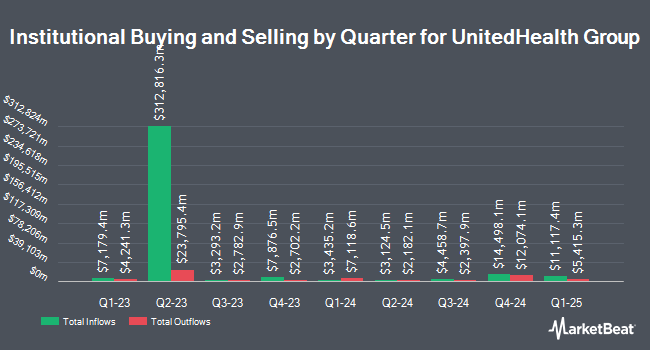

J. Safra Sarasin Holding AG raised its stake in UnitedHealth Group Incorporated (NYSE:UNH - Free Report) by 13.3% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 20,848 shares of the healthcare conglomerate's stock after buying an additional 2,442 shares during the quarter. J. Safra Sarasin Holding AG's holdings in UnitedHealth Group were worth $10,919,000 at the end of the most recent quarter.

Other large investors also recently bought and sold shares of the company. Marshall & Sterling Wealth Advisors Inc. purchased a new position in UnitedHealth Group in the fourth quarter valued at approximately $26,000. Hurley Capital LLC purchased a new position in UnitedHealth Group during the 4th quarter worth $28,000. Bayforest Capital Ltd lifted its holdings in UnitedHealth Group by 685.7% in the first quarter. Bayforest Capital Ltd now owns 55 shares of the healthcare conglomerate's stock valued at $29,000 after acquiring an additional 48 shares during the period. Aster Capital Management DIFC Ltd acquired a new stake in UnitedHealth Group in the fourth quarter valued at $30,000. Finally, IAG Wealth Partners LLC purchased a new stake in shares of UnitedHealth Group in the 1st quarter worth about $42,000. Institutional investors and hedge funds own 87.86% of the company's stock.

Insider Activity

In related news, CEO Patrick Hugh Conway sold 589 shares of UnitedHealth Group stock in a transaction dated Tuesday, June 10th. The stock was sold at an average price of $305.00, for a total value of $179,645.00. Following the transaction, the chief executive officer owned 10,398 shares of the company's stock, valued at approximately $3,171,390. This trade represents a 5.36% decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Kristen Gil purchased 3,700 shares of the company's stock in a transaction that occurred on Thursday, May 15th. The stock was bought at an average cost of $271.17 per share, for a total transaction of $1,003,329.00. Following the purchase, the director directly owned 3,818 shares in the company, valued at $1,035,327.06. This represents a 3,135.59% increase in their position. The disclosure for this purchase can be found here. Insiders acquired 109,408 shares of company stock valued at $31,607,768 over the last quarter. Insiders own 0.28% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts recently weighed in on the stock. Bank of America cut their target price on shares of UnitedHealth Group from $350.00 to $300.00 and set a "neutral" rating for the company in a research note on Tuesday. Wall Street Zen downgraded shares of UnitedHealth Group from a "buy" rating to a "hold" rating in a research note on Saturday, May 24th. Raymond James Financial downgraded shares of UnitedHealth Group from a "strong-buy" rating to a "market perform" rating in a research note on Wednesday, May 14th. Hsbc Global Res downgraded shares of UnitedHealth Group from a "hold" rating to a "moderate sell" rating in a research note on Wednesday, May 21st. Finally, Royal Bank Of Canada decreased their price objective on shares of UnitedHealth Group from $355.00 to $286.00 and set an "outperform" rating for the company in a research note on Wednesday. Three analysts have rated the stock with a sell rating, seven have given a hold rating and fifteen have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and an average target price of $373.52.

View Our Latest Stock Analysis on UnitedHealth Group

UnitedHealth Group Stock Performance

UNH stock opened at $237.40 on Friday. The company has a debt-to-equity ratio of 0.73, a quick ratio of 0.85 and a current ratio of 0.85. The stock has a market capitalization of $215.36 billion, a price-to-earnings ratio of 10.29, a PEG ratio of 1.56 and a beta of 0.43. UnitedHealth Group Incorporated has a 1 year low of $234.60 and a 1 year high of $630.73. The stock's fifty day moving average is $296.86 and its two-hundred day moving average is $416.24.

UnitedHealth Group (NYSE:UNH - Get Free Report) last issued its quarterly earnings results on Tuesday, July 29th. The healthcare conglomerate reported $4.08 EPS for the quarter, missing analysts' consensus estimates of $4.45 by ($0.37). The business had revenue of $111.62 billion for the quarter, compared to analyst estimates of $111.75 billion. UnitedHealth Group had a net margin of 5.04% and a return on equity of 23.32%. UnitedHealth Group's revenue for the quarter was up 12.9% on a year-over-year basis. During the same period last year, the business posted $6.80 earnings per share. On average, research analysts predict that UnitedHealth Group Incorporated will post 29.54 EPS for the current year.

UnitedHealth Group Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Tuesday, June 24th. Investors of record on Monday, June 16th were issued a dividend of $2.21 per share. The ex-dividend date of this dividend was Monday, June 16th. This is an increase from UnitedHealth Group's previous quarterly dividend of $2.10. This represents a $8.84 dividend on an annualized basis and a yield of 3.7%. UnitedHealth Group's dividend payout ratio is presently 38.30%.

About UnitedHealth Group

(

Free Report)

UnitedHealth Group Incorporated operates as a diversified health care company in the United States. The company operates through four segments: UnitedHealthcare, Optum Health, Optum Insight, and Optum Rx. The UnitedHealthcare segment offers consumer-oriented health benefit plans and services for national employers, public sector employers, mid-sized employers, small businesses, and individuals; health care coverage, and health and well-being services to individuals age 50 and older addressing their needs; Medicaid plans, children's health insurance and health care programs; and health and dental benefits, and hospital and clinical services, as well as health care benefits products and services to state programs caring for the economically disadvantaged, medically underserved, and those without the benefit of employer-funded health care coverage.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider UnitedHealth Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UnitedHealth Group wasn't on the list.

While UnitedHealth Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.