Tiger Pacific Capital LP boosted its position in Lufax Holding Ltd. Sponsored ADR (NYSE:LU - Free Report) by 71.7% in the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 6,757,978 shares of the company's stock after purchasing an additional 2,821,316 shares during the period. Lufax comprises 7.2% of Tiger Pacific Capital LP's investment portfolio, making the stock its 5th biggest position. Tiger Pacific Capital LP owned approximately 0.78% of Lufax worth $20,071,000 at the end of the most recent reporting period.

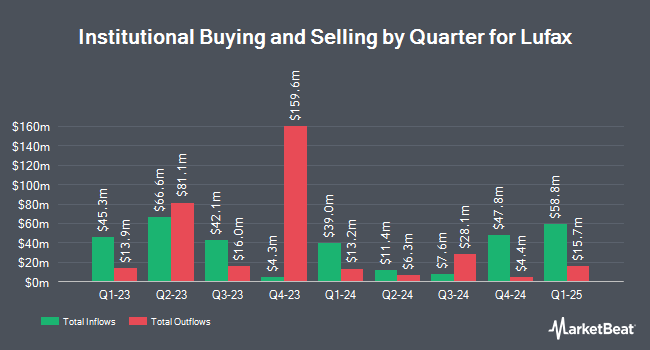

Other hedge funds have also recently bought and sold shares of the company. QRG Capital Management Inc. purchased a new position in Lufax in the 1st quarter valued at approximately $70,000. Mirae Asset Global Investments Co. Ltd. increased its stake in Lufax by 44.7% in the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 24,017 shares of the company's stock valued at $71,000 after purchasing an additional 7,417 shares in the last quarter. Russell Investments Group Ltd. purchased a new position in Lufax in the 1st quarter valued at approximately $101,000. OMERS ADMINISTRATION Corp acquired a new stake in Lufax during the 4th quarter valued at $142,000. Finally, Mitsubishi UFJ Asset Management Co. Ltd. grew its holdings in Lufax by 11.2% during the 1st quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 70,969 shares of the company's stock valued at $211,000 after buying an additional 7,122 shares during the last quarter. 69.14% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Separately, Wall Street Zen upgraded Lufax from a "sell" rating to a "hold" rating in a report on Saturday, July 26th. One analyst has rated the stock with a Hold rating and one has assigned a Sell rating to the company. According to MarketBeat, the company presently has a consensus rating of "Reduce" and an average target price of $3.20.

View Our Latest Analysis on Lufax

Lufax Price Performance

NYSE:LU traded down $0.02 during trading hours on Friday, reaching $3.01. 1,125,354 shares of the company traded hands, compared to its average volume of 3,177,008. The firm's 50-day moving average is $2.89 and its 200-day moving average is $2.88. The stock has a market cap of $2.60 billion, a P/E ratio of -3.90 and a beta of 0.69. Lufax Holding Ltd. Sponsored ADR has a 1-year low of $2.14 and a 1-year high of $4.15.

About Lufax

(

Free Report)

Lufax Holding Ltd operates as a financial service empowering institution for small and micro businesses in China. The company offers loan products, including general unsecured loans and secured loans, as well as consumer finance loans. It also provides wealth management products, such as asset management plans, mutual fund products, private investment fund products, and trust products.

Featured Articles

Before you consider Lufax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lufax wasn't on the list.

While Lufax currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.