KLP Kapitalforvaltning AS grew its stake in Bunge Global SA (NYSE:BG - Free Report) by 3.6% in the second quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 107,199 shares of the basic materials company's stock after purchasing an additional 3,700 shares during the period. KLP Kapitalforvaltning AS owned approximately 0.08% of Bunge Global worth $8,609,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

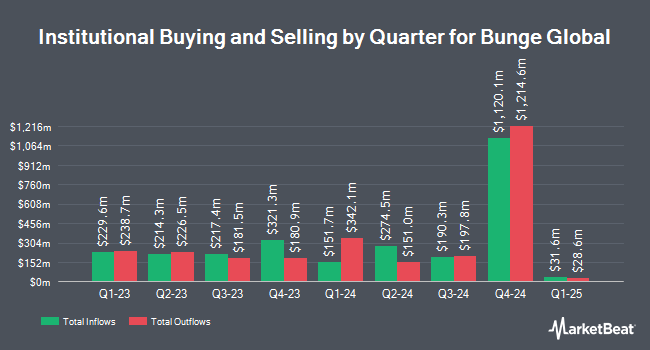

Other large investors have also made changes to their positions in the company. QRG Capital Management Inc. grew its position in Bunge Global by 45.7% in the second quarter. QRG Capital Management Inc. now owns 6,539 shares of the basic materials company's stock worth $525,000 after acquiring an additional 2,050 shares during the period. Ameritas Advisory Services LLC purchased a new position in Bunge Global in the second quarter worth approximately $29,000. Greenwood Capital Associates LLC purchased a new position in Bunge Global in the second quarter worth approximately $990,000. Cromwell Holdings LLC grew its position in Bunge Global by 4,175.0% in the second quarter. Cromwell Holdings LLC now owns 342 shares of the basic materials company's stock worth $27,000 after acquiring an additional 334 shares during the period. Finally, ASR Vermogensbeheer N.V. grew its position in Bunge Global by 1.3% in the second quarter. ASR Vermogensbeheer N.V. now owns 79,745 shares of the basic materials company's stock worth $6,402,000 after acquiring an additional 1,049 shares during the period. 86.23% of the stock is currently owned by hedge funds and other institutional investors.

Insiders Place Their Bets

In other Bunge Global news, Director Christopher Mahoney purchased 5,000 shares of the business's stock in a transaction on Monday, August 18th. The shares were bought at an average cost of $81.73 per share, for a total transaction of $408,650.00. Following the completion of the purchase, the director directly owned 7,164 shares in the company, valued at approximately $585,513.72. This represents a 231.05% increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which can be accessed through this link. 0.80% of the stock is currently owned by corporate insiders.

Bunge Global Stock Down 1.4%

Shares of NYSE BG opened at $81.25 on Friday. The stock has a market cap of $16.25 billion, a P/E ratio of 8.12, a PEG ratio of 6.15 and a beta of 0.66. The company has a current ratio of 2.07, a quick ratio of 1.29 and a debt-to-equity ratio of 0.59. Bunge Global SA has a 12-month low of $67.40 and a 12-month high of $97.27. The business's fifty day simple moving average is $82.24 and its 200-day simple moving average is $79.45.

Bunge Global (NYSE:BG - Get Free Report) last announced its quarterly earnings data on Wednesday, July 30th. The basic materials company reported $1.31 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.19 by $0.12. The business had revenue of $12.77 billion for the quarter, compared to analysts' expectations of $12.57 billion. Bunge Global had a return on equity of 9.16% and a net margin of 2.71%.The company's revenue for the quarter was down 3.6% compared to the same quarter last year. During the same period last year, the firm earned $1.73 earnings per share. Bunge Global has set its FY 2025 guidance at 7.750-7.750 EPS. As a group, equities analysts predict that Bunge Global SA will post 7.94 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several brokerages recently weighed in on BG. Morgan Stanley increased their price objective on Bunge Global from $74.00 to $83.00 and gave the stock an "equal weight" rating in a research report on Tuesday, August 12th. JPMorgan Chase & Co. began coverage on Bunge Global in a research report on Wednesday, August 20th. They issued an "overweight" rating and a $95.00 price objective for the company. Finally, Weiss Ratings reiterated a "hold (c)" rating on shares of Bunge Global in a research report on Wednesday. Three research analysts have rated the stock with a Buy rating and four have assigned a Hold rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $85.33.

Read Our Latest Stock Analysis on BG

Bunge Global Profile

(

Free Report)

Bunge Global SA operates as an agribusiness and food company worldwide. It operates through four segments: Agribusiness, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The Agribusiness segment purchases, stores, transports, processes, and sells agricultural commodities and commodity products, including oilseeds primarily soybeans, rapeseed, canola, and sunflower seeds, as well as grains comprising wheat and corn; and processes oilseeds into vegetable oils and protein meals.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bunge Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bunge Global wasn't on the list.

While Bunge Global currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.