Letko Brosseau & Associates Inc. cut its holdings in shares of Biogen Inc. (NASDAQ:BIIB - Free Report) by 3.3% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 115,610 shares of the biotechnology company's stock after selling 3,972 shares during the quarter. Letko Brosseau & Associates Inc. owned approximately 0.08% of Biogen worth $15,820,000 at the end of the most recent reporting period.

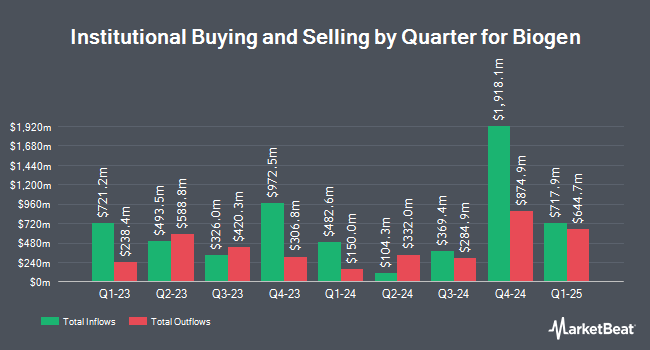

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in the business. Integrated Quantitative Investments LLC acquired a new position in shares of Biogen during the 4th quarter worth about $407,000. Sumitomo Mitsui Trust Group Inc. increased its stake in shares of Biogen by 6.5% during the 1st quarter. Sumitomo Mitsui Trust Group Inc. now owns 416,960 shares of the biotechnology company's stock worth $57,057,000 after purchasing an additional 25,464 shares during the last quarter. Asset Management One Co. Ltd. increased its stake in shares of Biogen by 5.5% during the 1st quarter. Asset Management One Co. Ltd. now owns 61,420 shares of the biotechnology company's stock worth $8,405,000 after purchasing an additional 3,194 shares during the last quarter. APG Asset Management N.V. increased its stake in shares of Biogen by 346.1% during the 4th quarter. APG Asset Management N.V. now owns 105,446 shares of the biotechnology company's stock worth $15,572,000 after purchasing an additional 81,811 shares during the last quarter. Finally, Assenagon Asset Management S.A. grew its stake in Biogen by 3.1% in the 1st quarter. Assenagon Asset Management S.A. now owns 44,796 shares of the biotechnology company's stock valued at $6,130,000 after buying an additional 1,336 shares during the last quarter. 87.93% of the stock is owned by institutional investors.

Wall Street Analysts Forecast Growth

BIIB has been the topic of a number of research reports. Truist Financial initiated coverage on shares of Biogen in a research note on Monday, July 21st. They issued a "hold" rating and a $142.00 price target on the stock. Morgan Stanley decreased their price target on shares of Biogen from $157.00 to $152.00 and set an "equal weight" rating on the stock in a research note on Wednesday, April 9th. Robert W. Baird decreased their price target on shares of Biogen from $300.00 to $255.00 and set an "outperform" rating on the stock in a research note on Friday, May 2nd. Mizuho decreased their price target on shares of Biogen from $207.00 to $169.00 and set an "outperform" rating on the stock in a research note on Wednesday, May 7th. Finally, Canaccord Genuity Group decreased their price target on shares of Biogen from $265.00 to $220.00 and set a "buy" rating on the stock in a research note on Friday, May 2nd. Twenty-one research analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average target price of $186.37.

Check Out Our Latest Report on Biogen

Biogen Price Performance

NASDAQ:BIIB traded up $1.36 on Thursday, hitting $128.00. The company had a trading volume of 3,239,539 shares, compared to its average volume of 1,140,306. The stock has a market capitalization of $18.76 billion, a price-to-earnings ratio of 12.64, a PEG ratio of 1.83 and a beta of 0.14. The company has a current ratio of 1.44, a quick ratio of 1.01 and a debt-to-equity ratio of 0.27. The firm has a 50 day moving average of $129.72 and a two-hundred day moving average of $131.90. Biogen Inc. has a 52 week low of $110.04 and a 52 week high of $219.44.

Biogen (NASDAQ:BIIB - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The biotechnology company reported $5.47 EPS for the quarter, beating the consensus estimate of $3.93 by $1.54. The business had revenue of $2.65 billion during the quarter, compared to the consensus estimate of $2.32 billion. Biogen had a net margin of 15.07% and a return on equity of 14.03%. The firm's revenue was up 7.3% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $5.28 EPS. On average, research analysts anticipate that Biogen Inc. will post 15.83 earnings per share for the current year.

Insider Buying and Selling

In other news, insider Rachid Izzar sold 2,223 shares of the firm's stock in a transaction on Tuesday, July 8th. The shares were sold at an average price of $135.00, for a total transaction of $300,105.00. Following the completion of the transaction, the insider owned 6,330 shares of the company's stock, valued at approximately $854,550. This trade represents a 25.99% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 0.18% of the stock is currently owned by insiders.

Biogen Profile

(

Free Report)

Biogen Inc discovers, develops, manufactures, and delivers therapies for treating neurological and neurodegenerative diseases in the United States, Europe, Germany, Asia, and internationally. The company provides TECFIDERA, VUMERITY, AVONEX, PLEGRIDY, TYSABRI, and FAMPYRA for multiple sclerosis (MS); SPINRAZA for spinal muscular atrophy; ADUHELM to treat Alzheimer's disease; FUMADERM to treat plaque psoriasis; BENEPALI, an etanercept biosimilar referencing ENBREL; IMRALDI, an adalimumab biosimilar referencing HUMIRA; FLIXABI, an infliximab biosimilar referencing REMICADE; and BYOOVIZ, a ranibizumab biosimilar referencing LUCENTIS.

Further Reading

Before you consider Biogen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Biogen wasn't on the list.

While Biogen currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.