Lbp Am Sa acquired a new stake in Target Corporation (NYSE:TGT - Free Report) in the 2nd quarter, according to the company in its most recent filing with the SEC. The fund acquired 55,008 shares of the retailer's stock, valued at approximately $5,427,000.

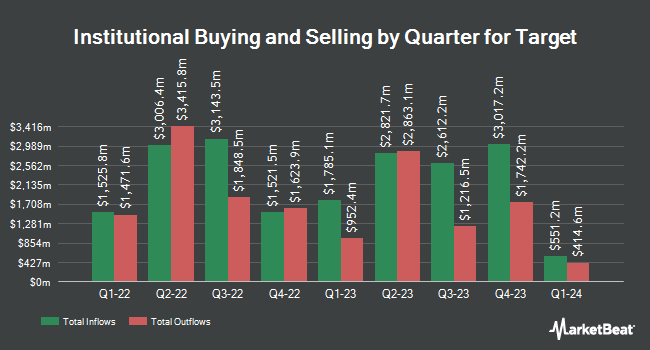

Several other institutional investors have also recently bought and sold shares of TGT. Victrix Investment Advisors raised its position in shares of Target by 33.0% during the second quarter. Victrix Investment Advisors now owns 17,961 shares of the retailer's stock worth $1,772,000 after acquiring an additional 4,459 shares during the last quarter. Columbia Asset Management raised its position in shares of Target by 9.6% during the second quarter. Columbia Asset Management now owns 40,202 shares of the retailer's stock worth $3,966,000 after acquiring an additional 3,535 shares during the last quarter. Cooper Financial Group bought a new stake in shares of Target during the second quarter worth $263,000. Park Place Capital Corp raised its position in shares of Target by 179.8% during the second quarter. Park Place Capital Corp now owns 8,852 shares of the retailer's stock worth $919,000 after acquiring an additional 5,688 shares during the last quarter. Finally, XML Financial LLC raised its position in shares of Target by 14.4% during the second quarter. XML Financial LLC now owns 2,388 shares of the retailer's stock worth $236,000 after acquiring an additional 300 shares during the last quarter. Institutional investors own 79.73% of the company's stock.

Target Stock Down 0.6%

NYSE:TGT opened at $89.20 on Thursday. Target Corporation has a 1 year low of $86.30 and a 1 year high of $161.50. The company has a current ratio of 0.99, a quick ratio of 0.32 and a debt-to-equity ratio of 0.99. The stock has a market cap of $40.53 billion, a price-to-earnings ratio of 10.40, a PEG ratio of 2.59 and a beta of 1.18. The stock has a 50-day moving average price of $96.56 and a two-hundred day moving average price of $97.74.

Target (NYSE:TGT - Get Free Report) last posted its earnings results on Wednesday, August 20th. The retailer reported $2.05 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $2.04 by $0.01. Target had a return on equity of 23.43% and a net margin of 3.72%.The firm had revenue of $24.99 billion during the quarter, compared to analysts' expectations of $24.84 billion. During the same period in the previous year, the firm earned $2.57 earnings per share. The company's revenue was down .9% on a year-over-year basis. Target has set its FY 2025 guidance at 7.000-9.000 EPS. As a group, equities analysts expect that Target Corporation will post 8.69 earnings per share for the current year.

Target Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, December 1st. Shareholders of record on Wednesday, November 12th will be paid a $1.14 dividend. The ex-dividend date of this dividend is Wednesday, November 12th. This is a positive change from Target's previous quarterly dividend of $1.12. This represents a $4.56 dividend on an annualized basis and a yield of 5.1%. Target's payout ratio is presently 53.15%.

Analysts Set New Price Targets

TGT has been the subject of a number of recent research reports. Citigroup boosted their target price on Target from $94.00 to $100.00 and gave the stock a "neutral" rating in a research report on Friday, August 22nd. Evercore ISI dropped their target price on Target from $106.00 to $105.00 and set an "in-line" rating for the company in a research report on Tuesday, September 23rd. Telsey Advisory Group restated a "market perform" rating and set a $110.00 target price on shares of Target in a research report on Wednesday, August 20th. Barclays reiterated an "underweight" rating and issued a $91.00 price objective on shares of Target in a report on Monday, July 21st. Finally, Royal Bank Of Canada upped their price objective on Target from $104.00 to $107.00 and gave the company an "outperform" rating in a report on Thursday, August 21st. Nine investment analysts have rated the stock with a Buy rating, twenty-three have issued a Hold rating and four have issued a Sell rating to the stock. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $110.48.

Get Our Latest Report on Target

Target Company Profile

(

Free Report)

Target Corporation operates as a general merchandise retailer in the United States. The company offers apparel for women, men, boys, girls, toddlers, and infants and newborns, as well as jewelry, accessories, and shoes; and beauty and personal care, baby gear, cleaning, paper products, and pet supplies.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Target, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Target wasn't on the list.

While Target currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.