L & S Advisors Inc decreased its holdings in Dover Corporation (NYSE:DOV - Free Report) by 33.2% during the 1st quarter, according to its most recent disclosure with the SEC. The firm owned 23,353 shares of the industrial products company's stock after selling 11,609 shares during the period. L & S Advisors Inc's holdings in Dover were worth $4,103,000 at the end of the most recent reporting period.

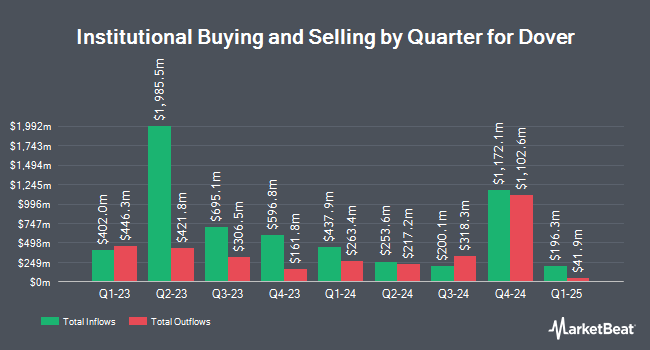

Several other institutional investors also recently bought and sold shares of DOV. North Capital Inc. acquired a new position in shares of Dover during the first quarter worth about $29,000. N.E.W. Advisory Services LLC purchased a new stake in shares of Dover during the first quarter valued at approximately $31,000. Orion Capital Management LLC purchased a new position in shares of Dover in the fourth quarter valued at $43,000. Ameriflex Group Inc. purchased a new stake in Dover during the 4th quarter worth $69,000. Finally, Quarry LP grew its stake in shares of Dover by 257.0% during the fourth quarter. Quarry LP now owns 407 shares of the industrial products company's stock valued at $76,000 after acquiring an additional 293 shares in the last quarter. 84.46% of the stock is currently owned by hedge funds and other institutional investors.

Dover Price Performance

Shares of DOV stock traded down $0.09 during trading hours on Thursday, reaching $174.21. 215,651 shares of the company were exchanged, compared to its average volume of 1,070,281. The stock's fifty day moving average is $182.42 and its two-hundred day moving average is $182.65. Dover Corporation has a fifty-two week low of $143.04 and a fifty-two week high of $222.31. The company has a market cap of $23.89 billion, a price-to-earnings ratio of 10.51, a P/E/G ratio of 1.41 and a beta of 1.26. The company has a debt-to-equity ratio of 0.36, a current ratio of 1.95 and a quick ratio of 1.35.

Dover (NYSE:DOV - Get Free Report) last released its quarterly earnings data on Thursday, July 24th. The industrial products company reported $2.44 EPS for the quarter, topping analysts' consensus estimates of $2.39 by $0.05. Dover had a net margin of 29.29% and a return on equity of 18.19%. The firm had revenue of $2.05 billion during the quarter, compared to analysts' expectations of $2.03 billion. During the same period in the previous year, the business posted $2.36 earnings per share. The company's revenue for the quarter was up 5.2% compared to the same quarter last year. Sell-side analysts forecast that Dover Corporation will post 9.45 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on DOV. Robert W. Baird raised their price objective on Dover from $219.00 to $234.00 and gave the company an "outperform" rating in a research note on Friday, July 25th. JPMorgan Chase & Co. boosted their target price on shares of Dover from $211.00 to $217.00 and gave the stock an "overweight" rating in a research report on Monday, July 28th. Wells Fargo & Company upped their price objective on Dover from $190.00 to $195.00 and gave the company an "equal weight" rating in a research note on Friday, July 25th. Mizuho increased their price objective on shares of Dover from $215.00 to $225.00 and gave the stock an "outperform" rating in a research note on Friday, June 13th. Finally, Royal Bank Of Canada raised their price target on shares of Dover from $203.00 to $206.00 and gave the company a "sector perform" rating in a research note on Friday, July 25th. Six research analysts have rated the stock with a hold rating and seven have issued a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $213.92.

Check Out Our Latest Analysis on DOV

About Dover

(

Free Report)

Dover Corporation provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions, and support services worldwide. The company's Engineered Products segment provides various equipment, component, software, solution, and services that are used in vehicle aftermarket, waste handling, industrial automation, aerospace and defense, industrial winch and hoist, and fluid dispensing end-market.

Recommended Stories

Before you consider Dover, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dover wasn't on the list.

While Dover currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.