King Luther Capital Management Corp lessened its stake in Tapestry, Inc. (NYSE:TPR - Free Report) by 23.7% in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 13,528 shares of the luxury accessories retailer's stock after selling 4,200 shares during the quarter. King Luther Capital Management Corp's holdings in Tapestry were worth $953,000 at the end of the most recent quarter.

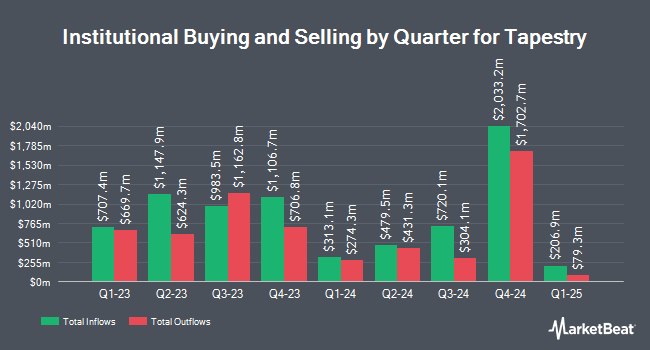

Other large investors have also made changes to their positions in the company. Harbour Investments Inc. increased its holdings in shares of Tapestry by 120.1% in the 1st quarter. Harbour Investments Inc. now owns 361 shares of the luxury accessories retailer's stock valued at $25,000 after purchasing an additional 197 shares in the last quarter. Greenline Partners LLC purchased a new position in shares of Tapestry in the 4th quarter valued at about $29,000. Coppell Advisory Solutions LLC increased its holdings in shares of Tapestry by 40.7% in the 4th quarter. Coppell Advisory Solutions LLC now owns 519 shares of the luxury accessories retailer's stock valued at $34,000 after purchasing an additional 150 shares in the last quarter. Opal Wealth Advisors LLC purchased a new position in shares of Tapestry in the 1st quarter valued at about $35,000. Finally, MorganRosel Wealth Management LLC purchased a new position in shares of Tapestry in the 1st quarter valued at about $35,000. Hedge funds and other institutional investors own 90.77% of the company's stock.

Analyst Upgrades and Downgrades

Several equities analysts have weighed in on TPR shares. JPMorgan Chase & Co. raised their target price on shares of Tapestry from $104.00 to $145.00 and gave the company an "overweight" rating in a report on Monday, July 28th. Citigroup raised their target price on shares of Tapestry from $81.00 to $94.00 and gave the company a "buy" rating in a report on Friday, May 9th. Wall Street Zen downgraded shares of Tapestry from a "strong-buy" rating to a "buy" rating in a report on Friday, July 18th. Argus raised their target price on shares of Tapestry from $78.00 to $92.00 and gave the company a "buy" rating in a report on Tuesday, June 17th. Finally, Barclays restated an "overweight" rating and set a $105.00 target price (up from $98.00) on shares of Tapestry in a report on Friday, July 11th. Four research analysts have rated the stock with a hold rating and seventeen have issued a buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $101.56.

View Our Latest Stock Report on Tapestry

Tapestry Price Performance

Tapestry stock opened at $110.93 on Wednesday. Tapestry, Inc. has a 1 year low of $37.47 and a 1 year high of $113.08. The firm has a 50 day moving average price of $95.40 and a 200 day moving average price of $82.11. The company has a market cap of $23.04 billion, a price-to-earnings ratio of 29.19, a PEG ratio of 2.18 and a beta of 1.51. The company has a debt-to-equity ratio of 1.59, a quick ratio of 1.22 and a current ratio of 1.76.

Tapestry Profile

(

Free Report)

Tapestry, Inc provides luxury accessories and branded lifestyle products in the United States, Japan, Greater China, and internationally. The company operates in three segments: Coach, Kate Spade, and Stuart Weitzman. It offers women's handbags; and women's accessories, such as small leather goods which includes mini and micro handbags, money pieces, wristlets, pouches, and cosmetic cases, as well as novelty accessories including address books, time management and travel accessories, sketchbooks, and portfolios; and belts, key rings, and charms.

Read More

Want to see what other hedge funds are holding TPR? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Tapestry, Inc. (NYSE:TPR - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tapestry, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tapestry wasn't on the list.

While Tapestry currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.