King Luther Capital Management Corp decreased its holdings in shares of LiveRamp Holdings, Inc. (NYSE:RAMP - Free Report) by 14.7% during the first quarter, according to the company in its most recent disclosure with the SEC. The fund owned 125,386 shares of the company's stock after selling 21,535 shares during the quarter. King Luther Capital Management Corp owned 0.19% of LiveRamp worth $3,278,000 at the end of the most recent reporting period.

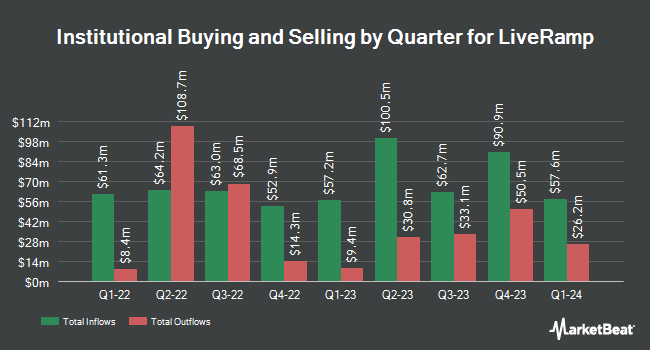

A number of other hedge funds have also recently modified their holdings of RAMP. Vanguard Group Inc. boosted its holdings in shares of LiveRamp by 3.2% in the first quarter. Vanguard Group Inc. now owns 9,131,290 shares of the company's stock valued at $238,692,000 after purchasing an additional 283,747 shares during the period. Dimensional Fund Advisors LP boosted its holdings in shares of LiveRamp by 4.7% in the fourth quarter. Dimensional Fund Advisors LP now owns 2,694,801 shares of the company's stock valued at $81,843,000 after purchasing an additional 121,856 shares during the period. Janus Henderson Group PLC boosted its holdings in shares of LiveRamp by 10.3% in the fourth quarter. Janus Henderson Group PLC now owns 1,798,198 shares of the company's stock valued at $54,600,000 after purchasing an additional 168,418 shares during the period. Charles Schwab Investment Management Inc. boosted its holdings in shares of LiveRamp by 0.9% in the first quarter. Charles Schwab Investment Management Inc. now owns 1,004,497 shares of the company's stock valued at $26,258,000 after purchasing an additional 8,537 shares during the period. Finally, Fort Washington Investment Advisors Inc. OH boosted its holdings in shares of LiveRamp by 27.1% in the first quarter. Fort Washington Investment Advisors Inc. OH now owns 997,402 shares of the company's stock valued at $26,072,000 after purchasing an additional 212,572 shares during the period. Institutional investors own 93.83% of the company's stock.

Insider Buying and Selling at LiveRamp

In other news, Director Timothy R. Cadogan sold 2,500 shares of the stock in a transaction on Monday, July 7th. The stock was sold at an average price of $34.00, for a total transaction of $85,000.00. Following the completion of the sale, the director owned 55,470 shares in the company, valued at approximately $1,885,980. This represents a 4.31% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CTO Mohsin Hussain sold 17,529 shares of the stock in a transaction on Wednesday, May 28th. The shares were sold at an average price of $33.00, for a total value of $578,457.00. Following the sale, the chief technology officer owned 79,616 shares of the company's stock, valued at approximately $2,627,328. This represents a 18.04% decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 3.31% of the company's stock.

LiveRamp Stock Performance

LiveRamp stock traded up $0.84 during mid-day trading on Friday, reaching $26.64. 918,630 shares of the company were exchanged, compared to its average volume of 579,907. The business has a fifty day moving average of $31.73 and a 200 day moving average of $29.95. The firm has a market cap of $1.75 billion, a P/E ratio of 121.10 and a beta of 1.00. LiveRamp Holdings, Inc. has a 12-month low of $22.82 and a 12-month high of $36.08.

LiveRamp (NYSE:RAMP - Get Free Report) last posted its earnings results on Wednesday, August 6th. The company reported $0.44 earnings per share for the quarter, topping analysts' consensus estimates of $0.43 by $0.01. The company had revenue of $194.82 million during the quarter, compared to analyst estimates of $191.22 million. LiveRamp had a return on equity of 2.21% and a net margin of 1.89%. LiveRamp's revenue was up 10.7% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.35 earnings per share. Sell-side analysts predict that LiveRamp Holdings, Inc. will post 0.48 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of brokerages recently issued reports on RAMP. DA Davidson began coverage on LiveRamp in a report on Wednesday, July 9th. They issued a "buy" rating and a $45.00 price target for the company. Wells Fargo & Company boosted their price target on LiveRamp from $26.00 to $31.00 and gave the company an "equal weight" rating in a report on Thursday, May 22nd. Wall Street Zen upgraded LiveRamp from a "buy" rating to a "strong-buy" rating in a report on Tuesday, April 22nd. Benchmark restated a "buy" rating and set a $51.00 target price (up previously from $48.00) on shares of LiveRamp in a report on Tuesday, August 5th. Finally, Morgan Stanley lowered their target price on LiveRamp from $34.00 to $30.00 and set an "equal weight" rating for the company in a report on Tuesday. One equities research analyst has rated the stock with a sell rating, two have assigned a hold rating, three have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $40.83.

Read Our Latest Stock Analysis on LiveRamp

LiveRamp Profile

(

Free Report)

LiveRamp Holdings, Inc, a technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally. The company operates LiveRamp Data Collaboration platform enables an organization to unify customer and prospect data to build a single view of the customer in a way that protects consumer privacy.

Further Reading

Before you consider LiveRamp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LiveRamp wasn't on the list.

While LiveRamp currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.