Kera Capital Partners Inc. bought a new position in shares of Fox Co. (NASDAQ:FOXA - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the SEC. The fund bought 5,461 shares of the company's stock, valued at approximately $309,000.

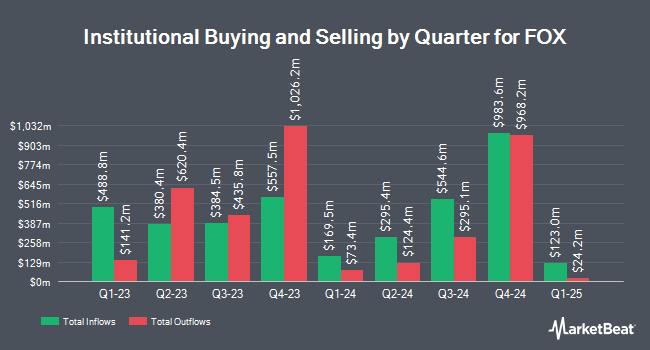

Other large investors have also modified their holdings of the company. DnB Asset Management AS raised its holdings in FOX by 0.6% in the 4th quarter. DnB Asset Management AS now owns 44,063 shares of the company's stock valued at $2,141,000 after acquiring an additional 245 shares during the last quarter. Jones Financial Companies Lllp lifted its position in FOX by 61.5% during the fourth quarter. Jones Financial Companies Lllp now owns 654 shares of the company's stock worth $32,000 after buying an additional 249 shares in the last quarter. SRS Capital Advisors Inc. boosted its stake in FOX by 91.0% during the fourth quarter. SRS Capital Advisors Inc. now owns 550 shares of the company's stock worth $27,000 after buying an additional 262 shares during the last quarter. US Bancorp DE grew its holdings in FOX by 2.0% in the 4th quarter. US Bancorp DE now owns 14,520 shares of the company's stock valued at $705,000 after buying an additional 281 shares in the last quarter. Finally, Metis Global Partners LLC increased its stake in shares of FOX by 2.8% in the 4th quarter. Metis Global Partners LLC now owns 10,783 shares of the company's stock worth $524,000 after acquiring an additional 292 shares during the last quarter. Hedge funds and other institutional investors own 52.52% of the company's stock.

FOX Stock Down 0.1%

FOX stock traded down $0.06 during mid-day trading on Friday, reaching $54.69. 6,991,266 shares of the company's stock were exchanged, compared to its average volume of 3,522,537. The company has a quick ratio of 2.14, a current ratio of 2.50 and a debt-to-equity ratio of 0.57. Fox Co. has a twelve month low of $32.76 and a twelve month high of $58.74. The company has a market cap of $24.59 billion, a P/E ratio of 11.71, a P/E/G ratio of 1.27 and a beta of 0.51. The company has a fifty day moving average of $51.85 and a 200-day moving average of $51.07.

FOX (NASDAQ:FOXA - Get Free Report) last announced its quarterly earnings data on Monday, May 12th. The company reported $1.10 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.93 by $0.17. The business had revenue of $4.37 billion for the quarter, compared to analysts' expectations of $4.14 billion. FOX had a return on equity of 18.50% and a net margin of 14.39%. The company's revenue for the quarter was up 26.8% compared to the same quarter last year. During the same period last year, the firm earned $1.40 earnings per share. Sell-side analysts expect that Fox Co. will post 4.38 EPS for the current year.

Wall Street Analyst Weigh In

Several research analysts have recently weighed in on FOXA shares. The Goldman Sachs Group set a $60.00 price target on shares of FOX and gave the company a "buy" rating in a research report on Tuesday, February 4th. Morgan Stanley boosted their target price on shares of FOX from $57.00 to $60.00 and gave the company an "equal weight" rating in a report on Tuesday, May 13th. Loop Capital raised their price target on shares of FOX from $62.00 to $64.00 and gave the stock a "buy" rating in a report on Tuesday, May 13th. Wolfe Research lowered shares of FOX from a "peer perform" rating to an "underperform" rating and set a $48.00 price target on the stock. in a research report on Monday, April 7th. Finally, Wells Fargo & Company increased their price objective on FOX from $58.00 to $62.00 and gave the stock an "overweight" rating in a research report on Tuesday, May 13th. Two investment analysts have rated the stock with a sell rating, ten have assigned a hold rating and nine have given a buy rating to the company's stock. According to data from MarketBeat, FOX presently has a consensus rating of "Hold" and an average target price of $52.71.

View Our Latest Stock Analysis on FOX

FOX Company Profile

(

Free Report)

Fox Corporation operates as a news, sports, and entertainment company in the United States (U.S.). The company operates through four segments: Cable Network Programming, Television, Credible, and The FOX Studio Lot. The Cable Network Programming segment produces and licenses news and sports content for distribution through traditional cable television systems, direct broadcast satellite operators and telecommunication companies, virtual multi-channel video programming distributors, and other digital platforms primarily in the U.S.

See Also

Before you consider FOX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FOX wasn't on the list.

While FOX currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.