Kranot Hishtalmut Le Morim Ve Gananot Havera Menahelet LTD acquired a new position in shares of Vertiv Holdings Co. (NYSE:VRT - Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund acquired 102,245 shares of the company's stock, valued at approximately $7,378,000.

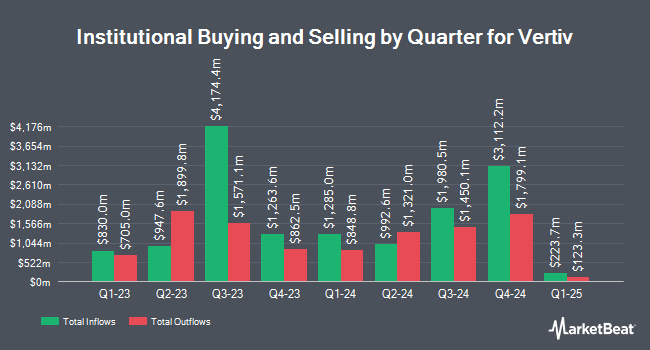

A number of other large investors have also made changes to their positions in VRT. GW&K Investment Management LLC acquired a new position in shares of Vertiv in the 1st quarter valued at about $26,000. North Star Investment Management Corp. raised its stake in shares of Vertiv by 4,120.0% during the 1st quarter. North Star Investment Management Corp. now owns 422 shares of the company's stock worth $30,000 after purchasing an additional 412 shares in the last quarter. Sachetta LLC lifted its holdings in shares of Vertiv by 242.0% during the 1st quarter. Sachetta LLC now owns 448 shares of the company's stock valued at $32,000 after buying an additional 317 shares during the last quarter. Colonial Trust Co SC boosted its holdings in Vertiv by 211.9% in the fourth quarter. Colonial Trust Co SC now owns 315 shares of the company's stock worth $36,000 after purchasing an additional 214 shares in the last quarter. Finally, Ameriflex Group Inc. acquired a new stake in Vertiv in the 4th quarter worth approximately $37,000. Institutional investors and hedge funds own 89.92% of the company's stock.

Vertiv Trading Up 5.1%

VRT opened at $137.52 on Friday. The company has a fifty day moving average of $118.59 and a 200-day moving average of $104.33. Vertiv Holdings Co. has a twelve month low of $53.60 and a twelve month high of $155.84. The company has a quick ratio of 1.28, a current ratio of 1.72 and a debt-to-equity ratio of 1.09. The stock has a market cap of $52.41 billion, a PE ratio of 79.96, a price-to-earnings-growth ratio of 1.30 and a beta of 1.75.

Vertiv (NYSE:VRT - Get Free Report) last announced its quarterly earnings results on Wednesday, April 23rd. The company reported $0.64 EPS for the quarter, beating analysts' consensus estimates of $0.62 by $0.02. Vertiv had a net margin of 7.92% and a return on equity of 56.01%. The business had revenue of $2.04 billion during the quarter, compared to analyst estimates of $1.94 billion. During the same quarter in the previous year, the business posted $0.43 EPS. Vertiv's quarterly revenue was up 24.2% on a year-over-year basis. On average, sell-side analysts predict that Vertiv Holdings Co. will post 3.59 EPS for the current year.

Vertiv Increases Dividend

The company also recently announced a dividend, which was paid on Thursday, June 26th. Shareholders of record on Tuesday, June 17th were given a dividend of $0.0375 per share. The ex-dividend date was Monday, June 16th. This represents a dividend yield of 0.14%. This is a boost from Vertiv's previous dividend of $0.01. Vertiv's dividend payout ratio (DPR) is currently 8.72%.

Insider Activity at Vertiv

In other news, EVP Stephen Liang sold 43,683 shares of Vertiv stock in a transaction on Friday, June 6th. The stock was sold at an average price of $115.83, for a total value of $5,059,801.89. Following the completion of the transaction, the executive vice president directly owned 9,551 shares in the company, valued at approximately $1,106,292.33. The trade was a 82.06% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Karsten Winther sold 5,500 shares of the firm's stock in a transaction on Friday, May 9th. The shares were sold at an average price of $94.33, for a total transaction of $518,815.00. Following the completion of the transaction, the insider directly owned 18,847 shares of the company's stock, valued at approximately $1,777,837.51. The trade was a 22.59% decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.63% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

Several research analysts have recently issued reports on VRT shares. Melius upgraded shares of Vertiv from a "hold" rating to a "buy" rating and set a $165.00 price objective on the stock in a report on Tuesday, July 8th. Melius Research raised shares of Vertiv from a "hold" rating to a "strong-buy" rating and upped their target price for the company from $134.00 to $165.00 in a research note on Tuesday, July 8th. Evercore ISI restated an "outperform" rating on shares of Vertiv in a report on Thursday, July 10th. KGI Securities assumed coverage on shares of Vertiv in a report on Thursday, April 24th. They set a "hold" rating for the company. Finally, Roth Capital upgraded Vertiv to a "strong-buy" rating in a research report on Monday, April 7th. Three research analysts have rated the stock with a hold rating, fifteen have issued a buy rating and three have given a strong buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Buy" and a consensus target price of $136.76.

View Our Latest Analysis on VRT

Vertiv Profile

(

Free Report)

Vertiv Holdings Co, together with its subsidiaries, designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vertiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertiv wasn't on the list.

While Vertiv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.