Kranot Hishtalmut Le Morim Tichoniim Havera Menahelet LTD boosted its stake in Invesco QQQ (NASDAQ:QQQ - Free Report) by 8.7% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 83,318 shares of the exchange traded fund's stock after purchasing an additional 6,699 shares during the period. Invesco QQQ comprises 9.7% of Kranot Hishtalmut Le Morim Tichoniim Havera Menahelet LTD's investment portfolio, making the stock its largest position. Kranot Hishtalmut Le Morim Tichoniim Havera Menahelet LTD's holdings in Invesco QQQ were worth $39,108,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

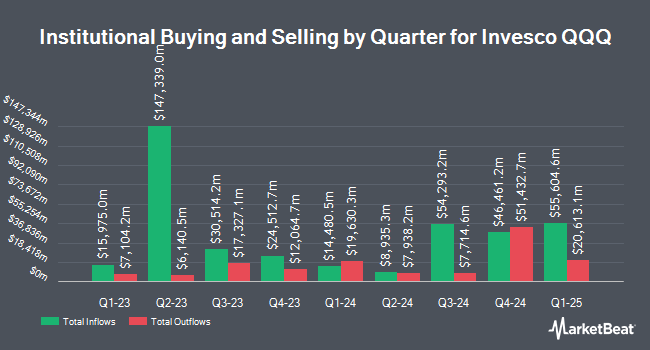

Other large investors have also bought and sold shares of the company. Wilkins Miller Wealth Management LLC purchased a new position in Invesco QQQ during the 4th quarter valued at about $1,018,000. Grant Private Wealth Management Inc bought a new stake in shares of Invesco QQQ in the fourth quarter worth approximately $815,000. Gemsstock Ltd. grew its stake in shares of Invesco QQQ by 266.4% in the fourth quarter. Gemsstock Ltd. now owns 293,500 shares of the exchange traded fund's stock worth $150,046,000 after acquiring an additional 213,400 shares during the period. Tandem Investment Partners LLC purchased a new position in shares of Invesco QQQ in the fourth quarter worth approximately $4,623,000. Finally, Wescott Financial Advisory Group LLC lifted its holdings in Invesco QQQ by 1.8% during the fourth quarter. Wescott Financial Advisory Group LLC now owns 146,844 shares of the exchange traded fund's stock valued at $75,071,000 after purchasing an additional 2,600 shares in the last quarter. 44.58% of the stock is owned by hedge funds and other institutional investors.

Invesco QQQ Price Performance

NASDAQ:QQQ traded down $0.40 during trading hours on Tuesday, hitting $567.74. 21,595,841 shares of the stock traded hands, compared to its average volume of 44,487,148. Invesco QQQ has a 1 year low of $402.39 and a 1 year high of $572.11. The stock has a 50 day moving average price of $540.06 and a 200 day moving average price of $509.18.

Invesco QQQ Cuts Dividend

The business also recently announced a quarterly dividend, which will be paid on Thursday, July 31st. Stockholders of record on Monday, June 23rd will be issued a $0.5911 dividend. This represents a $2.36 annualized dividend and a dividend yield of 0.42%. The ex-dividend date of this dividend is Monday, June 23rd.

Invesco QQQ Company Profile

(

Free Report)

PowerShares QQQ Trust, Series 1 is a unit investment trust that issues securities called Nasdaq-100 Index Tracking Stock. The Trust's investment objective is to provide investment results that generally correspond to the price and yield performance of the Nasdaq-100 Index. The Trust provides investors with the opportunity to purchase units of beneficial interest in the Trust representing proportionate undivided interests in the portfolio of securities held by the Trust, which consists of substantially all of the securities, in substantially the same weighting, as the component securities of the Nasdaq-100 Index.

Featured Stories

Before you consider Invesco QQQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invesco QQQ wasn't on the list.

While Invesco QQQ currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.