Artemis Investment Management LLP raised its stake in Kinross Gold Corporation (NYSE:KGC - Free Report) TSE: K by 365.8% during the first quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 6,876,921 shares of the mining company's stock after buying an additional 5,400,447 shares during the period. Kinross Gold comprises about 1.3% of Artemis Investment Management LLP's portfolio, making the stock its 14th biggest position. Artemis Investment Management LLP owned 0.56% of Kinross Gold worth $86,718,000 as of its most recent filing with the Securities and Exchange Commission.

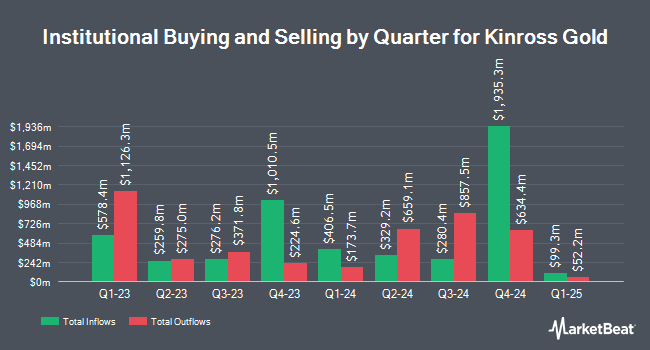

Several other institutional investors and hedge funds also recently made changes to their positions in KGC. Norges Bank acquired a new position in shares of Kinross Gold during the 4th quarter valued at $280,697,000. Man Group plc grew its holdings in Kinross Gold by 174.2% in the fourth quarter. Man Group plc now owns 9,243,267 shares of the mining company's stock worth $85,685,000 after purchasing an additional 5,871,904 shares during the period. First Eagle Investment Management LLC increased its stake in Kinross Gold by 80.9% in the fourth quarter. First Eagle Investment Management LLC now owns 12,610,383 shares of the mining company's stock valued at $116,898,000 after purchasing an additional 5,639,383 shares in the last quarter. Renaissance Technologies LLC raised its holdings in shares of Kinross Gold by 10.9% during the fourth quarter. Renaissance Technologies LLC now owns 32,862,230 shares of the mining company's stock valued at $304,633,000 after purchasing an additional 3,224,455 shares during the period. Finally, Merewether Investment Management LP acquired a new position in shares of Kinross Gold during the fourth quarter valued at about $23,765,000. Institutional investors and hedge funds own 63.69% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages have recently commented on KGC. National Bankshares restated an "outperform" rating on shares of Kinross Gold in a research note on Tuesday, June 24th. CIBC reissued an "outperform" rating on shares of Kinross Gold in a research note on Tuesday, May 13th. Stifel Canada upgraded Kinross Gold to a "strong-buy" rating in a report on Wednesday, March 19th. Royal Bank Of Canada increased their target price on Kinross Gold from $14.00 to $19.00 and gave the stock a "sector perform" rating in a report on Wednesday, June 4th. Finally, BMO Capital Markets began coverage on shares of Kinross Gold in a research report on Wednesday, April 16th. They issued an "outperform" rating for the company. Two research analysts have rated the stock with a hold rating, five have given a buy rating and three have assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Buy" and a consensus target price of $17.00.

Check Out Our Latest Research Report on KGC

Kinross Gold Stock Performance

Shares of NYSE:KGC traded up $0.76 during midday trading on Monday, reaching $15.63. The company had a trading volume of 17,969,143 shares, compared to its average volume of 18,779,444. The stock has a market cap of $19.17 billion, a P/E ratio of 15.95, a P/E/G ratio of 0.61 and a beta of 0.63. The company's 50 day moving average price is $14.86 and its 200 day moving average price is $12.54. The company has a current ratio of 2.83, a quick ratio of 1.22 and a debt-to-equity ratio of 0.17. Kinross Gold Corporation has a 52-week low of $7.84 and a 52-week high of $16.04.

Kinross Gold (NYSE:KGC - Get Free Report) TSE: K last announced its quarterly earnings data on Tuesday, May 6th. The mining company reported $0.30 EPS for the quarter, topping the consensus estimate of $0.22 by $0.08. Kinross Gold had a net margin of 21.74% and a return on equity of 15.63%. The business had revenue of $1.44 billion for the quarter, compared to analyst estimates of $1.43 billion. During the same quarter in the previous year, the firm posted $0.10 earnings per share. The company's revenue for the quarter was up 38.5% on a year-over-year basis. As a group, sell-side analysts anticipate that Kinross Gold Corporation will post 0.81 EPS for the current fiscal year.

Kinross Gold Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, June 12th. Investors of record on Thursday, May 29th were paid a $0.03 dividend. The ex-dividend date was Thursday, May 29th. This represents a $0.12 annualized dividend and a yield of 0.77%. Kinross Gold's payout ratio is 12.24%.

Kinross Gold Company Profile

(

Free Report)

Kinross Gold Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania. The company operates the Fort Knox mine and the Manh Choh project in Alaska, as well as the Round Mountain and the Bald Mountain mines in Nevada, the United States; the Paracatu mine in Brazil; the La Coipa and the Lobo-Marte project in Chile; the Tasiast mine in Mauritania; and the Great Bear project in Canada.

See Also

Before you consider Kinross Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kinross Gold wasn't on the list.

While Kinross Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.