Lansforsakringar Fondforvaltning AB publ decreased its position in Aflac Incorporated (NYSE:AFL - Free Report) by 2.3% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 173,971 shares of the financial services provider's stock after selling 4,085 shares during the period. Lansforsakringar Fondforvaltning AB publ's holdings in Aflac were worth $19,344,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

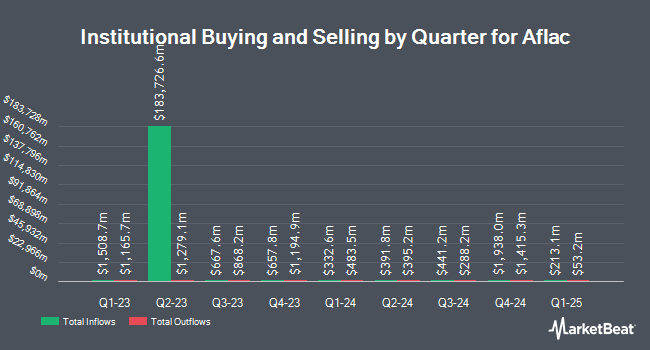

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. NorthRock Partners LLC raised its stake in shares of Aflac by 1.5% during the 1st quarter. NorthRock Partners LLC now owns 6,519 shares of the financial services provider's stock valued at $725,000 after buying an additional 95 shares during the last quarter. Valued Wealth Advisors LLC raised its stake in shares of Aflac by 24.4% during the 1st quarter. Valued Wealth Advisors LLC now owns 495 shares of the financial services provider's stock valued at $55,000 after buying an additional 97 shares during the last quarter. Phillips Wealth Planners LLC raised its stake in shares of Aflac by 1.5% during the 1st quarter. Phillips Wealth Planners LLC now owns 6,653 shares of the financial services provider's stock valued at $711,000 after buying an additional 100 shares during the last quarter. Optas LLC raised its stake in shares of Aflac by 3.5% during the 1st quarter. Optas LLC now owns 2,949 shares of the financial services provider's stock valued at $328,000 after buying an additional 101 shares during the last quarter. Finally, Apexium Financial LP raised its stake in shares of Aflac by 3.4% during the 1st quarter. Apexium Financial LP now owns 3,103 shares of the financial services provider's stock valued at $345,000 after buying an additional 103 shares during the last quarter. Hedge funds and other institutional investors own 67.44% of the company's stock.

Aflac Price Performance

Shares of NYSE:AFL traded down $1.27 during trading on Tuesday, reaching $105.59. 1,825,991 shares of the company's stock traded hands, compared to its average volume of 2,202,177. The company has a quick ratio of 0.11, a current ratio of 0.11 and a debt-to-equity ratio of 0.33. Aflac Incorporated has a fifty-two week low of $96.95 and a fifty-two week high of $115.50. The firm has a market cap of $56.47 billion, a PE ratio of 23.94, a P/E/G ratio of 3.00 and a beta of 0.85. The company has a 50-day simple moving average of $103.58 and a 200-day simple moving average of $105.01.

Aflac (NYSE:AFL - Get Free Report) last posted its quarterly earnings data on Tuesday, August 5th. The financial services provider reported $1.78 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.71 by $0.07. Aflac had a return on equity of 15.08% and a net margin of 15.32%.The company had revenue of $4.16 billion for the quarter, compared to analysts' expectations of $4.30 billion. During the same period in the previous year, the firm posted $1.83 EPS. Aflac's revenue was down 19.0% compared to the same quarter last year. As a group, analysts predict that Aflac Incorporated will post 6.88 earnings per share for the current year.

Aflac announced that its board has initiated a stock buyback program on Tuesday, August 12th that permits the company to repurchase 100,000,000 outstanding shares. This repurchase authorization permits the financial services provider to repurchase shares of its stock through open market purchases. Stock repurchase programs are often an indication that the company's management believes its stock is undervalued.

Aflac Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 2nd. Investors of record on Wednesday, August 20th will be issued a $0.58 dividend. This represents a $2.32 annualized dividend and a yield of 2.2%. The ex-dividend date is Wednesday, August 20th. Aflac's payout ratio is presently 52.61%.

Insider Transactions at Aflac

In related news, Director Joseph L. Moskowitz sold 1,000 shares of Aflac stock in a transaction dated Friday, August 8th. The stock was sold at an average price of $102.57, for a total value of $102,570.00. Following the sale, the director directly owned 25,105 shares in the company, valued at approximately $2,575,019.85. The trade was a 3.83% decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Insiders own 0.80% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts have weighed in on the company. Morgan Stanley lifted their price objective on Aflac from $108.00 to $113.00 and gave the company an "equal weight" rating in a research note on Monday, August 18th. JPMorgan Chase & Co. lifted their price objective on Aflac from $96.00 to $100.00 and gave the company a "neutral" rating in a research note on Tuesday, July 8th. Raymond James Financial reduced their price objective on Aflac from $115.00 to $110.00 and set an "outperform" rating for the company in a research note on Thursday, May 29th. Evercore ISI restated an "underperform" rating and set a $106.00 target price (up from $105.00) on shares of Aflac in a research report on Thursday, August 14th. Finally, Wells Fargo & Company raised their target price on Aflac from $105.00 to $107.00 and gave the company an "equal weight" rating in a research report on Monday, August 11th. Three research analysts have rated the stock with a Buy rating, eight have assigned a Hold rating and two have given a Sell rating to the stock. According to MarketBeat, the stock currently has an average rating of "Hold" and an average price target of $109.15.

View Our Latest Stock Report on AFL

Aflac Profile

(

Free Report)

Aflac Incorporated, through its subsidiaries, provides supplemental health and life insurance products. The company operates through Aflac Japan and Aflac U.S. segments. The Aflac Japan segment offers cancer, medical, nursing care, work leave, GIFT, and whole and term life insurance products, as well as WAYS and child endowment plans under saving type insurance products in Japan.

Recommended Stories

Before you consider Aflac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aflac wasn't on the list.

While Aflac currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.