LPL Financial LLC increased its holdings in shares of Fabrinet (NYSE:FN - Free Report) by 19.0% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 17,293 shares of the technology company's stock after purchasing an additional 2,762 shares during the quarter. LPL Financial LLC's holdings in Fabrinet were worth $3,415,000 as of its most recent SEC filing.

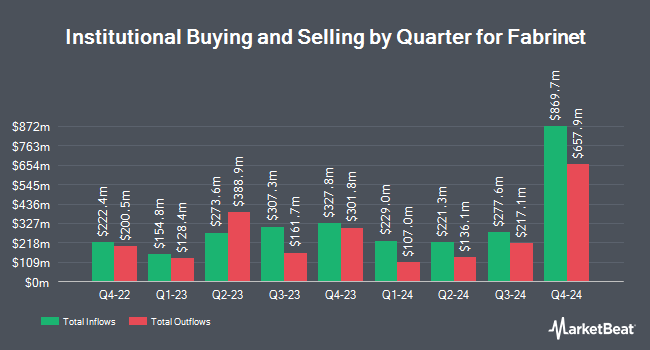

Other large investors have also added to or reduced their stakes in the company. Wayfinding Financial LLC acquired a new position in Fabrinet during the first quarter worth $30,000. Berbice Capital Management LLC acquired a new position in Fabrinet during the first quarter worth $30,000. Private Trust Co. NA boosted its holdings in Fabrinet by 44.3% during the first quarter. Private Trust Co. NA now owns 166 shares of the technology company's stock worth $33,000 after purchasing an additional 51 shares during the last quarter. SBI Securities Co. Ltd. lifted its stake in Fabrinet by 93.5% in the first quarter. SBI Securities Co. Ltd. now owns 180 shares of the technology company's stock valued at $36,000 after acquiring an additional 87 shares during the last quarter. Finally, Versant Capital Management Inc lifted its stake in Fabrinet by 353.7% in the first quarter. Versant Capital Management Inc now owns 186 shares of the technology company's stock valued at $37,000 after acquiring an additional 145 shares during the last quarter. Institutional investors and hedge funds own 97.38% of the company's stock.

Insider Buying and Selling at Fabrinet

In other Fabrinet news, COO Harpal Gill sold 18,675 shares of the company's stock in a transaction dated Wednesday, June 4th. The shares were sold at an average price of $240.00, for a total transaction of $4,482,000.00. Following the sale, the chief operating officer directly owned 18,068 shares of the company's stock, valued at $4,336,320. This represents a 50.83% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Company insiders own 0.38% of the company's stock.

Wall Street Analysts Forecast Growth

FN has been the subject of a number of recent analyst reports. JPMorgan Chase & Co. increased their price target on shares of Fabrinet from $235.00 to $318.00 and gave the company a "neutral" rating in a research note on Thursday, July 17th. Wolfe Research started coverage on shares of Fabrinet in a research report on Tuesday, July 8th. They issued a "peer perform" rating on the stock. Barclays set a $234.00 price objective on shares of Fabrinet and gave the company an "equal weight" rating in a research report on Tuesday, May 6th. Rosenblatt Securities increased their price objective on shares of Fabrinet from $250.00 to $290.00 and gave the company a "buy" rating in a research report on Thursday, June 12th. Finally, Needham & Company LLC reissued a "buy" rating and issued a $280.00 price objective on shares of Fabrinet in a research report on Tuesday, May 6th. Four analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus target price of $261.33.

Check Out Our Latest Research Report on FN

Fabrinet Stock Performance

Shares of NYSE:FN opened at $330.06 on Friday. The company's 50-day moving average is $296.70 and its 200 day moving average is $239.93. The company has a market capitalization of $11.83 billion, a P/E ratio of 36.76 and a beta of 1.02. Fabrinet has a fifty-two week low of $148.55 and a fifty-two week high of $356.55.

About Fabrinet

(

Free Report)

Fabrinet provides optical packaging and precision optical, electro-mechanical, and electronic manufacturing services in North America, the Asia-Pacific, and Europe. The company offers a range of advanced optical and electro-mechanical capabilities in the manufacturing process, including process design and engineering, supply chain management, manufacturing, printed circuit board assembly, advanced packaging, integration, final assembly, and testing.

Featured Articles

Want to see what other hedge funds are holding FN? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Fabrinet (NYSE:FN - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fabrinet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fabrinet wasn't on the list.

While Fabrinet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.