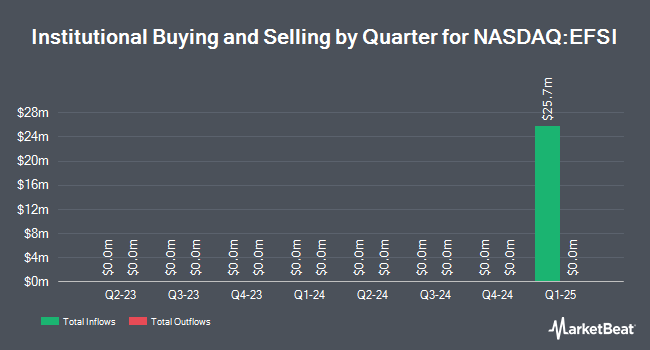

Jacobs Asset Management LLC acquired a new position in shares of Eagle Financial Services Inc. (NASDAQ:EFSI - Free Report) during the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 78,237 shares of the company's stock, valued at approximately $2,565,000. Eagle Financial Services accounts for 1.6% of Jacobs Asset Management LLC's portfolio, making the stock its 24th biggest position. Jacobs Asset Management LLC owned approximately 1.45% of Eagle Financial Services at the end of the most recent quarter.

Several other institutional investors and hedge funds have also recently bought and sold shares of the business. Wellington Management Group LLP acquired a new stake in Eagle Financial Services during the first quarter worth about $11,007,000. Persistent Asset Partners Ltd acquired a new stake in shares of Eagle Financial Services in the first quarter valued at approximately $687,000. Finally, Evermay Wealth Management LLC acquired a new stake in shares of Eagle Financial Services in the first quarter valued at approximately $86,000. Institutional investors and hedge funds own 0.31% of the company's stock.

Eagle Financial Services Price Performance

Shares of NASDAQ EFSI traded up $0.87 during mid-day trading on Friday, reaching $37.43. 12,860 shares of the company traded hands, compared to its average volume of 14,188. Eagle Financial Services Inc. has a fifty-two week low of $28.70 and a fifty-two week high of $37.43. The company has a debt-to-equity ratio of 0.39, a current ratio of 1.03 and a quick ratio of 1.03. The firm has a market cap of $201.37 million, a PE ratio of 17.33 and a beta of 0.26. The stock has a fifty day simple moving average of $33.48 and a 200-day simple moving average of $32.23.

Eagle Financial Services (NASDAQ:EFSI - Get Free Report) last posted its quarterly earnings data on Thursday, July 24th. The company reported $0.98 EPS for the quarter, beating analysts' consensus estimates of $0.82 by $0.16. The business had revenue of $20.61 million for the quarter. Eagle Financial Services had a net margin of 7.45% and a return on equity of 9.87%.

Eagle Financial Services Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, August 15th. Investors of record on Monday, August 4th were paid a $0.31 dividend. The ex-dividend date of this dividend was Monday, August 4th. This represents a $1.24 dividend on an annualized basis and a yield of 3.3%. Eagle Financial Services's dividend payout ratio (DPR) is currently 57.41%.

Wall Street Analyst Weigh In

Several equities research analysts have commented on the stock. Keefe, Bruyette & Woods raised their price target on shares of Eagle Financial Services from $38.00 to $39.00 and gave the company an "outperform" rating in a research note on Monday, August 4th. DA Davidson raised their price target on shares of Eagle Financial Services from $39.00 to $40.00 and gave the company a "buy" rating in a research note on Wednesday, July 30th. Finally, Wall Street Zen upgraded shares of Eagle Financial Services from a "hold" rating to a "buy" rating in a research note on Saturday, July 26th. Two equities research analysts have rated the stock with a Buy rating, According to data from MarketBeat.com, Eagle Financial Services presently has a consensus rating of "Buy" and a consensus target price of $39.50.

Get Our Latest Stock Analysis on EFSI

About Eagle Financial Services

(

Free Report)

Eagle Financial Services, Inc operates as the bank holding company for Bank of Clarke County that provides various retail and commercial banking products and services in the Shenandoah Valley and Northern Virginia. The company's deposit products include checking, NOW, money market, and regular savings accounts; and demand and time deposits.

Recommended Stories

Before you consider Eagle Financial Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eagle Financial Services wasn't on the list.

While Eagle Financial Services currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.