Jacobs Levy Equity Management Inc. increased its stake in shares of Caribou Biosciences, Inc. (NASDAQ:CRBU - Free Report) by 19.4% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 1,442,121 shares of the company's stock after buying an additional 234,052 shares during the quarter. Jacobs Levy Equity Management Inc. owned 1.55% of Caribou Biosciences worth $1,317,000 at the end of the most recent quarter.

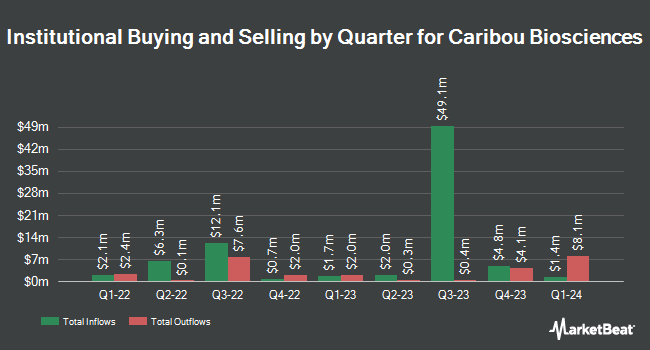

A number of other institutional investors have also recently bought and sold shares of CRBU. Price T Rowe Associates Inc. MD grew its stake in Caribou Biosciences by 28.8% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 35,848 shares of the company's stock valued at $57,000 after purchasing an additional 8,008 shares during the period. Northern Trust Corp grew its stake in Caribou Biosciences by 3.4% in the 4th quarter. Northern Trust Corp now owns 714,737 shares of the company's stock valued at $1,136,000 after purchasing an additional 23,531 shares during the period. Ameriprise Financial Inc. bought a new position in Caribou Biosciences in the 4th quarter valued at $649,000. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its stake in Caribou Biosciences by 4.9% in the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 176,654 shares of the company's stock valued at $281,000 after purchasing an additional 8,199 shares during the period. Finally, Millennium Management LLC grew its stake in Caribou Biosciences by 52.9% in the 4th quarter. Millennium Management LLC now owns 859,825 shares of the company's stock valued at $1,367,000 after purchasing an additional 297,351 shares during the period. Institutional investors own 77.51% of the company's stock.

Analysts Set New Price Targets

Separately, Wall Street Zen upgraded Caribou Biosciences from a "sell" rating to a "hold" rating in a research note on Sunday, August 24th. Three research analysts have rated the stock with a Buy rating, According to MarketBeat.com, Caribou Biosciences has an average rating of "Buy" and a consensus price target of $6.67.

Get Our Latest Stock Report on CRBU

Caribou Biosciences Price Performance

Shares of NASDAQ CRBU traded down $0.08 during trading on Wednesday, reaching $1.72. 1,008,107 shares of the stock traded hands, compared to its average volume of 623,480. Caribou Biosciences, Inc. has a 52-week low of $0.66 and a 52-week high of $3.00. The company has a 50-day moving average of $1.92 and a 200-day moving average of $1.33. The stock has a market capitalization of $160.17 million, a P/E ratio of -0.97 and a beta of 2.54.

Caribou Biosciences (NASDAQ:CRBU - Get Free Report) last issued its quarterly earnings results on Tuesday, August 12th. The company reported ($0.35) EPS for the quarter, beating analysts' consensus estimates of ($0.40) by $0.05. Caribou Biosciences had a negative return on equity of 62.35% and a negative net margin of 1,800.93%.The firm had revenue of $2.67 million for the quarter, compared to analysts' expectations of $1.64 million. Analysts expect that Caribou Biosciences, Inc. will post -1.64 earnings per share for the current fiscal year.

About Caribou Biosciences

(

Free Report)

Caribou Biosciences, Inc, a clinical-stage biopharmaceutical company, engages in the development of genome-edited allogeneic cell therapies for the treatment of hematologic malignancies in the United States and internationally. Its lead product candidate is CB-010, an allogeneic anti-CD19 CAR-T cell therapy that is in phase 1 clinical trial to treat relapsed or refractory B cell non-Hodgkin lymphoma.

See Also

Before you consider Caribou Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caribou Biosciences wasn't on the list.

While Caribou Biosciences currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.