Kestra Private Wealth Services LLC purchased a new stake in The Bancorp, Inc. (NASDAQ:TBBK - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the SEC. The firm purchased 8,256 shares of the bank's stock, valued at approximately $436,000.

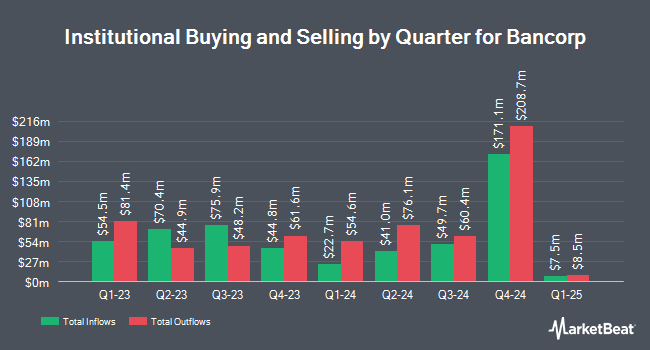

A number of other large investors have also made changes to their positions in TBBK. Invesco Ltd. boosted its position in Bancorp by 26.2% during the 4th quarter. Invesco Ltd. now owns 2,246,836 shares of the bank's stock worth $118,251,000 after purchasing an additional 466,795 shares during the period. Nantahala Capital Management LLC lifted its stake in Bancorp by 65.7% in the fourth quarter. Nantahala Capital Management LLC now owns 974,455 shares of the bank's stock valued at $51,286,000 after buying an additional 386,295 shares during the last quarter. Balyasny Asset Management L.P. raised its stake in Bancorp by 599.8% during the 4th quarter. Balyasny Asset Management L.P. now owns 368,416 shares of the bank's stock valued at $19,390,000 after acquiring an additional 315,772 shares in the last quarter. JPMorgan Chase & Co. raised its position in shares of Bancorp by 70.3% during the 4th quarter. JPMorgan Chase & Co. now owns 653,444 shares of the bank's stock worth $34,391,000 after buying an additional 269,660 shares in the last quarter. Finally, Emerald Advisers LLC boosted its stake in Bancorp by 63.1% during the first quarter. Emerald Advisers LLC now owns 548,269 shares of the bank's stock valued at $28,971,000 after buying an additional 212,102 shares in the last quarter. Hedge funds and other institutional investors own 96.22% of the company's stock.

Bancorp Stock Performance

Shares of Bancorp stock opened at $63.67 on Friday. The company has a current ratio of 0.91, a quick ratio of 0.88 and a debt-to-equity ratio of 0.15. The firm has a market capitalization of $2.97 billion, a P/E ratio of 13.69 and a beta of 1.25. The business's fifty day simple moving average is $56.93 and its 200 day simple moving average is $54.37. The Bancorp, Inc. has a 12 month low of $40.51 and a 12 month high of $70.63.

Bancorp (NASDAQ:TBBK - Get Free Report) last announced its earnings results on Thursday, July 24th. The bank reported $1.27 earnings per share for the quarter, topping analysts' consensus estimates of $1.26 by $0.01. Bancorp had a return on equity of 27.65% and a net margin of 28.45%. The business had revenue of $138.00 million for the quarter, compared to analyst estimates of $94.87 million. As a group, analysts anticipate that The Bancorp, Inc. will post 5.31 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of research firms have recently issued reports on TBBK. Barclays restated a "buy" rating on shares of Bancorp in a report on Monday, July 7th. Jefferies Financial Group raised shares of Bancorp to a "buy" rating in a research report on Monday, July 7th. Keefe, Bruyette & Woods reissued a "market perform" rating and issued a $65.00 price target on shares of Bancorp in a report on Friday, July 11th. Wall Street Zen cut shares of Bancorp from a "hold" rating to a "sell" rating in a research note on Wednesday, May 21st. Finally, Oppenheimer reiterated an "outperform" rating on shares of Bancorp in a research report on Friday, July 18th. One investment analyst has rated the stock with a sell rating, one has given a hold rating, five have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $62.00.

Read Our Latest Stock Analysis on Bancorp

Bancorp Company Profile

(

Free Report)

The Bancorp, Inc operates as the bank holding company for The Bancorp Bank, National Association that provides banking products and services in the United States. It offers a range of deposit products and services, including checking, savings, time, money market, and commercial accounts; overdrafts; and certificates of deposit.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bancorp wasn't on the list.

While Bancorp currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.