Leo Wealth LLC bought a new stake in CrowdStrike (NASDAQ:CRWD - Free Report) in the second quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund bought 1,504 shares of the company's stock, valued at approximately $766,000.

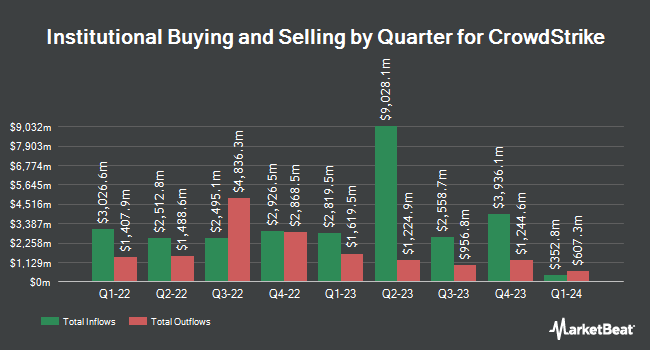

A number of other institutional investors have also recently added to or reduced their stakes in CRWD. Brighton Jones LLC lifted its stake in CrowdStrike by 44.9% in the fourth quarter. Brighton Jones LLC now owns 7,803 shares of the company's stock valued at $2,670,000 after acquiring an additional 2,417 shares during the last quarter. Pallas Capital Advisors LLC grew its holdings in CrowdStrike by 17.8% during the first quarter. Pallas Capital Advisors LLC now owns 1,859 shares of the company's stock valued at $655,000 after purchasing an additional 281 shares during the last quarter. Harbor Capital Advisors Inc. grew its holdings in CrowdStrike by 43.5% during the first quarter. Harbor Capital Advisors Inc. now owns 4,396 shares of the company's stock valued at $1,550,000 after purchasing an additional 1,332 shares during the last quarter. GAMMA Investing LLC grew its holdings in CrowdStrike by 43.6% during the first quarter. GAMMA Investing LLC now owns 3,082 shares of the company's stock valued at $1,087,000 after purchasing an additional 936 shares during the last quarter. Finally, Simplicity Wealth LLC grew its holdings in CrowdStrike by 96.9% during the first quarter. Simplicity Wealth LLC now owns 1,353 shares of the company's stock valued at $477,000 after purchasing an additional 666 shares during the last quarter. 71.16% of the stock is currently owned by institutional investors and hedge funds.

Insiders Place Their Bets

In related news, President Michael Sentonas sold 20,000 shares of the firm's stock in a transaction that occurred on Wednesday, October 1st. The shares were sold at an average price of $500.00, for a total value of $10,000,000.00. Following the completion of the sale, the president owned 379,116 shares of the company's stock, valued at $189,558,000. This trade represents a 5.01% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. Also, CEO George Kurtz sold 42,267 shares of the company's stock in a transaction on Tuesday, August 5th. The stock was sold at an average price of $450.47, for a total value of $19,040,015.49. Following the transaction, the chief executive officer directly owned 2,132,887 shares in the company, valued at approximately $960,801,606.89. This represents a 1.94% decrease in their position. The disclosure for this sale can be found here. Insiders sold 132,816 shares of company stock worth $62,606,356 over the last ninety days. 3.32% of the stock is owned by insiders.

CrowdStrike Trading Down 0.2%

Shares of CRWD opened at $509.13 on Friday. The stock has a market cap of $127.77 billion, a PE ratio of -427.84, a PEG ratio of 119.83 and a beta of 1.19. The company has a current ratio of 1.88, a quick ratio of 1.88 and a debt-to-equity ratio of 0.20. CrowdStrike has a 1 year low of $294.68 and a 1 year high of $517.98. The stock has a 50 day simple moving average of $449.10 and a 200-day simple moving average of $443.15.

CrowdStrike (NASDAQ:CRWD - Get Free Report) last announced its earnings results on Wednesday, August 27th. The company reported $0.93 EPS for the quarter, topping the consensus estimate of $0.83 by $0.10. The business had revenue of $1.17 billion for the quarter, compared to the consensus estimate of $1.15 billion. CrowdStrike had a negative return on equity of 1.53% and a negative net margin of 6.84%.CrowdStrike's revenue was up 21.4% compared to the same quarter last year. During the same period in the previous year, the business earned $1.04 EPS. CrowdStrike has set its FY 2026 guidance at 3.600-3.72 EPS. Q3 2026 guidance at 0.930-0.95 EPS. On average, sell-side analysts predict that CrowdStrike will post 0.55 EPS for the current fiscal year.

Analyst Ratings Changes

Several equities analysts have commented on CRWD shares. Canaccord Genuity Group increased their price target on CrowdStrike from $430.00 to $500.00 and gave the company a "hold" rating in a report on Monday, September 22nd. Citigroup reiterated an "outperform" rating on shares of CrowdStrike in a report on Tuesday, September 23rd. Zacks Research upgraded CrowdStrike from a "hold" rating to a "strong-buy" rating in a report on Friday, August 29th. BTIG Research reissued a "buy" rating and set a $489.00 price objective on shares of CrowdStrike in a report on Thursday, September 18th. Finally, Deutsche Bank Aktiengesellschaft lifted their price objective on CrowdStrike from $430.00 to $435.00 and gave the stock a "hold" rating in a report on Thursday, September 18th. One analyst has rated the stock with a Strong Buy rating, twenty-eight have issued a Buy rating, seventeen have issued a Hold rating and two have issued a Sell rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $493.33.

Check Out Our Latest Stock Analysis on CRWD

CrowdStrike Company Profile

(

Free Report)

CrowdStrike Holdings, Inc provides cybersecurity solutions in the United States and internationally. Its unified platform offers cloud-delivered protection of endpoints, cloud workloads, identity, and data. The company offers corporate endpoint and cloud workload security, managed security, security and vulnerability management, IT operations management, identity protection, SIEM and log management, threat intelligence, data protection, security orchestration, automation and response and AI powered workflow automation, and securing generative AI workload services.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CrowdStrike, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CrowdStrike wasn't on the list.

While CrowdStrike currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.