Kingdon Capital Management L.L.C. reduced its stake in shares of Okta, Inc. (NASDAQ:OKTA - Free Report) by 57.7% during the 1st quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 55,000 shares of the company's stock after selling 75,000 shares during the period. Kingdon Capital Management L.L.C.'s holdings in Okta were worth $5,787,000 at the end of the most recent reporting period.

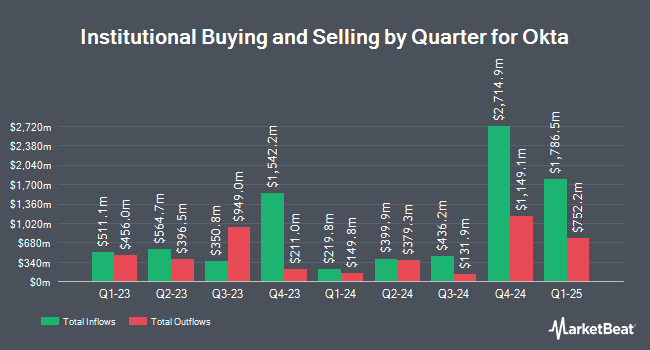

Other institutional investors also recently made changes to their positions in the company. Vanguard Group Inc. boosted its position in shares of Okta by 3.4% in the 1st quarter. Vanguard Group Inc. now owns 17,792,886 shares of the company's stock worth $1,872,167,000 after buying an additional 582,956 shares in the last quarter. Massachusetts Financial Services Co. MA boosted its position in shares of Okta by 325.6% in the 1st quarter. Massachusetts Financial Services Co. MA now owns 3,699,944 shares of the company's stock worth $389,308,000 after buying an additional 2,830,582 shares in the last quarter. Point72 Asset Management L.P. boosted its position in shares of Okta by 236.8% in the 4th quarter. Point72 Asset Management L.P. now owns 2,236,942 shares of the company's stock worth $176,271,000 after buying an additional 1,572,786 shares in the last quarter. Ameriprise Financial Inc. boosted its position in shares of Okta by 5.2% in the 1st quarter. Ameriprise Financial Inc. now owns 2,014,665 shares of the company's stock worth $211,982,000 after buying an additional 100,411 shares in the last quarter. Finally, Ninety One UK Ltd purchased a new stake in shares of Okta in the 1st quarter worth about $189,915,000. 86.64% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

OKTA has been the topic of several recent research reports. Canaccord Genuity Group upgraded shares of Okta from a "hold" rating to a "buy" rating and boosted their price objective for the stock from $115.00 to $120.00 in a research report on Tuesday, August 26th. Arete initiated coverage on shares of Okta in a research report on Monday, July 7th. They issued a "sell" rating and a $83.00 price objective on the stock. Jefferies Financial Group boosted their price objective on shares of Okta from $100.00 to $105.00 and gave the stock a "hold" rating in a research report on Wednesday, August 27th. Cantor Fitzgerald reiterated an "overweight" rating and issued a $130.00 price objective on shares of Okta in a research report on Wednesday, August 27th. Finally, BTIG Research reissued a "buy" rating on shares of Okta in a research note on Thursday, May 22nd. Twenty-two research analysts have rated the stock with a Buy rating, thirteen have given a Hold rating and three have issued a Sell rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $118.25.

Get Our Latest Report on OKTA

Insider Activity at Okta

In related news, CRO Jonathan James Addison sold 9,000 shares of the stock in a transaction that occurred on Friday, July 25th. The shares were sold at an average price of $100.00, for a total transaction of $900,000.00. Following the completion of the sale, the executive owned 7,067 shares of the company's stock, valued at approximately $706,700. This represents a 56.02% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Todd Mckinnon sold 31,592 shares of the stock in a transaction that occurred on Monday, July 21st. The stock was sold at an average price of $95.30, for a total transaction of $3,010,717.60. Following the sale, the chief executive officer directly owned 20,682 shares of the company's stock, valued at approximately $1,970,994.60. This trade represents a 60.44% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 88,594 shares of company stock worth $8,382,790. Corporate insiders own 5.68% of the company's stock.

Okta Trading Up 0.4%

Shares of NASDAQ OKTA traded up $0.32 on Wednesday, reaching $89.82. 3,395,132 shares of the company traded hands, compared to its average volume of 3,753,850. Okta, Inc. has a fifty-two week low of $70.56 and a fifty-two week high of $127.57. The company has a 50 day moving average of $94.64 and a 200 day moving average of $102.20. The stock has a market capitalization of $15.73 billion, a PE ratio of 105.67, a P/E/G ratio of 4.52 and a beta of 0.83.

Okta (NASDAQ:OKTA - Get Free Report) last posted its quarterly earnings data on Tuesday, August 26th. The company reported $0.91 EPS for the quarter, beating analysts' consensus estimates of $0.84 by $0.07. Okta had a net margin of 6.08% and a return on equity of 3.31%. The company had revenue of $728,000 billion during the quarter, compared to the consensus estimate of $711.84 million. During the same quarter in the prior year, the company posted $0.72 EPS. The company's quarterly revenue was up 12.7% compared to the same quarter last year. Okta has set its FY 2026 guidance at 3.330-3.380 EPS. Q3 2026 guidance at 0.740-0.750 EPS. As a group, research analysts expect that Okta, Inc. will post 0.42 earnings per share for the current year.

Okta Company Profile

(

Free Report)

Okta, Inc operates as an identity partner in the United States and internationally. The company offers Okta's suite of products and services used to manage and secure identities, such as Single Sign-On that enables users to access applications in the cloud or on-premises from various devices; Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, web applications, and data; API Access Management enables organizations to secure APIs; Access Gateway enables organizations to extend Workforce Identity Cloud; and Okta Device Access enables end users to securely log in to devices with Okta credentials.

Featured Stories

Before you consider Okta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Okta wasn't on the list.

While Okta currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report