Jag Capital Management LLC cut its position in Boston Scientific Corporation (NYSE:BSX - Free Report) by 26.7% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 158,466 shares of the medical equipment provider's stock after selling 57,769 shares during the period. Boston Scientific accounts for approximately 1.9% of Jag Capital Management LLC's investment portfolio, making the stock its 18th biggest holding. Jag Capital Management LLC's holdings in Boston Scientific were worth $17,021,000 at the end of the most recent reporting period.

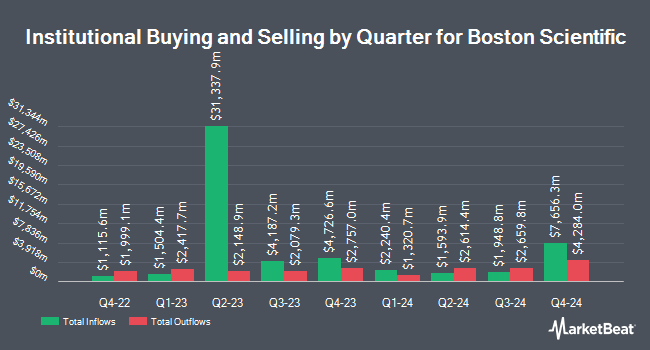

Several other large investors also recently made changes to their positions in BSX. 1248 Management LLC acquired a new position in Boston Scientific during the 1st quarter valued at about $26,000. Y.D. More Investments Ltd purchased a new position in shares of Boston Scientific in the 1st quarter worth approximately $27,000. Sound Income Strategies LLC raised its holdings in shares of Boston Scientific by 90.9% in the 2nd quarter. Sound Income Strategies LLC now owns 252 shares of the medical equipment provider's stock worth $27,000 after purchasing an additional 120 shares during the period. Oliver Lagore Vanvalin Investment Group bought a new stake in shares of Boston Scientific in the 2nd quarter worth approximately $37,000. Finally, Activest Wealth Management raised its holdings in shares of Boston Scientific by 6,216.7% in the 1st quarter. Activest Wealth Management now owns 379 shares of the medical equipment provider's stock worth $38,000 after purchasing an additional 373 shares during the period. 89.07% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In related news, Director Edward J. Ludwig sold 4,000 shares of the firm's stock in a transaction that occurred on Friday, July 25th. The shares were sold at an average price of $106.03, for a total transaction of $424,120.00. Following the completion of the sale, the director owned 18,479 shares of the company's stock, valued at $1,959,328.37. This trade represents a 17.79% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, EVP Arthur C. Butcher sold 17,313 shares of the firm's stock in a transaction that occurred on Friday, August 1st. The shares were sold at an average price of $104.63, for a total transaction of $1,811,459.19. Following the sale, the executive vice president directly owned 23,600 shares of the company's stock, valued at $2,469,268. This trade represents a 42.32% decrease in their position. The disclosure for this sale can be found here. Insiders sold 174,214 shares of company stock worth $17,972,457 over the last three months. 0.50% of the stock is currently owned by insiders.

Boston Scientific Price Performance

Shares of NYSE BSX opened at $94.92 on Tuesday. Boston Scientific Corporation has a fifty-two week low of $80.64 and a fifty-two week high of $109.50. The company has a 50 day simple moving average of $101.75 and a two-hundred day simple moving average of $101.84. The company has a market capitalization of $140.64 billion, a price-to-earnings ratio of 56.50, a P/E/G ratio of 2.30 and a beta of 0.61. The company has a debt-to-equity ratio of 0.49, a quick ratio of 0.82 and a current ratio of 1.37.

Boston Scientific (NYSE:BSX - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The medical equipment provider reported $0.75 earnings per share for the quarter, beating analysts' consensus estimates of $0.72 by $0.03. Boston Scientific had a net margin of 13.55% and a return on equity of 19.21%. The business had revenue of $5.06 billion during the quarter, compared to the consensus estimate of $4.89 billion. During the same quarter last year, the firm earned $0.62 earnings per share. The business's revenue for the quarter was up 22.8% on a year-over-year basis. Boston Scientific has set its Q3 2025 guidance at 0.700-0.720 EPS. Analysts expect that Boston Scientific Corporation will post 2.85 EPS for the current fiscal year.

Analyst Ratings Changes

A number of brokerages have issued reports on BSX. Canaccord Genuity Group boosted their target price on shares of Boston Scientific from $131.00 to $132.00 and gave the company a "buy" rating in a report on Wednesday, October 1st. Needham & Company LLC reiterated a "buy" rating and issued a $121.00 target price on shares of Boston Scientific in a research report on Wednesday, October 1st. Raymond James Financial upped their price target on shares of Boston Scientific from $121.00 to $124.00 and gave the company a "strong-buy" rating in a research report on Thursday, July 24th. Weiss Ratings restated a "buy (b-)" rating on shares of Boston Scientific in a research report on Wednesday, October 8th. Finally, Erste Group Bank downgraded shares of Boston Scientific from a "buy" rating to a "hold" rating in a research note on Friday, October 3rd. Two analysts have rated the stock with a Strong Buy rating, twenty-three have given a Buy rating and two have assigned a Hold rating to the company's stock. According to data from MarketBeat.com, Boston Scientific presently has a consensus rating of "Buy" and an average price target of $120.71.

Check Out Our Latest Report on BSX

About Boston Scientific

(

Free Report)

Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. It operates through two segments, MedSurg and Cardiovascular. The company offers devices to diagnose and treat gastrointestinal and pulmonary conditions, such as resolution clips, biliary stent systems, stents and electrocautery enhanced delivery systems, direct visualization systems, digital catheters, and single-use duodenoscopes; devices to treat urological conditions, including ureteral stents, catheters, baskets, guidewires, sheaths, balloons, single-use digital flexible ureteroscopes, holmium laser systems, artificial urinary sphincter, laser system, fiber, and hydrogel systems; and devices to treat neurological movement disorders and manage chronic pain, such as spinal cord stimulator system, proprietary programming software, radiofrequency generator, indirect decompression systems, practice optimization tools, and deep brain stimulation system.

Featured Articles

Want to see what other hedge funds are holding BSX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Boston Scientific Corporation (NYSE:BSX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Boston Scientific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Scientific wasn't on the list.

While Boston Scientific currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report