Lyell Wealth Management LP raised its stake in shares of Quanta Services, Inc. (NYSE:PWR - Free Report) by 216.0% during the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 30,081 shares of the construction company's stock after acquiring an additional 20,563 shares during the period. Lyell Wealth Management LP's holdings in Quanta Services were worth $7,646,000 as of its most recent SEC filing.

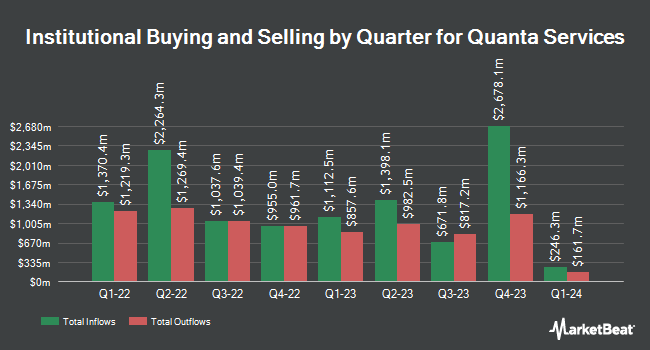

Other large investors have also bought and sold shares of the company. Brighton Jones LLC bought a new stake in shares of Quanta Services during the 4th quarter worth $298,000. CIBC Private Wealth Group LLC raised its stake in shares of Quanta Services by 3.3% during the 4th quarter. CIBC Private Wealth Group LLC now owns 8,045 shares of the construction company's stock worth $2,512,000 after purchasing an additional 260 shares during the period. Alliancebernstein L.P. raised its stake in shares of Quanta Services by 33.8% during the 4th quarter. Alliancebernstein L.P. now owns 244,869 shares of the construction company's stock worth $77,391,000 after purchasing an additional 61,889 shares during the period. Summit Financial LLC bought a new stake in shares of Quanta Services during the 4th quarter worth $541,000. Finally, Franklin Resources Inc. increased its holdings in Quanta Services by 4.4% in the 4th quarter. Franklin Resources Inc. now owns 970,722 shares of the construction company's stock worth $306,797,000 after acquiring an additional 41,309 shares during the last quarter. 90.49% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

Several brokerages recently weighed in on PWR. DA Davidson lifted their price objective on Quanta Services from $305.00 to $395.00 and gave the stock a "neutral" rating in a report on Friday. Roth Capital reissued a "buy" rating and issued a $450.00 price objective (up previously from $350.00) on shares of Quanta Services in a report on Tuesday. Northland Securities lowered Quanta Services from an "outperform" rating to a "market perform" rating and set a $354.00 price objective for the company. in a report on Wednesday, July 2nd. UBS Group lifted their price objective on Quanta Services from $413.00 to $474.00 and gave the stock a "buy" rating in a report on Friday, July 25th. Finally, The Goldman Sachs Group reissued a "buy" rating and issued a $414.00 price objective (up previously from $364.00) on shares of Quanta Services in a report on Wednesday, June 4th. Eleven analysts have rated the stock with a hold rating, fourteen have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, Quanta Services has an average rating of "Moderate Buy" and a consensus price target of $379.32.

Read Our Latest Analysis on PWR

Quanta Services Price Performance

Shares of PWR traded down $10.95 during trading hours on Friday, reaching $395.18. 2,094,000 shares of the company's stock traded hands, compared to its average volume of 1,116,995. The stock has a market cap of $58.59 billion, a PE ratio of 61.17, a price-to-earnings-growth ratio of 2.79 and a beta of 1.10. The company has a current ratio of 1.37, a quick ratio of 1.26 and a debt-to-equity ratio of 0.59. The firm's 50 day simple moving average is $375.39 and its 200-day simple moving average is $319.00. Quanta Services, Inc. has a 12 month low of $227.08 and a 12 month high of $424.94.

Quanta Services (NYSE:PWR - Get Free Report) last released its earnings results on Thursday, July 31st. The construction company reported $2.48 earnings per share for the quarter, topping analysts' consensus estimates of $2.44 by $0.04. The company had revenue of $6.77 billion during the quarter, compared to the consensus estimate of $6.55 billion. Quanta Services had a return on equity of 18.41% and a net margin of 3.73%. Quanta Services's quarterly revenue was up 21.1% compared to the same quarter last year. During the same quarter in the previous year, the company posted $1.90 EPS. Equities analysts expect that Quanta Services, Inc. will post 9.34 EPS for the current year.

Quanta Services Announces Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, July 11th. Investors of record on Tuesday, July 1st were given a $0.10 dividend. The ex-dividend date was Tuesday, July 1st. This represents a $0.40 dividend on an annualized basis and a yield of 0.1%. Quanta Services's payout ratio is presently 6.45%.

Quanta Services Company Profile

(

Free Report)

Quanta Services, Inc provides infrastructure solutions for the electric and gas utility, renewable energy, communications, and pipeline and energy industries in the United States, Canada, Australia, and internationally. The company's Electric Power Infrastructure Solutions segment engages in the design, procurement, construction, upgrade, repair, and maintenance of electric power transmission and distribution infrastructure and substation facilities; installation, maintenance, and upgrade of electric power infrastructure projects; installation of smart grid technologies on electric power networks; and design, installation, maintenance, and repair of commercial and industrial wirings.

Featured Stories

Before you consider Quanta Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Quanta Services wasn't on the list.

While Quanta Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.