Kaufman Rossin Wealth LLC bought a new stake in shares of Citizens Financial Group, Inc. (NYSE:CFG - Free Report) during the 1st quarter, according to its most recent filing with the SEC. The fund bought 6,971 shares of the bank's stock, valued at approximately $286,000.

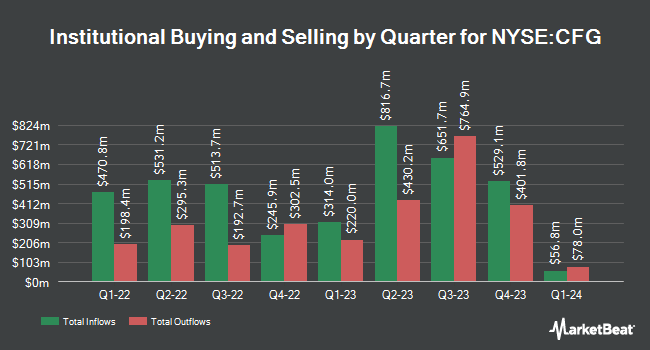

Several other institutional investors have also made changes to their positions in CFG. Ameriflex Group Inc. acquired a new stake in shares of Citizens Financial Group during the 4th quarter valued at about $26,000. Grove Bank & Trust boosted its position in shares of Citizens Financial Group by 97.1% during the 1st quarter. Grove Bank & Trust now owns 678 shares of the bank's stock valued at $28,000 after acquiring an additional 334 shares in the last quarter. Colonial Trust Co SC boosted its position in shares of Citizens Financial Group by 673.0% during the 4th quarter. Colonial Trust Co SC now owns 889 shares of the bank's stock valued at $39,000 after acquiring an additional 774 shares in the last quarter. Cary Street Partners Investment Advisory LLC boosted its position in shares of Citizens Financial Group by 143.4% during the 1st quarter. Cary Street Partners Investment Advisory LLC now owns 1,076 shares of the bank's stock valued at $44,000 after acquiring an additional 634 shares in the last quarter. Finally, NBT Bank N A NY bought a new stake in Citizens Financial Group during the first quarter worth about $45,000. 94.90% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of research analysts have recently issued reports on CFG shares. Keefe, Bruyette & Woods upgraded shares of Citizens Financial Group from a "market perform" rating to an "outperform" rating and set a $57.00 target price for the company in a research note on Wednesday, July 9th. Wells Fargo & Company set a $57.00 target price on shares of Citizens Financial Group in a research note on Wednesday, July 2nd. Evercore ISI upgraded shares of Citizens Financial Group from an "in-line" rating to an "outperform" rating and lifted their target price for the company from $48.00 to $55.00 in a research note on Friday, July 18th. Raymond James Financial lifted their target price on shares of Citizens Financial Group from $48.00 to $57.00 and gave the company a "strong-buy" rating in a research note on Friday, July 18th. Finally, DA Davidson lifted their target price on shares of Citizens Financial Group from $49.00 to $55.00 and gave the company a "buy" rating in a research note on Friday, July 18th. One analyst has rated the stock with a Strong Buy rating, fourteen have assigned a Buy rating and three have given a Hold rating to the company. Based on data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $51.53.

Check Out Our Latest Analysis on Citizens Financial Group

Citizens Financial Group Trading Up 1.2%

NYSE CFG traded up $0.63 during trading hours on Tuesday, hitting $51.32. The company's stock had a trading volume of 1,187,991 shares, compared to its average volume of 4,762,644. The stock has a fifty day moving average of $47.06 and a 200 day moving average of $42.76. Citizens Financial Group, Inc. has a twelve month low of $32.60 and a twelve month high of $51.34. The firm has a market capitalization of $22.13 billion, a P/E ratio of 15.60, a PEG ratio of 0.56 and a beta of 0.78. The company has a quick ratio of 0.84, a current ratio of 0.85 and a debt-to-equity ratio of 0.54.

Citizens Financial Group (NYSE:CFG - Get Free Report) last issued its earnings results on Thursday, July 17th. The bank reported $0.92 EPS for the quarter, beating the consensus estimate of $0.88 by $0.04. Citizens Financial Group had a net margin of 13.26% and a return on equity of 6.94%. The firm had revenue of $2.04 billion during the quarter, compared to the consensus estimate of $2.01 billion. During the same quarter in the prior year, the firm earned $0.82 earnings per share. The business's quarterly revenue was up 3.8% on a year-over-year basis. Equities research analysts forecast that Citizens Financial Group, Inc. will post 3.92 earnings per share for the current fiscal year.

Citizens Financial Group Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Thursday, August 14th. Shareholders of record on Thursday, July 31st were paid a $0.42 dividend. This represents a $1.68 annualized dividend and a yield of 3.3%. The ex-dividend date of this dividend was Thursday, July 31st. Citizens Financial Group's dividend payout ratio is presently 51.06%.

Citizens Financial Group announced that its board has approved a stock repurchase plan on Friday, June 13th that authorizes the company to repurchase $1.50 billion in outstanding shares. This repurchase authorization authorizes the bank to purchase up to 8.5% of its shares through open market purchases. Shares repurchase plans are generally a sign that the company's management believes its stock is undervalued.

Citizens Financial Group Profile

(

Free Report)

Citizens Financial Group, Inc operates as the bank holding company that provides retail and commercial banking products and services to individuals, small businesses, middle-market companies, corporations, and institutions in the United States. The company operates in two segments, Consumer Banking and Commercial Banking.

See Also

Before you consider Citizens Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Citizens Financial Group wasn't on the list.

While Citizens Financial Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.