Kinsale Capital Group Inc. lifted its position in shares of Copart, Inc. (NASDAQ:CPRT - Free Report) by 18.7% in the first quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 121,079 shares of the business services provider's stock after buying an additional 19,060 shares during the period. Copart makes up about 1.7% of Kinsale Capital Group Inc.'s holdings, making the stock its 27th biggest holding. Kinsale Capital Group Inc.'s holdings in Copart were worth $6,852,000 at the end of the most recent reporting period.

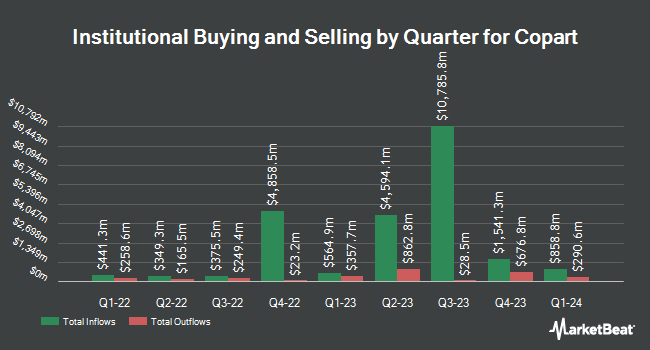

Other institutional investors and hedge funds have also made changes to their positions in the company. Bellwether Advisors LLC increased its holdings in Copart by 2.1% in the 1st quarter. Bellwether Advisors LLC now owns 35,625 shares of the business services provider's stock valued at $2,016,000 after purchasing an additional 736 shares in the last quarter. LPL Financial LLC increased its holdings in Copart by 18.6% in the 1st quarter. LPL Financial LLC now owns 701,132 shares of the business services provider's stock valued at $39,677,000 after purchasing an additional 109,734 shares in the last quarter. Second Half Financial Partners LLC increased its holdings in Copart by 27.8% in the 1st quarter. Second Half Financial Partners LLC now owns 9,902 shares of the business services provider's stock valued at $560,000 after purchasing an additional 2,154 shares in the last quarter. Texas Yale Capital Corp. increased its holdings in Copart by 13.1% in the 1st quarter. Texas Yale Capital Corp. now owns 23,490 shares of the business services provider's stock valued at $1,329,000 after purchasing an additional 2,720 shares in the last quarter. Finally, Empirical Finance LLC increased its holdings in Copart by 2.2% in the 1st quarter. Empirical Finance LLC now owns 29,126 shares of the business services provider's stock valued at $1,648,000 after purchasing an additional 631 shares in the last quarter. 85.78% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several analysts recently issued reports on the company. Robert W. Baird lowered their price target on Copart from $64.00 to $55.00 and set an "outperform" rating for the company in a report on Thursday, July 17th. Stephens assumed coverage on Copart in a research note on Tuesday, July 8th. They set an "equal weight" rating and a $50.00 target price for the company. Finally, JPMorgan Chase & Co. lowered their target price on Copart from $60.00 to $55.00 and set a "neutral" rating for the company in a research note on Friday, May 23rd.

Read Our Latest Analysis on CPRT

Insider Buying and Selling

In related news, CEO Jeffrey Liaw sold 24,088 shares of Copart stock in a transaction dated Tuesday, July 15th. The stock was sold at an average price of $46.43, for a total value of $1,118,405.84. Following the completion of the transaction, the chief executive officer directly owned 31,527 shares in the company, valued at approximately $1,463,798.61. This trade represents a 43.31% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 9.68% of the company's stock.

Copart Stock Down 1.3%

Shares of Copart stock traded down $0.61 during trading hours on Monday, hitting $46.08. 4,628,608 shares of the company's stock traded hands, compared to its average volume of 6,950,240. The stock has a 50 day simple moving average of $49.54 and a 200-day simple moving average of $54.86. The company has a market cap of $44.56 billion, a PE ratio of 30.32 and a beta of 1.07. Copart, Inc. has a twelve month low of $45.52 and a twelve month high of $64.38.

Copart (NASDAQ:CPRT - Get Free Report) last posted its quarterly earnings results on Thursday, May 22nd. The business services provider reported $0.42 EPS for the quarter, hitting analysts' consensus estimates of $0.42. The business had revenue of $1.21 billion during the quarter, compared to the consensus estimate of $1.23 billion. Copart had a return on equity of 18.20% and a net margin of 32.21%. The company's revenue for the quarter was up 7.5% compared to the same quarter last year. During the same period last year, the firm earned $0.39 earnings per share. As a group, equities research analysts predict that Copart, Inc. will post 1.57 EPS for the current year.

Copart Profile

(

Free Report)

Copart, Inc provides online auctions and vehicle remarketing services. It offers a range of services for processing and selling vehicles over the Internet through its Virtual Bidding Third Generation Internet auction-style sales technology on behalf of vehicle sellers, insurance companies, banks and finance companies, charities, and fleet operators and dealers, as well as individual owners.

Read More

Before you consider Copart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Copart wasn't on the list.

While Copart currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.