Linden Thomas Advisory Services LLC lifted its position in shares of Costco Wholesale Corporation (NASDAQ:COST - Free Report) by 30.1% in the 2nd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 3,983 shares of the retailer's stock after acquiring an additional 921 shares during the period. Linden Thomas Advisory Services LLC's holdings in Costco Wholesale were worth $3,943,000 as of its most recent filing with the Securities & Exchange Commission.

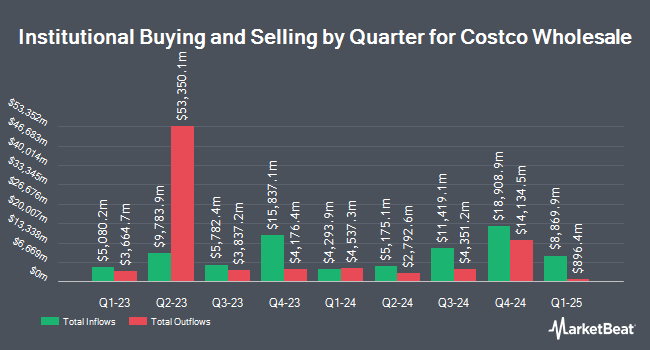

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Leavell Investment Management Inc. increased its position in shares of Costco Wholesale by 30.7% during the second quarter. Leavell Investment Management Inc. now owns 2,996 shares of the retailer's stock valued at $2,966,000 after acquiring an additional 703 shares in the last quarter. Burke & Herbert Bank & Trust Co. increased its position in shares of Costco Wholesale by 2.2% during the second quarter. Burke & Herbert Bank & Trust Co. now owns 2,042 shares of the retailer's stock valued at $2,021,000 after acquiring an additional 43 shares in the last quarter. Guardian Financial Partners LLC boosted its holdings in Costco Wholesale by 3.0% in the second quarter. Guardian Financial Partners LLC now owns 1,717 shares of the retailer's stock worth $1,699,000 after purchasing an additional 50 shares during the last quarter. Rational Advisors Inc. boosted its holdings in Costco Wholesale by 2.6% in the second quarter. Rational Advisors Inc. now owns 4,223 shares of the retailer's stock worth $4,181,000 after purchasing an additional 106 shares during the last quarter. Finally, AG2R LA Mondiale Gestion D Actifs boosted its holdings in Costco Wholesale by 0.8% in the second quarter. AG2R LA Mondiale Gestion D Actifs now owns 16,496 shares of the retailer's stock worth $16,330,000 after purchasing an additional 128 shares during the last quarter. Institutional investors own 68.48% of the company's stock.

Costco Wholesale Stock Down 1.1%

COST opened at $932.14 on Friday. The company has a debt-to-equity ratio of 0.20, a quick ratio of 0.55 and a current ratio of 1.03. Costco Wholesale Corporation has a fifty-two week low of $867.34 and a fifty-two week high of $1,078.23. The firm's fifty day moving average is $945.23 and its 200 day moving average is $972.11. The stock has a market cap of $413.11 billion, a price-to-earnings ratio of 51.19, a price-to-earnings-growth ratio of 5.66 and a beta of 0.98.

Costco Wholesale (NASDAQ:COST - Get Free Report) last released its earnings results on Thursday, September 25th. The retailer reported $5.87 earnings per share for the quarter, beating analysts' consensus estimates of $5.81 by $0.06. Costco Wholesale had a net margin of 2.94% and a return on equity of 30.09%. The company had revenue of $86.16 billion for the quarter, compared to analysts' expectations of $86.01 billion. During the same quarter in the previous year, the company earned $5.15 EPS. Costco Wholesale's revenue for the quarter was up 8.1% on a year-over-year basis. On average, sell-side analysts forecast that Costco Wholesale Corporation will post 18.03 earnings per share for the current fiscal year.

Costco Wholesale Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, November 14th. Investors of record on Friday, October 31st will be paid a dividend of $1.30 per share. The ex-dividend date is Friday, October 31st. This represents a $5.20 dividend on an annualized basis and a dividend yield of 0.6%. Costco Wholesale's payout ratio is 28.56%.

Wall Street Analyst Weigh In

Several equities research analysts recently issued reports on the stock. Wolfe Research assumed coverage on shares of Costco Wholesale in a report on Thursday, September 18th. They issued a "peer perform" rating on the stock. JPMorgan Chase & Co. dropped their target price on shares of Costco Wholesale from $1,160.00 to $1,050.00 and set an "overweight" rating on the stock in a report on Friday, September 26th. Truist Financial dropped their target price on shares of Costco Wholesale from $1,042.00 to $1,033.00 and set a "hold" rating on the stock in a report on Friday, September 26th. BTIG Research initiated coverage on shares of Costco Wholesale in a research note on Tuesday, October 14th. They set a "buy" rating and a $1,115.00 price target on the stock. Finally, Evercore ISI dropped their price target on shares of Costco Wholesale from $1,060.00 to $1,025.00 and set an "outperform" rating on the stock in a research note on Friday, September 26th. Nineteen investment analysts have rated the stock with a Buy rating and eleven have issued a Hold rating to the company's stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $1,068.15.

Get Our Latest Analysis on COST

Insider Activity

In related news, EVP Claudine Adamo sold 2,700 shares of Costco Wholesale stock in a transaction on Friday, October 24th. The shares were sold at an average price of $935.68, for a total transaction of $2,526,336.00. Following the transaction, the executive vice president owned 6,851 shares in the company, valued at approximately $6,410,343.68. The trade was a 28.27% decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, EVP Teresa A. Jones sold 600 shares of Costco Wholesale stock in a transaction on Wednesday, August 20th. The shares were sold at an average price of $992.05, for a total transaction of $595,230.00. Following the transaction, the executive vice president owned 2,362 shares in the company, valued at approximately $2,343,222.10. This trade represents a 20.26% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 7,920 shares of company stock worth $7,373,175 in the last quarter. Corporate insiders own 0.18% of the company's stock.

About Costco Wholesale

(

Free Report)

Costco Wholesale Corporation, together with its subsidiaries, engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden. The company offers branded and private-label products in a range of merchandise categories.

Read More

Want to see what other hedge funds are holding COST? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Costco Wholesale Corporation (NASDAQ:COST - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Costco Wholesale, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Costco Wholesale wasn't on the list.

While Costco Wholesale currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report