Evernest Financial Advisors LLC boosted its holdings in Kingstone Companies, Inc (NASDAQ:KINS - Free Report) by 57.1% during the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 156,500 shares of the insurance provider's stock after acquiring an additional 56,900 shares during the quarter. Kingstone Companies accounts for 0.8% of Evernest Financial Advisors LLC's portfolio, making the stock its 25th largest position. Evernest Financial Advisors LLC owned about 1.12% of Kingstone Companies worth $2,412,000 as of its most recent SEC filing.

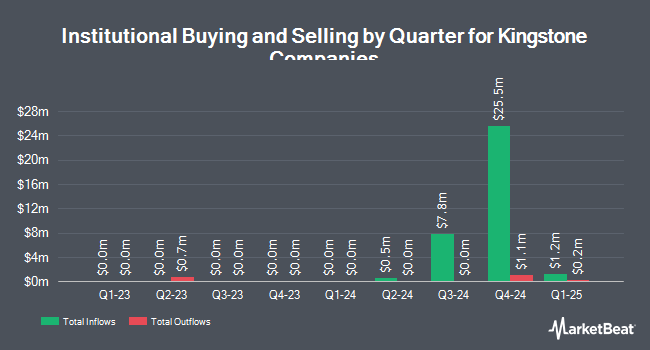

Several other large investors have also recently added to or reduced their stakes in the business. Millennium Management LLC increased its position in Kingstone Companies by 484.9% in the 1st quarter. Millennium Management LLC now owns 285,834 shares of the insurance provider's stock valued at $4,759,000 after acquiring an additional 236,968 shares during the period. American Century Companies Inc. boosted its stake in Kingstone Companies by 89.6% during the 1st quarter. American Century Companies Inc. now owns 161,809 shares of the insurance provider's stock valued at $2,694,000 after purchasing an additional 76,451 shares in the last quarter. Palisades Investment Partners LLC boosted its stake in Kingstone Companies by 128.1% during the 2nd quarter. Palisades Investment Partners LLC now owns 139,592 shares of the insurance provider's stock valued at $2,151,000 after purchasing an additional 78,387 shares in the last quarter. LPL Financial LLC boosted its stake in Kingstone Companies by 62.8% during the 1st quarter. LPL Financial LLC now owns 118,436 shares of the insurance provider's stock valued at $1,972,000 after purchasing an additional 45,686 shares in the last quarter. Finally, De Lisle Partners LLP boosted its stake in Kingstone Companies by 139.3% during the 1st quarter. De Lisle Partners LLP now owns 95,710 shares of the insurance provider's stock valued at $1,593,000 after purchasing an additional 55,710 shares in the last quarter. 14.91% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

Separately, Weiss Ratings reaffirmed a "hold (c+)" rating on shares of Kingstone Companies in a research note on Wednesday, October 8th. One investment analyst has rated the stock with a Hold rating, Based on data from MarketBeat, the company presently has an average rating of "Hold".

Check Out Our Latest Report on Kingstone Companies

Kingstone Companies Stock Performance

Shares of NASDAQ KINS opened at $14.77 on Thursday. The stock has a fifty day moving average price of $14.22 and a two-hundred day moving average price of $15.54. The company has a debt-to-equity ratio of 0.05, a quick ratio of 0.46 and a current ratio of 0.46. The firm has a market cap of $208.85 million, a P/E ratio of 7.39 and a beta of 0.49. Kingstone Companies, Inc has a 1 year low of $9.50 and a 1 year high of $22.40.

Kingstone Companies (NASDAQ:KINS - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The insurance provider reported $0.75 earnings per share for the quarter, topping the consensus estimate of $0.55 by $0.20. The business had revenue of $59.80 million during the quarter, compared to analyst estimates of $45.20 million. Kingstone Companies had a return on equity of 33.21% and a net margin of 14.84%. Kingstone Companies has set its FY 2025 guidance at 1.950-2.35 EPS. Research analysts forecast that Kingstone Companies, Inc will post 1.4 EPS for the current fiscal year.

Kingstone Companies Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Tuesday, August 26th. Stockholders of record on Monday, August 11th were paid a dividend of $0.05 per share. The ex-dividend date of this dividend was Monday, August 11th. This represents a $0.20 annualized dividend and a dividend yield of 1.4%. Kingstone Companies's dividend payout ratio (DPR) is currently 10.00%.

Kingstone Companies Profile

(

Free Report)

Kingstone Companies, Inc, through its subsidiary, provides property and casualty insurance products to individuals in the United States. It offers personal line of insurance products, such as homeowners and dwelling fire, cooperative/condominiums, renters, and personal umbrella policies. The company also provides for-hire vehicle physical damage only policies for livery and car service vehicles and taxicabs; and canine legal liability policies.

Featured Stories

Want to see what other hedge funds are holding KINS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Kingstone Companies, Inc (NASDAQ:KINS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Kingstone Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kingstone Companies wasn't on the list.

While Kingstone Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.