Jump Financial LLC lessened its holdings in shares of BioCryst Pharmaceuticals, Inc. (NASDAQ:BCRX - Free Report) by 43.5% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 148,849 shares of the biotechnology company's stock after selling 114,489 shares during the period. Jump Financial LLC owned 0.07% of BioCryst Pharmaceuticals worth $1,116,000 as of its most recent filing with the SEC.

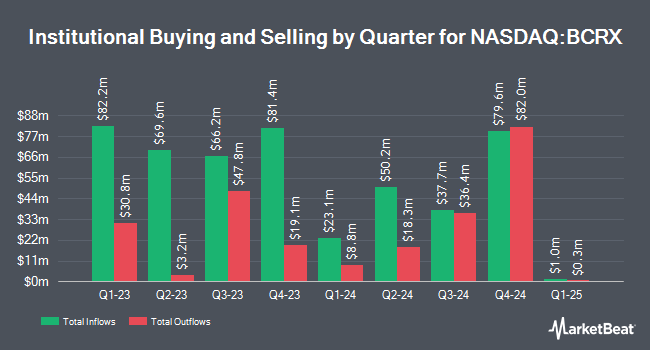

Other hedge funds also recently modified their holdings of the company. Headlands Technologies LLC acquired a new position in shares of BioCryst Pharmaceuticals during the first quarter worth $32,000. GF Fund Management CO. LTD. acquired a new position in shares of BioCryst Pharmaceuticals during the fourth quarter worth $33,000. GAMMA Investing LLC lifted its holdings in shares of BioCryst Pharmaceuticals by 1,161.8% during the first quarter. GAMMA Investing LLC now owns 5,918 shares of the biotechnology company's stock worth $44,000 after purchasing an additional 5,449 shares during the period. New Age Alpha Advisors LLC acquired a new position in shares of BioCryst Pharmaceuticals during the first quarter worth $62,000. Finally, Allspring Global Investments Holdings LLC acquired a new position in shares of BioCryst Pharmaceuticals during the first quarter worth $79,000. Institutional investors and hedge funds own 85.88% of the company's stock.

Insider Activity at BioCryst Pharmaceuticals

In other news, Director Theresa Heggie sold 70,000 shares of the business's stock in a transaction dated Wednesday, August 13th. The shares were sold at an average price of $8.51, for a total transaction of $595,700.00. Following the completion of the sale, the director directly owned 65,352 shares of the company's stock, valued at $556,145.52. The trade was a 51.72% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 5.10% of the stock is currently owned by insiders.

Analyst Upgrades and Downgrades

BCRX has been the subject of a number of analyst reports. Wall Street Zen raised shares of BioCryst Pharmaceuticals from a "buy" rating to a "strong-buy" rating in a research note on Saturday, July 26th. Barclays lifted their target price on shares of BioCryst Pharmaceuticals from $8.00 to $11.00 and gave the stock an "equal weight" rating in a research note on Wednesday, May 7th. Bank of America lifted their target price on shares of BioCryst Pharmaceuticals from $13.00 to $15.00 and gave the stock a "buy" rating in a research note on Tuesday, July 1st. Royal Bank Of Canada reaffirmed an "outperform" rating and issued a $13.00 price target on shares of BioCryst Pharmaceuticals in a research note on Monday, June 30th. Finally, Wedbush lifted their price target on shares of BioCryst Pharmaceuticals from $16.00 to $18.00 and gave the company an "outperform" rating in a research note on Monday, June 30th. Nine research analysts have rated the stock with a Buy rating and one has issued a Hold rating to the company's stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $16.70.

View Our Latest Research Report on BioCryst Pharmaceuticals

BioCryst Pharmaceuticals Stock Down 0.9%

BCRX traded down $0.08 during midday trading on Thursday, hitting $8.22. The company had a trading volume of 426,794 shares, compared to its average volume of 3,710,541. The stock's 50 day moving average price is $8.57 and its 200 day moving average price is $8.77. The company has a market capitalization of $1.72 billion, a price-to-earnings ratio of -45.75, a PEG ratio of 1.89 and a beta of 1.13. BioCryst Pharmaceuticals, Inc. has a 52 week low of $6.01 and a 52 week high of $11.31.

BioCryst Pharmaceuticals (NASDAQ:BCRX - Get Free Report) last posted its earnings results on Monday, August 4th. The biotechnology company reported $0.15 EPS for the quarter, topping the consensus estimate of $0.03 by $0.12. The business had revenue of $163.35 million for the quarter, compared to the consensus estimate of $149.59 million. The company's revenue was up 49.5% on a year-over-year basis. During the same period in the previous year, the firm earned ($0.06) earnings per share. Research analysts predict that BioCryst Pharmaceuticals, Inc. will post -0.36 EPS for the current year.

About BioCryst Pharmaceuticals

(

Free Report)

BioCryst Pharmaceuticals, Inc, a biotechnology company, develops oral small-molecule and protein therapeutics to treat rare diseases. The company markets peramivir injection, an intravenous neuraminidase inhibitor for the treatment of acute uncomplicated influenza under the RAPIVAB, RAPIACTA, and PERAMIFLU names; and ORLADEYO, an oral serine protease inhibitor to treat hereditary angioedema.

See Also

Before you consider BioCryst Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BioCryst Pharmaceuticals wasn't on the list.

While BioCryst Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.