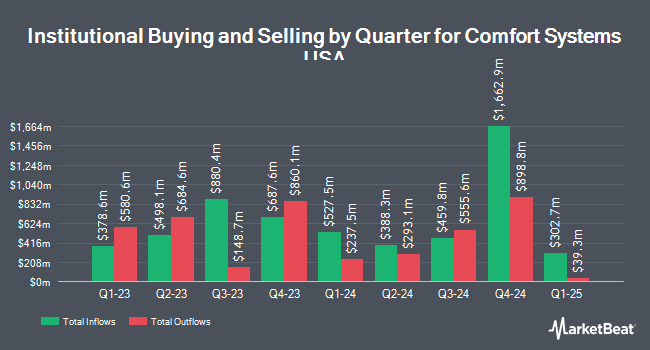

KLP Kapitalforvaltning AS raised its position in shares of Comfort Systems USA, Inc. (NYSE:FIX - Free Report) by 6.1% in the second quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 8,700 shares of the construction company's stock after purchasing an additional 500 shares during the quarter. KLP Kapitalforvaltning AS's holdings in Comfort Systems USA were worth $4,665,000 as of its most recent SEC filing.

Other large investors have also made changes to their positions in the company. Sumitomo Mitsui Trust Group Inc. grew its stake in shares of Comfort Systems USA by 13.1% during the 1st quarter. Sumitomo Mitsui Trust Group Inc. now owns 2,556 shares of the construction company's stock valued at $824,000 after purchasing an additional 296 shares during the period. Farther Finance Advisors LLC grew its stake in shares of Comfort Systems USA by 27.7% during the 1st quarter. Farther Finance Advisors LLC now owns 1,102 shares of the construction company's stock valued at $364,000 after acquiring an additional 239 shares during the period. Wealth Enhancement Advisory Services LLC grew its stake in shares of Comfort Systems USA by 97.7% during the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 7,375 shares of the construction company's stock valued at $2,377,000 after acquiring an additional 3,644 shares during the period. Dynamic Advisor Solutions LLC grew its stake in shares of Comfort Systems USA by 256.0% during the 1st quarter. Dynamic Advisor Solutions LLC now owns 2,040 shares of the construction company's stock valued at $658,000 after acquiring an additional 1,467 shares during the period. Finally, Spire Wealth Management grew its stake in shares of Comfort Systems USA by 9.8% during the 1st quarter. Spire Wealth Management now owns 1,005 shares of the construction company's stock valued at $324,000 after acquiring an additional 90 shares during the period. 96.51% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of research analysts recently issued reports on FIX shares. Zacks Research downgraded Comfort Systems USA from a "strong-buy" rating to a "hold" rating in a research note on Friday, September 26th. Wall Street Zen upgraded Comfort Systems USA from a "hold" rating to a "buy" rating in a research note on Saturday, July 26th. DA Davidson boosted their price objective on Comfort Systems USA from $630.00 to $810.00 and gave the company a "buy" rating in a research note on Monday, July 28th. UBS Group boosted their price objective on Comfort Systems USA from $710.00 to $875.00 and gave the company a "buy" rating in a research note on Monday, September 15th. Finally, Stifel Nicolaus upped their price target on Comfort Systems USA from $512.00 to $581.00 and gave the stock a "buy" rating in a research note on Friday, July 11th. Six investment analysts have rated the stock with a Buy rating and two have issued a Hold rating to the company. According to MarketBeat, the company has an average rating of "Moderate Buy" and an average target price of $668.60.

Get Our Latest Research Report on Comfort Systems USA

Insider Buying and Selling at Comfort Systems USA

In other news, insider Brian E. Lane sold 10,000 shares of the company's stock in a transaction that occurred on Thursday, August 7th. The stock was sold at an average price of $691.74, for a total transaction of $6,917,400.00. Following the sale, the insider directly owned 188,046 shares of the company's stock, valued at $130,078,940.04. This represents a 5.05% decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CFO William George III sold 8,436 shares of the company's stock in a transaction that occurred on Friday, August 8th. The stock was sold at an average price of $692.60, for a total value of $5,842,773.60. Following the sale, the chief financial officer directly owned 47,473 shares in the company, valued at $32,879,799.80. This trade represents a 15.09% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 26,783 shares of company stock worth $18,710,798. Company insiders own 1.59% of the company's stock.

Comfort Systems USA Trading Down 2.1%

FIX stock opened at $817.14 on Friday. Comfort Systems USA, Inc. has a 1-year low of $276.44 and a 1-year high of $858.55. The company has a debt-to-equity ratio of 0.03, a current ratio of 1.13 and a quick ratio of 1.10. The company has a market capitalization of $28.83 billion, a price-to-earnings ratio of 41.99 and a beta of 1.58. The business has a 50 day simple moving average of $747.01 and a two-hundred day simple moving average of $562.74.

Comfort Systems USA (NYSE:FIX - Get Free Report) last posted its quarterly earnings results on Monday, August 15th. The construction company reported $0.90 earnings per share for the quarter. Comfort Systems USA had a return on equity of 39.33% and a net margin of 9.01%.The business had revenue of $713.90 million during the quarter. Research analysts anticipate that Comfort Systems USA, Inc. will post 16.85 EPS for the current fiscal year.

Comfort Systems USA Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Monday, August 25th. Stockholders of record on Thursday, August 14th were issued a dividend of $0.50 per share. This is a positive change from Comfort Systems USA's previous quarterly dividend of $0.45. The ex-dividend date of this dividend was Thursday, August 14th. This represents a $2.00 annualized dividend and a dividend yield of 0.2%. Comfort Systems USA's payout ratio is currently 10.28%.

Comfort Systems USA Profile

(

Free Report)

Comfort Systems USA, Inc, together with its subsidiaries, provides mechanical and electrical installation, renovation, maintenance, repair, and replacement services for the mechanical and electrical services industry in the United States. It operates through two segments, Mechanical and Electrical. The company offers heating, ventilation, and air conditioning systems, as well as plumbing, electrical, piping and controls, off-site construction, monitoring, and fire protection.

Recommended Stories

Want to see what other hedge funds are holding FIX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Comfort Systems USA, Inc. (NYSE:FIX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Comfort Systems USA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Comfort Systems USA wasn't on the list.

While Comfort Systems USA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report