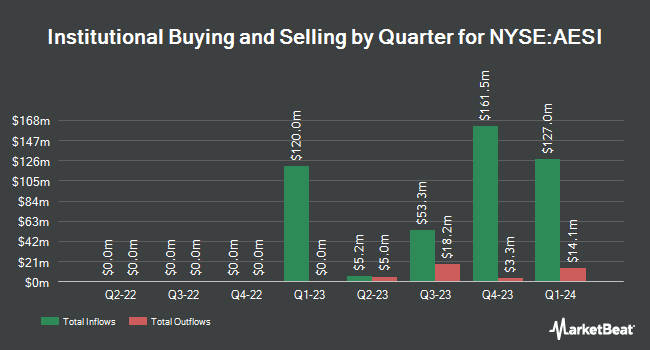

Kettle Hill Capital Management LLC bought a new stake in Atlas Energy Solutions Inc. (NYSE:AESI - Free Report) in the 1st quarter, according to its most recent filing with the Securities and Exchange Commission. The firm bought 124,963 shares of the company's stock, valued at approximately $2,229,000. Kettle Hill Capital Management LLC owned about 0.10% of Atlas Energy Solutions as of its most recent filing with the Securities and Exchange Commission.

Several other hedge funds have also bought and sold shares of the company. Tower Research Capital LLC TRC lifted its stake in Atlas Energy Solutions by 307.9% in the 4th quarter. Tower Research Capital LLC TRC now owns 1,387 shares of the company's stock valued at $31,000 after purchasing an additional 1,047 shares during the last quarter. New York State Teachers Retirement System lifted its stake in Atlas Energy Solutions by 9.3% in the 1st quarter. New York State Teachers Retirement System now owns 14,161 shares of the company's stock valued at $253,000 after purchasing an additional 1,200 shares during the last quarter. Mutual of America Capital Management LLC lifted its stake in Atlas Energy Solutions by 13.9% in the 1st quarter. Mutual of America Capital Management LLC now owns 10,460 shares of the company's stock valued at $187,000 after purchasing an additional 1,277 shares during the last quarter. Teachers Retirement System of The State of Kentucky lifted its position in Atlas Energy Solutions by 6.1% during the first quarter. Teachers Retirement System of The State of Kentucky now owns 22,440 shares of the company's stock worth $400,000 after acquiring an additional 1,292 shares during the last quarter. Finally, Larson Financial Group LLC lifted its position in Atlas Energy Solutions by 201.8% during the first quarter. Larson Financial Group LLC now owns 1,968 shares of the company's stock worth $35,000 after acquiring an additional 1,316 shares during the last quarter. 34.59% of the stock is currently owned by institutional investors and hedge funds.

Atlas Energy Solutions Price Performance

NYSE:AESI traded up $0.08 during mid-day trading on Wednesday, reaching $10.55. The stock had a trading volume of 587,848 shares, compared to its average volume of 1,705,378. The stock has a 50-day simple moving average of $12.56 and a two-hundred day simple moving average of $14.11. The stock has a market capitalization of $1.30 billion, a PE ratio of 75.33 and a beta of 1.19. The company has a debt-to-equity ratio of 0.39, a current ratio of 1.56 and a quick ratio of 1.30. Atlas Energy Solutions Inc. has a 12 month low of $10.40 and a 12 month high of $26.86.

Atlas Energy Solutions Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, August 21st. Shareholders of record on Thursday, August 14th were paid a dividend of $0.25 per share. This represents a $1.00 dividend on an annualized basis and a dividend yield of 9.5%. The ex-dividend date of this dividend was Thursday, August 14th. Atlas Energy Solutions's payout ratio is presently 714.29%.

Analysts Set New Price Targets

Several equities research analysts have issued reports on AESI shares. Citigroup cut their price objective on shares of Atlas Energy Solutions from $18.00 to $14.00 and set a "neutral" rating for the company in a research report on Tuesday, May 13th. Piper Sandler cut their price objective on shares of Atlas Energy Solutions from $16.00 to $14.00 and set a "neutral" rating for the company in a research report on Thursday, August 14th. Finally, Stifel Nicolaus cut their price objective on shares of Atlas Energy Solutions from $14.50 to $14.00 and set a "buy" rating for the company in a research report on Monday, August 11th. Four investment analysts have rated the stock with a Buy rating and seven have given a Hold rating to the company's stock. According to MarketBeat, Atlas Energy Solutions has an average rating of "Hold" and an average price target of $18.83.

Get Our Latest Stock Analysis on Atlas Energy Solutions

Atlas Energy Solutions Profile

(

Free Report)

Atlas Energy Solutions Inc engages in the production, processing, and sale of mesh and sand that are used as a proppant during the well completion process in the Permian Basin of Texas and New Mexico. The company provides transportation and logistics, storage solutions, and contract labor services. It sells its products and services to oil and natural gas exploration and production companies, and oilfield services companies.

Featured Stories

Before you consider Atlas Energy Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Atlas Energy Solutions wasn't on the list.

While Atlas Energy Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.