Credit Agricole S A lifted its holdings in shares of Kenvue Inc. (NYSE:KVUE - Free Report) by 34.8% in the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 694,016 shares of the company's stock after purchasing an additional 179,120 shares during the quarter. Credit Agricole S A's holdings in Kenvue were worth $16,643,000 at the end of the most recent quarter.

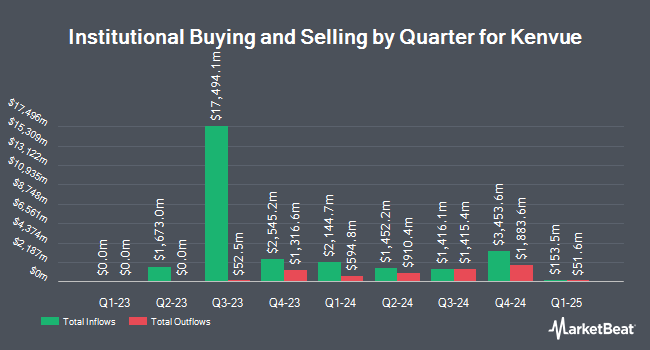

Several other hedge funds and other institutional investors also recently modified their holdings of KVUE. NewEdge Advisors LLC grew its holdings in shares of Kenvue by 14.1% during the fourth quarter. NewEdge Advisors LLC now owns 37,489 shares of the company's stock worth $800,000 after purchasing an additional 4,637 shares in the last quarter. Ossiam grew its holdings in shares of Kenvue by 20.5% during the fourth quarter. Ossiam now owns 4,709 shares of the company's stock worth $101,000 after purchasing an additional 800 shares in the last quarter. Hsbc Holdings PLC grew its holdings in shares of Kenvue by 18.6% during the fourth quarter. Hsbc Holdings PLC now owns 3,369,706 shares of the company's stock worth $71,853,000 after purchasing an additional 527,506 shares in the last quarter. Price T Rowe Associates Inc. MD grew its holdings in shares of Kenvue by 3.5% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 245,885,918 shares of the company's stock worth $5,249,665,000 after purchasing an additional 8,211,748 shares in the last quarter. Finally, MGO One Seven LLC grew its holdings in shares of Kenvue by 12.2% during the fourth quarter. MGO One Seven LLC now owns 37,771 shares of the company's stock worth $806,000 after purchasing an additional 4,116 shares in the last quarter. Hedge funds and other institutional investors own 97.64% of the company's stock.

Analyst Ratings Changes

A number of research firms recently weighed in on KVUE. Bank of America dropped their target price on Kenvue from $27.00 to $25.00 and set a "buy" rating for the company in a research report on Tuesday, July 15th. Canaccord Genuity Group dropped their target price on Kenvue from $29.00 to $26.00 and set a "buy" rating for the company in a research report on Friday, August 8th. Citigroup dropped their target price on Kenvue from $24.50 to $22.00 and set a "neutral" rating for the company in a research report on Tuesday, July 15th. JPMorgan Chase & Co. dropped their target price on Kenvue from $27.00 to $26.00 and set an "overweight" rating for the company in a research report on Friday, July 25th. Finally, Zacks Research upgraded Kenvue to a "strong sell" rating in a research report on Monday, August 11th. Five research analysts have rated the stock with a Buy rating, seven have assigned a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus target price of $24.38.

Read Our Latest Stock Report on KVUE

Kenvue Trading Up 0.7%

Shares of NYSE:KVUE traded up $0.1550 during trading on Friday, reaching $21.5950. 8,620,226 shares of the company traded hands, compared to its average volume of 18,631,350. The firm has a market capitalization of $41.44 billion, a price-to-earnings ratio of 29.18, a P/E/G ratio of 3.10 and a beta of 0.83. Kenvue Inc. has a 52-week low of $19.75 and a 52-week high of $25.17. The company has a current ratio of 0.98, a quick ratio of 0.68 and a debt-to-equity ratio of 0.66. The business's fifty day moving average is $21.52 and its 200-day moving average is $22.43.

Kenvue (NYSE:KVUE - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The company reported $0.29 earnings per share for the quarter, beating analysts' consensus estimates of $0.28 by $0.01. The firm had revenue of $3.84 billion during the quarter, compared to analyst estimates of $3.94 billion. Kenvue had a return on equity of 20.06% and a net margin of 9.37%.The business's quarterly revenue was down 4.0% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $0.32 earnings per share. Kenvue has set its FY 2025 guidance at 1.000-1.050 EPS. As a group, analysts forecast that Kenvue Inc. will post 1.14 EPS for the current year.

Kenvue Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, August 27th. Stockholders of record on Wednesday, August 13th will be paid a dividend of $0.2075 per share. This represents a $0.83 dividend on an annualized basis and a dividend yield of 3.8%. This is a boost from Kenvue's previous quarterly dividend of $0.21. The ex-dividend date of this dividend is Wednesday, August 13th. Kenvue's payout ratio is currently 112.16%.

About Kenvue

(

Free Report)

Kenvue Inc operates as a consumer health company worldwide. The company operates through three segments: Self Care, Skin Health and Beauty, and Essential Health. The Self Care segment offers cough, cold and allergy, pain care, digestive health, smoking cessation, eye care, and other products under the Tylenol, Motrin, Benadryl, Nicorette, Zarbee's, ORSLTM, Rhinocort, Calpol, and Zyrtec brands.

See Also

Before you consider Kenvue, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kenvue wasn't on the list.

While Kenvue currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.