Jones Financial Companies Lllp boosted its stake in shares of Seabridge Gold, Inc. (NYSE:SA - Free Report) TSE: SEA by 912,796.4% in the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 502,093 shares of the basic materials company's stock after purchasing an additional 502,038 shares during the quarter. Jones Financial Companies Lllp owned approximately 0.50% of Seabridge Gold worth $5,859,000 at the end of the most recent reporting period.

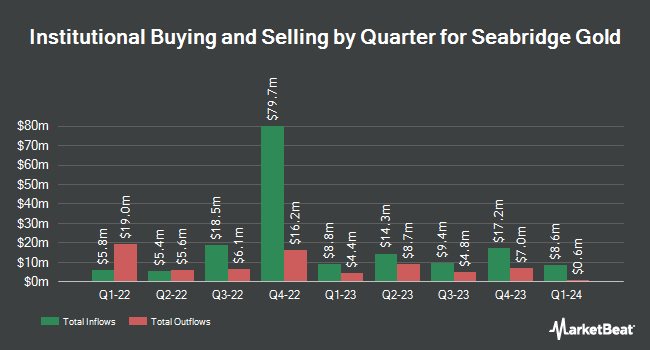

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in SA. Kopernik Global Investors LLC boosted its position in Seabridge Gold by 141.0% during the 1st quarter. Kopernik Global Investors LLC now owns 7,342,955 shares of the basic materials company's stock valued at $85,692,000 after purchasing an additional 4,295,907 shares during the period. Russell Investments Group Ltd. boosted its position in Seabridge Gold by 66.3% during the 1st quarter. Russell Investments Group Ltd. now owns 1,192,840 shares of the basic materials company's stock valued at $13,903,000 after purchasing an additional 475,352 shares during the period. Ontario Teachers Pension Plan Board boosted its position in Seabridge Gold by 36.6% during the 1st quarter. Ontario Teachers Pension Plan Board now owns 1,344,887 shares of the basic materials company's stock valued at $15,657,000 after purchasing an additional 360,183 shares during the period. Bank of America Corp DE boosted its position in Seabridge Gold by 138.6% during the 4th quarter. Bank of America Corp DE now owns 414,500 shares of the basic materials company's stock worth $4,729,000 after acquiring an additional 240,756 shares during the period. Finally, Amundi boosted its position in Seabridge Gold by 30.3% during the 1st quarter. Amundi now owns 845,655 shares of the basic materials company's stock worth $9,370,000 after acquiring an additional 196,687 shares during the period. Institutional investors and hedge funds own 34.85% of the company's stock.

Seabridge Gold Price Performance

Shares of SA traded up $1.49 during midday trading on Monday, reaching $20.32. The stock had a trading volume of 1,184,462 shares, compared to its average volume of 845,865. Seabridge Gold, Inc. has a 52 week low of $9.40 and a 52 week high of $20.55. The company has a debt-to-equity ratio of 0.57, a current ratio of 4.24 and a quick ratio of 4.24. The firm's 50 day moving average price is $16.51 and its 200-day moving average price is $13.89. The company has a market capitalization of $2.08 billion, a P/E ratio of -53.46 and a beta of 0.68.

Seabridge Gold (NYSE:SA - Get Free Report) TSE: SEA last posted its quarterly earnings data on Wednesday, August 13th. The basic materials company reported $0.09 EPS for the quarter.

Analyst Ratings Changes

Separately, Wall Street Zen upgraded Seabridge Gold from a "sell" rating to a "hold" rating in a research report on Saturday.

Read Our Latest Research Report on SA

Seabridge Gold Company Profile

(

Free Report)

Seabridge Gold Inc, together with its subsidiaries, engages in the acquisition and exploration of gold properties in North America. The company also explores for gold, copper, silver, and molybdenum deposits. The company was formerly known as Seabridge Resources Inc and changed its name to Seabridge Gold Inc in June 2002.

Featured Stories

Before you consider Seabridge Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seabridge Gold wasn't on the list.

While Seabridge Gold currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.