Legato Capital Management LLC purchased a new stake in IBEX Limited (NASDAQ:IBEX - Free Report) in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 16,749 shares of the company's stock, valued at approximately $408,000. Legato Capital Management LLC owned about 0.13% of IBEX as of its most recent filing with the Securities and Exchange Commission (SEC).

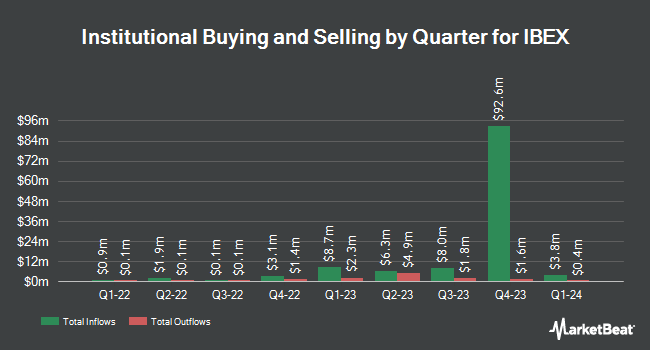

Other hedge funds and other institutional investors have also made changes to their positions in the company. Commonwealth Equity Services LLC purchased a new stake in shares of IBEX in the 4th quarter valued at $563,000. Quantbot Technologies LP increased its holdings in IBEX by 711.1% during the 4th quarter. Quantbot Technologies LP now owns 2,636 shares of the company's stock worth $57,000 after purchasing an additional 2,311 shares during the period. Prudential Financial Inc. purchased a new stake in IBEX during the 4th quarter worth about $280,000. Segall Bryant & Hamill LLC purchased a new stake in IBEX during the 4th quarter worth about $1,169,000. Finally, JPMorgan Chase & Co. increased its stake in shares of IBEX by 1,369.6% during the fourth quarter. JPMorgan Chase & Co. now owns 284,292 shares of the company's stock worth $6,109,000 after buying an additional 264,947 shares during the period. Institutional investors and hedge funds own 81.24% of the company's stock.

Insider Transactions at IBEX

In other IBEX news, CEO Robert Thomas Dechant sold 15,000 shares of the firm's stock in a transaction on Friday, June 13th. The shares were sold at an average price of $28.96, for a total transaction of $434,400.00. Following the transaction, the chief executive officer directly owned 198,633 shares of the company's stock, valued at approximately $5,752,411.68. This trade represents a 7.02% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Also, insider Paul Joseph Inson sold 3,690 shares of the firm's stock in a transaction on Tuesday, May 27th. The stock was sold at an average price of $28.59, for a total transaction of $105,497.10. Following the transaction, the insider directly owned 17,352 shares in the company, valued at $496,093.68. The trade was a 17.54% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 63,910 shares of company stock worth $1,874,647. Insiders own 6.72% of the company's stock.

Wall Street Analysts Forecast Growth

IBEX has been the topic of several recent analyst reports. Baird R W lowered IBEX from a "strong-buy" rating to a "hold" rating in a report on Monday, May 12th. Robert W. Baird downgraded IBEX from an "outperform" rating to a "neutral" rating and set a $30.00 price objective on the stock. in a report on Monday, May 12th.

Get Our Latest Stock Analysis on IBEX

IBEX Stock Performance

NASDAQ:IBEX traded down $0.09 during mid-day trading on Tuesday, reaching $29.93. 15,131 shares of the stock were exchanged, compared to its average volume of 173,013. The company has a 50 day simple moving average of $29.29 and a 200-day simple moving average of $26.19. The stock has a market capitalization of $400.24 million, a P/E ratio of 13.14 and a beta of 0.77. The company has a quick ratio of 1.67, a current ratio of 1.67 and a debt-to-equity ratio of 0.01. IBEX Limited has a 1 year low of $15.17 and a 1 year high of $32.08.

IBEX Company Profile

(

Free Report)

IBEX Limited provides end-to-end technology-enabled customer lifecycle experience solutions in the United States and internationally. The company products and services portfolio includes ibex Connect, that offers customer service, technical support, revenue generation, and other revenue generation outsourced back-office services through the CX model, which integrates voice, email, chat, SMS, social media, and other communication applications; ibex Digital, a customer acquisition solution that comprises digital marketing, e-commerce technology, and platform solutions; and ibex CX, a customer experience solution, which provides a suite of proprietary software tools to measure, monitor, and manage its clients' customer experience.

See Also

Before you consider IBEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IBEX wasn't on the list.

While IBEX currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.