Knights of Columbus Asset Advisors LLC lessened its holdings in shares of Mirum Pharmaceuticals, Inc. (NASDAQ:MIRM - Free Report) by 57.1% in the first quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 19,757 shares of the company's stock after selling 26,245 shares during the quarter. Knights of Columbus Asset Advisors LLC's holdings in Mirum Pharmaceuticals were worth $890,000 as of its most recent filing with the Securities & Exchange Commission.

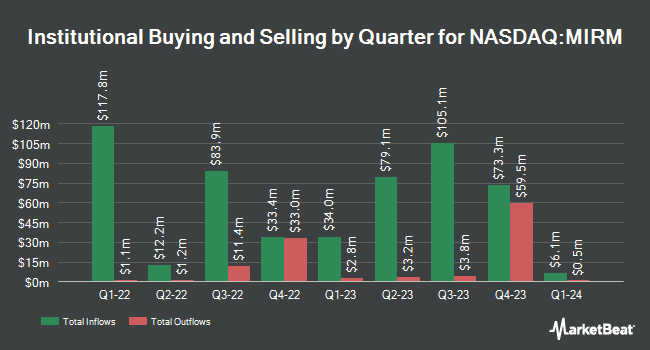

A number of other hedge funds and other institutional investors also recently made changes to their positions in the business. Janus Henderson Group PLC raised its holdings in shares of Mirum Pharmaceuticals by 2.3% during the fourth quarter. Janus Henderson Group PLC now owns 4,581,642 shares of the company's stock valued at $189,481,000 after acquiring an additional 101,358 shares in the last quarter. Price T Rowe Associates Inc. MD raised its holdings in shares of Mirum Pharmaceuticals by 10.8% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 1,422,729 shares of the company's stock valued at $58,831,000 after acquiring an additional 138,623 shares in the last quarter. Geode Capital Management LLC raised its holdings in shares of Mirum Pharmaceuticals by 0.8% during the fourth quarter. Geode Capital Management LLC now owns 943,344 shares of the company's stock valued at $39,016,000 after acquiring an additional 7,147 shares in the last quarter. Clearbridge Investments LLC raised its holdings in shares of Mirum Pharmaceuticals by 2.0% during the fourth quarter. Clearbridge Investments LLC now owns 907,317 shares of the company's stock valued at $37,518,000 after acquiring an additional 18,217 shares in the last quarter. Finally, Lord Abbett & CO. LLC raised its holdings in shares of Mirum Pharmaceuticals by 5.5% during the fourth quarter. Lord Abbett & CO. LLC now owns 782,354 shares of the company's stock valued at $32,350,000 after acquiring an additional 40,986 shares in the last quarter.

Mirum Pharmaceuticals Stock Up 1.3%

Shares of NASDAQ MIRM traded up $0.69 during trading on Wednesday, reaching $51.86. The company had a trading volume of 60,671 shares, compared to its average volume of 462,131. Mirum Pharmaceuticals, Inc. has a 12-month low of $36.20 and a 12-month high of $54.78. The stock has a market cap of $2.57 billion, a PE ratio of -32.17 and a beta of 0.97. The business's 50-day moving average is $49.26 and its 200 day moving average is $46.74. The company has a quick ratio of 3.04, a current ratio of 3.22 and a debt-to-equity ratio of 1.32.

Mirum Pharmaceuticals (NASDAQ:MIRM - Get Free Report) last released its earnings results on Wednesday, May 14th. The company reported ($0.30) EPS for the quarter, topping analysts' consensus estimates of ($0.35) by $0.05. Mirum Pharmaceuticals had a negative return on equity of 33.63% and a negative net margin of 20.39%. The firm had revenue of $111.59 million for the quarter, compared to analysts' expectations of $98.47 million. During the same period in the prior year, the firm posted ($0.54) earnings per share. The company's quarterly revenue was up 61.2% on a year-over-year basis. As a group, equities analysts forecast that Mirum Pharmaceuticals, Inc. will post -1.43 earnings per share for the current fiscal year.

Insider Activity at Mirum Pharmaceuticals

In other news, SVP Jolanda Howe sold 564 shares of the stock in a transaction on Wednesday, July 2nd. The stock was sold at an average price of $48.25, for a total value of $27,213.00. Following the sale, the senior vice president directly owned 2,903 shares of the company's stock, valued at approximately $140,069.75. This represents a 16.27% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Corporate insiders own 22.87% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on MIRM shares. HC Wainwright restated a "buy" rating and set a $73.00 target price on shares of Mirum Pharmaceuticals in a report on Monday, May 19th. Wall Street Zen cut Mirum Pharmaceuticals from a "buy" rating to a "hold" rating in a research note on Sunday, July 6th. Raymond James Financial reaffirmed a "strong-buy" rating on shares of Mirum Pharmaceuticals in a research note on Tuesday, May 13th. Evercore ISI reaffirmed an "outperform" rating on shares of Mirum Pharmaceuticals in a research note on Friday, July 11th. Finally, JMP Securities upped their price target on Mirum Pharmaceuticals from $74.00 to $76.00 and gave the stock a "market outperform" rating in a research note on Friday, May 9th. One investment analyst has rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Buy" and an average target price of $65.50.

View Our Latest Stock Report on MIRM

Mirum Pharmaceuticals Profile

(

Free Report)

Mirum Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of novel therapies for debilitating rare and orphan diseases. Its lead product candidate is LIVMARLI (maralixibat), an orally administered and minimally absorbed ileal bile acid transporter (IBAT) inhibitor that is approved for the treatment of cholestatic pruritus in patients with Alagille syndrome in the United States and internationally.

See Also

Before you consider Mirum Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mirum Pharmaceuticals wasn't on the list.

While Mirum Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.