Johnson Financial Group LLC lifted its stake in shares of Immunome, Inc. (NASDAQ:IMNM - Free Report) by 140.0% during the first quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 48,000 shares of the company's stock after acquiring an additional 28,000 shares during the quarter. Johnson Financial Group LLC owned 0.06% of Immunome worth $323,000 as of its most recent filing with the Securities and Exchange Commission.

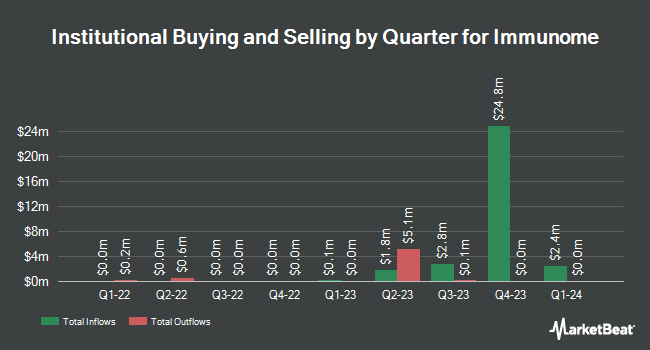

A number of other large investors have also modified their holdings of the stock. Raymond James Financial Inc. purchased a new position in shares of Immunome during the fourth quarter worth about $274,000. Commonwealth Equity Services LLC purchased a new position in shares of Immunome during the fourth quarter worth about $202,000. KLP Kapitalforvaltning AS purchased a new position in shares of Immunome during the fourth quarter worth about $75,000. JPMorgan Chase & Co. grew its holdings in shares of Immunome by 2,540.4% during the fourth quarter. JPMorgan Chase & Co. now owns 648,610 shares of the company's stock worth $6,888,000 after purchasing an additional 624,045 shares during the last quarter. Finally, Wellington Management Group LLP grew its holdings in shares of Immunome by 3.5% during the fourth quarter. Wellington Management Group LLP now owns 145,564 shares of the company's stock worth $1,546,000 after purchasing an additional 4,874 shares during the last quarter. Hedge funds and other institutional investors own 44.58% of the company's stock.

Immunome Price Performance

Shares of IMNM stock traded up $0.30 during midday trading on Wednesday, reaching $10.21. 374,871 shares of the company traded hands, compared to its average volume of 1,016,056. The firm's 50 day simple moving average is $9.57 and its two-hundred day simple moving average is $8.91. Immunome, Inc. has a 1-year low of $5.15 and a 1-year high of $16.73. The firm has a market cap of $888.68 million, a PE ratio of -3.32 and a beta of 1.93.

Immunome (NASDAQ:IMNM - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The company reported ($0.50) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.52) by $0.02. Immunome had a negative return on equity of 76.10% and a negative net margin of 1,687.08%. The firm had revenue of $4.02 million during the quarter, compared to the consensus estimate of $1.03 million. As a group, research analysts anticipate that Immunome, Inc. will post -2.21 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several brokerages have issued reports on IMNM. Wall Street Zen raised Immunome from a "sell" rating to a "hold" rating in a report on Thursday, May 22nd. Wedbush reaffirmed an "outperform" rating and set a $21.00 price objective on shares of Immunome in a report on Thursday, August 7th. Finally, JPMorgan Chase & Co. lowered their price target on Immunome from $23.00 to $22.00 and set an "overweight" rating on the stock in a report on Thursday, August 7th. One investment analyst has rated the stock with a hold rating and seven have given a buy rating to the stock. Based on data from MarketBeat, Immunome currently has a consensus rating of "Moderate Buy" and a consensus price target of $23.14.

View Our Latest Research Report on IMNM

Insider Activity

In related news, Director Jean Jacques Bienaime acquired 5,000 shares of the business's stock in a transaction that occurred on Tuesday, June 3rd. The stock was purchased at an average cost of $9.38 per share, for a total transaction of $46,900.00. Following the transaction, the director directly owned 36,415 shares of the company's stock, valued at approximately $341,572.70. This trade represents a 15.92% increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this link. 7.69% of the stock is owned by corporate insiders.

Immunome Profile

(

Free Report)

Immunome, Inc, a biotechnology company, develops targeted cancer therapies. The company's clinical asset comprises AL102, an investigational gamma secretase inhibitor currently in evaluation in a Phase 3 trial for the treatment of desmoid tumors; and preclinical assets consist of IM-1021, a receptor tyrosine kinase-like orphan receptor 1 and antibody-drug conjugates, as well as IM-3050, a fibroblast activation protein targeted radioligand therapy; and IM-4320, an anti-IL-38 immunotherapy candidate.

Featured Articles

Before you consider Immunome, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Immunome wasn't on the list.

While Immunome currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.