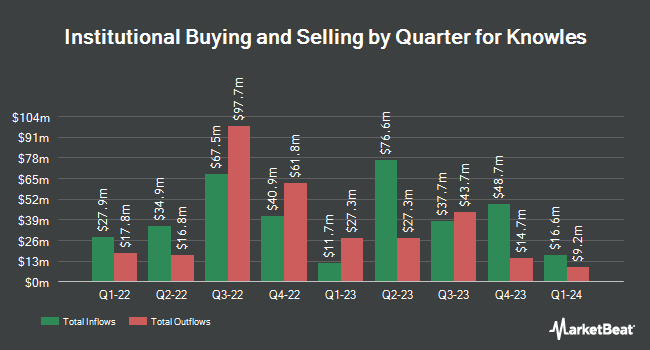

Royce & Associates LP raised its position in shares of Knowles Corporation (NYSE:KN - Free Report) by 31.5% in the first quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 1,611,679 shares of the communications equipment provider's stock after purchasing an additional 386,155 shares during the period. Royce & Associates LP owned about 1.84% of Knowles worth $24,498,000 as of its most recent filing with the Securities & Exchange Commission.

Other institutional investors and hedge funds have also bought and sold shares of the company. Versant Capital Management Inc raised its position in shares of Knowles by 725.6% in the 1st quarter. Versant Capital Management Inc now owns 1,643 shares of the communications equipment provider's stock worth $25,000 after acquiring an additional 1,444 shares in the last quarter. Sterling Capital Management LLC raised its position in shares of Knowles by 835.5% in the 4th quarter. Sterling Capital Management LLC now owns 2,741 shares of the communications equipment provider's stock worth $55,000 after acquiring an additional 2,448 shares in the last quarter. Bank of Montreal Can bought a new position in shares of Knowles in the 4th quarter worth $203,000. Stifel Financial Corp bought a new position in shares of Knowles in the 4th quarter worth $209,000. Finally, Ethic Inc. bought a new position in shares of Knowles in the 4th quarter worth $210,000. 96.35% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other news, SVP Raymond D. Cabrera sold 5,545 shares of the company's stock in a transaction dated Thursday, May 15th. The stock was sold at an average price of $17.25, for a total value of $95,651.25. Following the sale, the senior vice president owned 111,286 shares in the company, valued at $1,919,683.50. This represents a 4.75% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders own 2.54% of the company's stock.

Knowles Stock Up 1.2%

KN stock traded up $0.24 on Monday, hitting $20.63. 467,526 shares of the company's stock were exchanged, compared to its average volume of 732,421. Knowles Corporation has a 12-month low of $12.19 and a 12-month high of $20.85. The firm has a 50 day moving average price of $17.46 and a two-hundred day moving average price of $17.03. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.29 and a current ratio of 2.00. The stock has a market cap of $1.79 billion, a P/E ratio of 71.13 and a beta of 1.41.

Knowles (NYSE:KN - Get Free Report) last posted its quarterly earnings results on Thursday, April 24th. The communications equipment provider reported $0.18 earnings per share for the quarter, meeting the consensus estimate of $0.18. The business had revenue of $132.20 million for the quarter, compared to the consensus estimate of $128.95 million. Knowles had a return on equity of 8.22% and a net margin of 4.40%. The company's quarterly revenue was down .8% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.18 EPS.

Analyst Upgrades and Downgrades

Several research analysts have recently commented on the company. Wall Street Zen raised Knowles from a "hold" rating to a "buy" rating in a research report on Monday, July 21st. Robert W. Baird boosted their target price on Knowles from $18.00 to $22.00 and gave the stock an "outperform" rating in a research note on Friday, April 25th. Finally, Craig Hallum boosted their target price on Knowles from $20.00 to $22.00 and gave the stock a "buy" rating in a research note on Friday.

Get Our Latest Report on Knowles

Knowles Profile

(

Free Report)

Knowles Corporation offers capacitors, radio frequency (RF) filtering products, balanced armature speakers, micro-acoustic microphones, and audio solutions in Asia, the United States, Europe, other Americas, and internationally. It operates through three segments: Precision Devices (PD); Medtech & Specialty Audio (MSA); and Consumer MEMS Microphones (CMM).

See Also

Before you consider Knowles, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Knowles wasn't on the list.

While Knowles currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.