June 10th. The stock was sold at an average price of $34.60, for a total value of $147,050.00. Following the completion of the sale, the chief technology officer owned 20,750 shares of the company's stock, valued at approximately $717,950. This trade represents a 17.00% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, President Scott Wisniewski sold 50,000 shares of the firm's stock in a transaction on Monday, June 9th. The shares were sold at an average price of $35.65, for a total value of $1,782,500.00. Following the completion of the transaction, the president owned 545,595 shares of the company's stock, valued at approximately $19,450,461.75. This represents a 8.39% decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 184,250 shares of company stock worth $6,146,750. Company insiders own 41.80% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts have recently weighed in on the stock. B. Riley reissued a "buy" rating and issued a $44.00 target price (up previously from $36.00) on shares of AST SpaceMobile in a research note on Monday, June 16th. Roth Capital assumed coverage on shares of AST SpaceMobile in a report on Thursday, April 10th. They issued a "buy" rating and a $42.00 price target on the stock. Bank of America began coverage on shares of AST SpaceMobile in a report on Wednesday, June 25th. They issued a "neutral" rating and a $55.00 price target on the stock. Scotiabank reiterated a "sector perform" rating and set a $45.40 target price on shares of AST SpaceMobile in a report on Monday, June 23rd. Finally, Oppenheimer started coverage on shares of AST SpaceMobile in a research report on Monday, May 5th. They issued a "market perform" rating for the company. Three research analysts have rated the stock with a hold rating and five have given a buy rating to the company. According to MarketBeat.com, AST SpaceMobile currently has an average rating of "Moderate Buy" and an average target price of $45.34.

Get Our Latest Analysis on AST SpaceMobile

AST SpaceMobile Profile

(

Free Report)

AST SpaceMobile, Inc, together with its subsidiaries, develops and provides access to a space-based cellular broadband network for smartphones in the United States. Its SpaceMobile service provides cellular broadband services to end-users who are out of terrestrial cellular coverage. The company was founded in 2017 and is headquartered in Midland, Texas.

Recommended Stories

Before you consider AST SpaceMobile, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AST SpaceMobile wasn't on the list.

While AST SpaceMobile currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.