LVM Capital Management Ltd. MI cut its stake in Apple Inc. (NASDAQ:AAPL - Free Report) by 0.9% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm owned 387,208 shares of the iPhone maker's stock after selling 3,705 shares during the period. Apple comprises about 8.2% of LVM Capital Management Ltd. MI's holdings, making the stock its 2nd largest holding. LVM Capital Management Ltd. MI's holdings in Apple were worth $79,443,000 as of its most recent filing with the Securities and Exchange Commission.

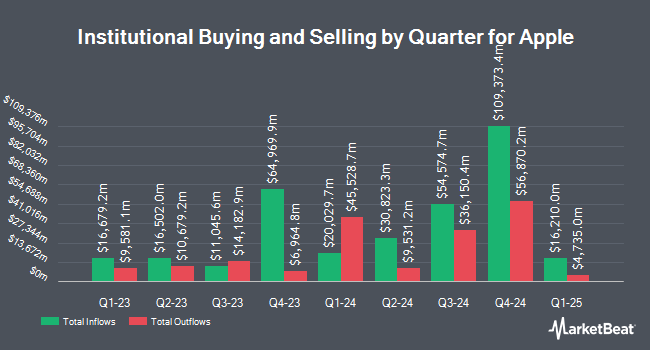

Several other institutional investors and hedge funds have also made changes to their positions in AAPL. First National Bank of Hutchinson boosted its position in shares of Apple by 24.6% during the 4th quarter. First National Bank of Hutchinson now owns 35,319 shares of the iPhone maker's stock worth $8,845,000 after acquiring an additional 6,982 shares in the last quarter. Eagle Capital Management LLC lifted its holdings in shares of Apple by 0.5% in the 4th quarter. Eagle Capital Management LLC now owns 54,085 shares of the iPhone maker's stock valued at $13,544,000 after purchasing an additional 272 shares during the last quarter. Brighton Jones LLC lifted its holdings in shares of Apple by 14.8% in the 4th quarter. Brighton Jones LLC now owns 537,314 shares of the iPhone maker's stock valued at $134,554,000 after purchasing an additional 69,207 shares during the last quarter. Revolve Wealth Partners LLC lifted its holdings in shares of Apple by 4.2% in the 4th quarter. Revolve Wealth Partners LLC now owns 66,857 shares of the iPhone maker's stock valued at $16,742,000 after purchasing an additional 2,695 shares during the last quarter. Finally, Highview Capital Management LLC DE lifted its holdings in shares of Apple by 2.4% in the 4th quarter. Highview Capital Management LLC DE now owns 50,264 shares of the iPhone maker's stock valued at $12,587,000 after purchasing an additional 1,155 shares during the last quarter. 67.73% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several equities analysts recently issued reports on the company. JPMorgan Chase & Co. boosted their price target on Apple from $255.00 to $280.00 and gave the company an "overweight" rating in a research report on Friday. Morgan Stanley set a $240.00 price target on Apple and gave the stock an "overweight" rating in a report on Wednesday, September 3rd. Rosenblatt Securities upped their target price on Apple from $223.00 to $241.00 and gave the company a "neutral" rating in a research note on Wednesday, September 10th. BMO Capital Markets restated a "buy" rating on shares of Apple in a report on Wednesday, August 13th. Finally, Raymond James Financial restated an "outperform" rating and set a $240.00 target price (up from $230.00) on shares of Apple in a research note on Friday, August 1st. Two analysts have rated the stock with a Strong Buy rating, fifteen have assigned a Buy rating, fourteen have given a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $242.74.

Get Our Latest Stock Analysis on Apple

Insider Activity at Apple

In other news, SVP Deirdre O'brien sold 34,821 shares of the business's stock in a transaction on Friday, August 8th. The shares were sold at an average price of $223.20, for a total transaction of $7,772,047.20. Following the transaction, the senior vice president directly owned 136,687 shares in the company, valued at $30,508,538.40. The trade was a 20.30% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. 0.06% of the stock is currently owned by corporate insiders.

Apple Price Performance

Apple stock traded up $7.62 during mid-day trading on Friday, hitting $245.50. The company's stock had a trading volume of 163,435,991 shares, compared to its average volume of 47,568,860. The company has a quick ratio of 0.83, a current ratio of 0.87 and a debt-to-equity ratio of 1.25. The stock has a market capitalization of $3.64 trillion, a P/E ratio of 37.25, a P/E/G ratio of 2.47 and a beta of 1.11. Apple Inc. has a twelve month low of $169.21 and a twelve month high of $260.10. The stock's fifty day moving average price is $224.35 and its two-hundred day moving average price is $212.42.

Apple (NASDAQ:AAPL - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The iPhone maker reported $1.57 earnings per share for the quarter, topping the consensus estimate of $1.43 by $0.14. Apple had a net margin of 24.30% and a return on equity of 170.91%. The firm had revenue of $94.04 billion for the quarter, compared to analysts' expectations of $88.64 billion. During the same period in the previous year, the company posted $1.40 EPS. The company's quarterly revenue was up 9.6% compared to the same quarter last year. Research analysts forecast that Apple Inc. will post 7.28 earnings per share for the current year.

Apple Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, August 14th. Stockholders of record on Monday, August 11th were issued a dividend of $0.26 per share. This represents a $1.04 annualized dividend and a dividend yield of 0.4%. The ex-dividend date was Monday, August 11th. Apple's payout ratio is currently 15.78%.

Apple Company Profile

(

Free Report)

Apple Inc designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod.

Featured Stories

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report